Despite a huge decline in foreign exchange gains, United Bank registered a 41pc growth in profit, netting 770.2 million Br in the last fiscal year.

The Bank's earnings per share (EPS) also increased by 3.8Br to 39.2Br, marking the highest increase in six years.

Even though the Bank registered a growth from the previous years, it did not perform better than other banks that had even been established later than United, according to Zafu Eyessuswork Zafu, the chairperson of the board of directors of United Bank.

The Bank registered a modest increase in commissions and service charges by a margin of seven percent to 498.8 million Br. The Bank's revenues from interest on loans, advances and investment in the National Bank of Ethiopia (NBE) bond shot up by 39pc to 3.2 billion Br.

This massive increase in revenues largely contributed to good profit performance, according to Abdulmenan Mohammed, a financial statement analyst with close to two decades of experience.

However, United's foreign exchange gains plummeted by 84pc to 17.4 million Br.

The Bank's earnings per share (EPS) also increased by 3.8Br to 39.2Br, marking the highest increase in six years.

Taye Dibekulu, the outgoing president of United, attributed the decline to the huge fall in foreign exchange earnings of the country, which is mainly related to the decline in export trade and the reduction in the inflow of remittances coupled with NBE foreign exchange regulations.

Increased income comes in unison with a considerable expansion in expenses. Interest expenses shot up by 43pc to 1.5 billion Br due to a massive increase in deposits. General administration expenses have also spiked to 479.9 million Br, registering a 36pc increase. Salaries and benefits went up to 848.7 million Br.

United’s reversal of 77.3 million Br net for the provision of doubtful loans, advances and other assets accounted for eight percent of the profit after tax.

Its total assets increased by 27pc to 35.7 billion Br, with the Bank’s disbursed loans and advances reaching 21.6 billion Br with a 45pc increase in the last fiscal year.

“The growth in loans and advances is impressive,” Abdulmenan commented. “United achieved a level that has not been achieved by banks that have released their annual reports so far.”

The 26pc increase in the total deposits mobilised by the Bank to 29.1 billion Br pushed the loan-to-deposit ratio up to 74.3pc from 64.4pc.

Applauding the bank's achievement in increasing the loan-to-deposit ratio, Abdulmenan cautioned the management to refrain from a further increase.

"The loan-to-deposit ratio of United reached the maximum level,” he told Fortune.

United’s investment in NBE bonds reached 7.4 billion Br, which accounted for 21pc of the total assets and 25pc of the total deposits of the Bank.

The decline, both in value and relative terms, of the liquidity level of the bank was reflected in the total cash and bank balances that decreased by 15pc to 3.8 billion Br. The ratio of cash and bank balances to total assets declined by five percentage points to 11pc. United's ratio of balances to deposits also went down to 13pc from 19.6pc.

“Such reductions must have been caused by the massive increase in loans and advances," said Abdulmenan. "The liquidity ratios reveal that United had tight liquidity, so it should take extra care from further reduction."

As United’s paid-up capital increased by 27pc to nearly 2.3 billion Br, its capital adequacy ratio (CAR) also rose by 16pc.

“This indicates that United is a well-capitalised bank,” the expert confirmed.

Yemane Bisrat, a shareholder of United Bank, expressed his general satisfaction over the performance of the Bank during the last fiscal year.

However, Yemane says that he is not happy with the decline in the foreign exchanging earnings of the Bank.

He believes that sticking to the regulatory framework of the NBE would be crucial, though it might not be helpful sometimes for the short-term gains in foreign currency transactions.

Taye, who is departing from the Bank, says that the Bank stands in fifth place in the private banking industry next to Awash, Dashen, Abyssinia and Wegagen banks.

The board of the Bank has appointed Melaku Kebede, who was vice president of United in charge of IT, as acting president replacing Taye.

To improve its standing among the private banks in the sector, United hired Deloitte Consulting Ltd in April 2018 to design a 12-year strategic road map for the Bank. The consulting firm has developed and delivered the plan dubbed Vision 2030 to the Bank, which has started implementing the strategic programme.

PUBLISHED ON

Dec 14,2019 [ VOL

20 , NO

1024]

Fortune News | Feb 20,2021

Fortune News | Jan 09,2021

Agenda | Sep 06,2020

Featured | Oct 16,2021

Viewpoints | Dec 10,2018

Agenda | Mar 05,2022

Fortune News | May 08,2021

Agenda | Oct 01,2022

Fortune News | Mar 13,2021

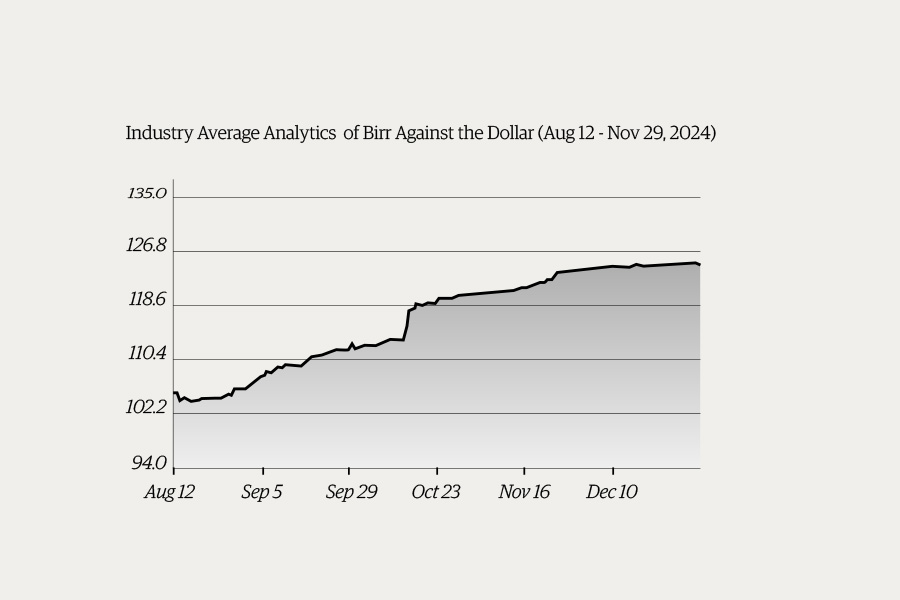

Money Market Watch | Jan 05,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...