Viewpoints | Sep 26,2021

Jan 7 , 2024

Modern monetary theory provides a useful lens through which to view the mounting sovereign debt crisis in the developing world. It sheds light on why low- and middle-income countries borrow in foreign currencies, while also suggesting that rich countries could provide significant relief if they so desired, writes Ndongo Samba Sylla, head of research and policy for the Africa Region at International Development Economics Associates. This commentary is provided by Project Syndicate (PS).

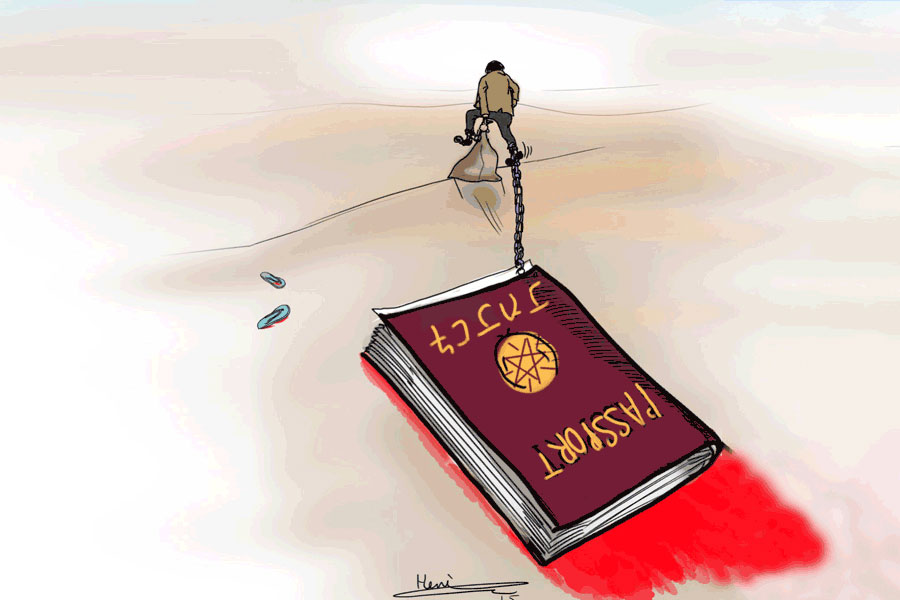

The widening debt crises in the Global South largely emanate from a flawed multilateral system. But it also reflects the inadequacies of the dominant analytical and policy frameworks – specifically, their assumptions about the nature of money, the economic possibilities available to currency-issuing governments, and the underlying causes of developing countries’ external indebtedness.

Viewed through the lens of modern monetary theory (MMT), the limitations of mainstream economic thinking as applied to sovereign debt crises become even clearer. The basic idea behind the theory is that, unlike households or private firms, governments that control their own fiat currency cannot default (assuming their debt is denominated in their own currency). As they are not money-constrained, they can spend to achieve their goals. Their main constraint is the availability of productive capacity, which determines the risk of inflation.

MMT explains why the most indebted countries, in absolute and relative terms, are not in distress. Consider that Japan’s sovereign debt-to-GDP ratio was 254pc last year, while the ratio was 144pc in the United States, 113pc in Canada, and 104pc in the United Kingdom. Yet none of these countries is experiencing a sovereign debt crisis. By contrast, in 2020, Argentina, Ecuador, and Zambia had much lower debt-to-GDP ratios when they defaulted on their external obligations.

The main difference is that Japan, the US, Canada, and the UK are monetarily sovereign. Their public debt is denominated in their national currency, while their central banks maintain some control over the interest rates applied to that debt. Most governments in the Global South are at risk of insolvency because they borrowed in foreign currencies.

MMT implies that if rich countries desired to provide significant debt relief to the Global South, the main challenges would be coordination – between different creditors and debtors, as well as other relevant actors – and accountability, not affordability. Given that these countries cannot run out of their own currency, there are no financial constraints on cancelling in whole or in part the public and publicly guaranteed external debt stock of 131 lower- and middle-income countries (excluding China, Russia, and India). This debt stood at 2.6 trillion dollars in 2022 – an amount less than Germany's public debt.

Why do Global South countries currently in or at risk of debt distress borrow in foreign currencies in the first place?

Economists’ usual answer is that these countries would otherwise lack “money” and “savings.” Such a view is based on an erroneous understanding of the nature of money. Currency-issuing governments cannot run out of their own money. As the Bank of England has shown, banks are not intermediaries between savers and loan applicants; instead, they create new purchasing power every time they extend a loan.

This leads to another important observation derived from MMT. As money is not scarce, anything that is technically and materially feasible at the national level can be financed in the national currency. Developing countries need not issue foreign-currency debt to finance projects that require locally available resources such as labour, land, raw materials, equipment, and technologies. When needed resources are not locally available and can be purchased only with foreign currencies, developing countries might be forced to take on the burden of dollar-denominated debt.

One could imagine resource-poor or climate-vulnerable countries making such a choice.

But this ignores that Global South countries often earn substantial income from exports. The issue is that a significant proportion of this income is remitted back to foreign investors – many of whom benefit from an inequitable global tax architecture – as profits or dividends. This is on top of the fraudulent practices that result in illicit financial flows.

Between 2000 and 2018, for example, African countries suffered greater financial hardship from profit transfers by foreign investors, dividend repatriation by subsidiaries to their parent companies, and illicit financial flows than from servicing its external debt. They issued foreign-currency debt that paid the highest interest rates partly to plug the gap created by foreign nationals appropriating – both legally and illegally – vast dollar earnings.

Consider Zambia, a copper-producing country that lost around 10.6 billion dollars in illicit financial flows between 1970 and 1996 (355pc of its GDP in 1996), 8.8 billion dollars between 2001 and 2010, and 12.5 billion dollars between 2013 and 2015. Zambia’s public and publicly guaranteed external debt was 1.2 billion in 2010, rising to 12.5 billion dollars by 2021.

If the Zambian government had better fiscal and technical control over its export sector, it would have accumulated sufficient dollar reserves to enhance food and energy self-sufficiency and to finance investment in infrastructure and other public goods requiring importing foreign productive capacity. There would have been no need to take on so much foreign-currency debt. The same could be said for other resource-rich African countries.

In a just world, countries subject to asymmetric tax agreements and resource theft would be fairly compensated, rather than crushed by austerity policies. Barring that, external debt cancellation would help developing countries invest in climate resilience and improve the health and well-being of their populations. As many policymakers, economists, and social movements have argued, it is an urgent necessity.

But even such a bold step would not be enough to address the root causes of recurring debt crises in the Global South. That would require stopping the financial bleeding caused by multinational corporations and promoting an economic development strategy that makes full use of the resources each country can command with its national currency.

PUBLISHED ON

Jan 07,2024 [ VOL

24 , NO

1236]

Fortune News | Jan 27,2024

My Opinion | Apr 13, 2025

Radar | Feb 09,2019

Editorial | Sep 02,2023

Commentaries | May 11,2024

My Opinion | 131766 Views | Aug 14,2021

My Opinion | 128149 Views | Aug 21,2021

My Opinion | 126095 Views | Sep 10,2021

My Opinion | 123717 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...