Radar | Jun 22,2024

Apr 22 , 2023

By Asseged G. Medhin

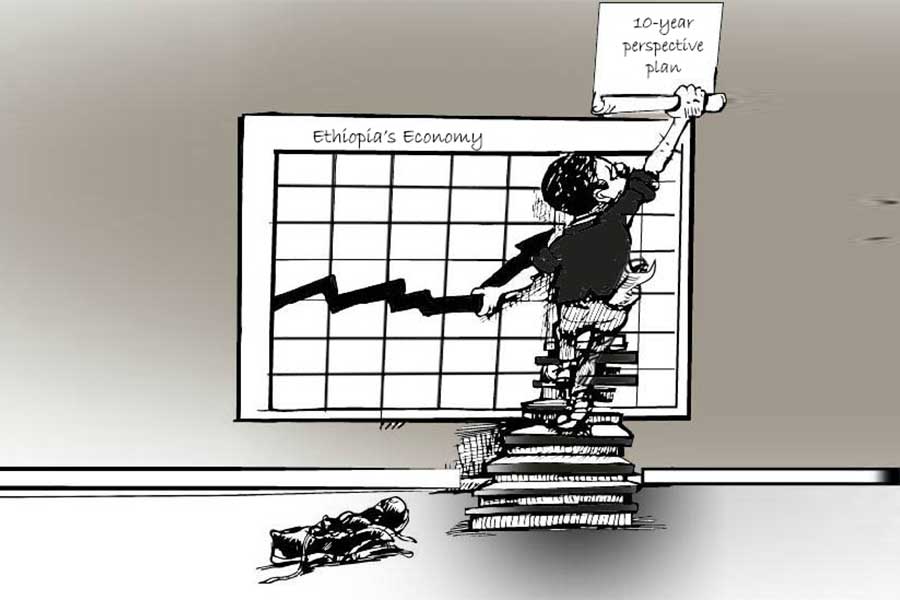

As the world still grapples with the consequences of the 2008 financial crisis, recent events have shown that we have yet to learn from past mistakes. The ongoing instability in the global economy, particularly with the bankruptcy of top US banks, serves as a stark reminder of the potential domino effect on international markets. For instance, the Ethiopian financial and insurance industries are not immune to such repercussions, which could eventually impact aid, foreign trade, and the country’s balance of payments.

The urgent need for robust corporate governance cannot be overstated, as it is pivotal in ensuring justice and security in any organisation. When these two key aspects are in place, employees are empowered to be engaged, productive, and committed to delivering value and customer satisfaction. However, when corporate governance is neglected, the potential for bribery, nepotism, chaos, and the collapse of established norms and values arises.

The recent failure of top American banks has highlighted the risks associated with lax regulatory measures and the systemic dangers of institutions deemed “too big to fail.” As a result, policymakers have been reconsidering which large banks should be subject to enhanced prudential regulatory requirements (EPR) to address the risk of financial instability.

With its limited investment options and inherent concentration risk, the Ethiopian financial sector can glean valuable lessons from these events. To avoid similar pitfalls, the country’s regulatory body must devise a framework that fosters policy dialogue and evaluates the risk profiles of financial institutions. Ethiopia’s financial institutions can protect themselves against potential failures by emphasising corporate governance.

For any modern company, effective corporate governance must promote sustainable income, learning, and growth while maintaining healthy customer relations. The cornerstones of corporate governance — justice, security, sustainable income, learning and growth, development, and customer relations — should be at the heart of a company’s directors` board. Failing to uphold these principles can lead to loss of credibility, inability to achieve targets, and, ultimately, bankruptcy.

Transparent corporate governance, which can be understood by employees, stakeholders, and customers alike, is essential for fostering an environment conducive to growth and development. Without such transparency, change agents may become fearful, and companies risk leaving themselves vulnerable to another financial collapse.

As the global economy continues to navigate turbulent waters, the necessity of implementing robust corporate governance becomes increasingly apparent. The Ethiopian financial sector, as well as others around the world, must take decisive action to address the risk of financial failures and to reinforce their resilience against potential crises.

One crucial aspect of corporate governance is the recognition and management of risk. Financial institutions must be able to identify inherent risks, such as concentration, liquidity, and interest rate, and develop comprehensive strategies to address them. By doing so, they can safeguard their operations and maintain stability in the face of economic challenges.

Another critical component of corporate governance is fostering a culture of accountability and transparency. The board of directors and top management should be held accountable for their actions and decisions, which should be made in the best interests of shareholders and stakeholders. Communication channels should be established to ensure that information is shared with employees, shareholders, and regulators in a timely and credible manner.

The role of regulators in overseeing and enforcing corporate governance cannot be understated. Regulatory agencies must collaborate closely with financial institutions to establish clear guidelines and expectations for corporate governance. They can foster a proactive approach to risk management and compliance, ultimately reducing the likelihood of financial collapses.

Continuous learning and adaptation in corporate governance should not be overlooked either. Financial institutions and businesses must be prepared to evolve and adapt their governance structures to keep pace with the rapidly changing economic landscape. This may involve investing in professional development for board members and top management and adopting new technologies and methodologies to enhance their governance practices.

PUBLISHED ON

Apr 22,2023 [ VOL

24 , NO

1199]

Radar | Jun 22,2024

Radar | Feb 03,2024

Exclusive Interviews | May 17,2025

Fortune News | May 13,2023

Radar | Jun 30,2024

Radar | Jan 27,2024

Editorial | Dec 26,2020

View From Arada | Jun 21,2025

Radar | Jan 19,2024

Fortune News | Jan 03,2025

My Opinion | 131770 Views | Aug 14,2021

My Opinion | 128154 Views | Aug 21,2021

My Opinion | 126099 Views | Sep 10,2021

My Opinion | 123721 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...