Commentaries | May 29,2021

Jan 13 , 2024

By Dani Rodrik

Another tumultuous year has confirmed that the global economy is at a turning point. We face four big challenges: the climate transition, the problem of good jobs, an economic development crisis, and the search for a newer, healthier form of globalisation. To address each, we must leave behind established modes of thinking and seek creative workable solutions, while recognising that these efforts will be necessarily uncoordinated and experimental.

Climate change is the most daunting challenge - and the one that has been overlooked the longest – at great cost. If we are to avoid condemning humanity to a dystopian future, we must act fast to decarbonise the global economy. We have long known that we must wean ourselves from fossil fuels, develop green alternatives, and shore up our defences against the lasting environmental damage that past inaction has already caused.

However, it has become clear that little of this is likely to be achieved through global cooperation or economists' favoured policies.

Instead, individual countries will forge ahead with their own green agendas, implementing policies that best account for their specific political constraints, as the United States (US), China, and the European Union (EU) have already been doing. The result will be a hodge-podge of emission caps, tax incentives, research and development support, and green industrial policies with little global coherence and occasional costs for other countries. Messy though it may be, an uncoordinated push for climate action may be the best we can realistically hope for.

But our physical environment is not the only threat we face. Inequality, the erosion of the middle class, and labour-market polarisation have caused equally significant damage to our social environment. The consequences are now widely evident. Economic, regional, and cultural gaps within countries are widening, and liberal democracy (and the values that support it) appears to be in decline, reflecting rising support for xenophobic, authoritarian populists and the growing backlash against scientific and technical expertise.

Social transfers and the welfare state can help, but what is most needed is an increase in the supply of good jobs for the less-educated workers who have lost access to them. We need more productive, well-remunerated employment opportunities that can provide dignity and social recognition for those without a college degree. Expanding the supply of such jobs will require not only more investment in education and a more robust defence of workers' rights but also a new brand of industrial policies for services, where the bulk of future employment will be created.

The disappearance of manufacturing jobs over time reflects both greater automation and stronger global competition.

Developing countries have not been immune to either factor. Many have experienced "premature de-industrialisation": their absorption of workers into formal, productive manufacturing firms is now very limited, which means they are precluded from pursuing the kind of export-oriented development strategy that has been so effective in East Asia and a few other countries. Together with the climate challenge, this crisis of growth strategies in low-income countries calls for an entirely new development model.

As in the advanced economies, services will be the main source of employment creation for low- and middle-income countries. But most services in these economies are dominated by very small, informal enterprises – often sole proprietorships – and there are essentially no ready-made models of service-led development to emulate. Governments will have to experiment, combining investment in the green transition with productivity enhancements in labour-absorbing services.

Finally, globalisation itself must be reinvented.

The post-1990 hyper-globalisation model has been overtaken by the rise of US-China geopolitical competition, and by the higher priority placed on domestic social, economic, public-health, and environmental concerns. No longer fit for purpose, globalisation as we know it will have to be replaced by a new understanding that rebalances national needs and the requirements of a healthy global economy that facilitates international trade and long-term foreign investment.

Most likely, the new globalisation model will be less intrusive, acknowledging the needs of all countries (not just major powers) that want greater policy flexibility to address domestic challenges and national security imperatives. One possibility is that the US or China will take an overly expansive view of its security needs, seeking global primacy (in the US case) or regional domination (China). The result would be a "weaponisation" of economic interdependence and significant economic decoupling, with trade and investment treated as a zero-sum game.

But there could also be a more favourable scenario in which both powers keep their geopolitical ambitions in check, recognising that their competing economic goals are better served through accommodation and cooperation. This scenario might serve the global economy well, even if – or perhaps because – it falls short of hyper-globalisation. As the Bretton Woods era showed, a significant expansion of global trade and investment is compatible with a thin model of globalization, wherein countries retain considerable policy autonomy with which to foster social cohesion and economic growth at home.

The biggest gift major powers can give to the world economy is to manage their own domestic economies well.

All these challenges call for new ideas and frameworks. We do not need to throw conventional economics out the window. But to remain relevant, economists must learn to apply the tools of their trade to the objectives and constraints of the day. They will have to be open to experimentation, and sympathetic if governments engage in actions that do not conform to the playbooks of the past.

PUBLISHED ON

Jan 13,2024 [ VOL

24 , NO

1237]

Commentaries | May 29,2021

Viewpoints | Apr 22,2023

Sponsored Contents | Apr 04,2022

Editorial | Sep 14,2019

Commentaries | Jan 13,2024

Radar | Nov 27,2021

Commentaries | May 13,2023

Fortune News | Apr 19,2025

Commentaries | Sep 14,2024

News Analysis | Oct 27,2024

My Opinion | 131766 Views | Aug 14,2021

My Opinion | 128149 Views | Aug 21,2021

My Opinion | 126095 Views | Sep 10,2021

My Opinion | 123717 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

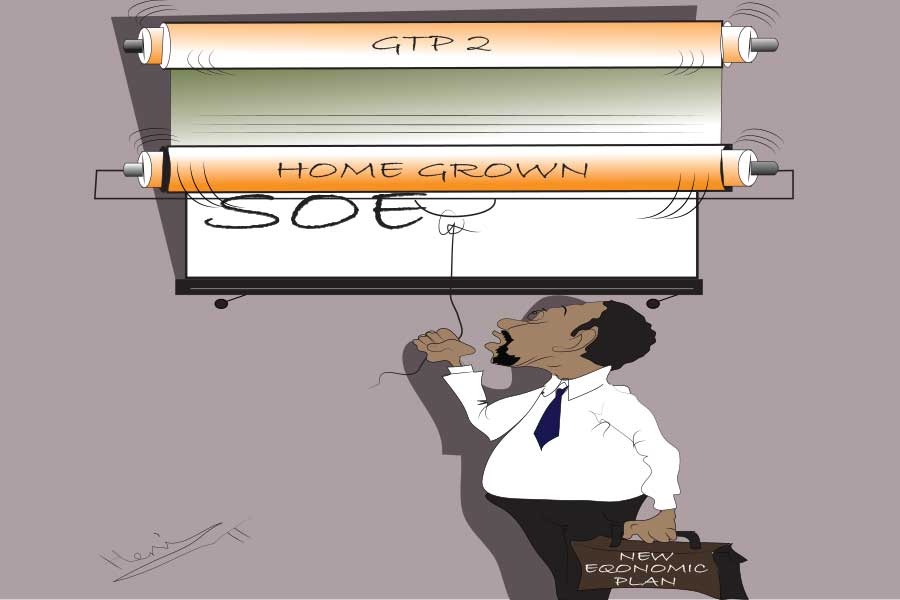

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...