Commentaries | Apr 04,2020

May 11 , 2024

By Yeraeifirae Sileshi (MD)

The path to a reformed and efficient healthcare system may be paved with rough roads, but it is also momentous, with opportunities to unleash collaborative efforts between the public and private sectors. Yeraeifirae Sileshi (MD) (yeraei@wajeehospital.com) writes that there is potential to create a more secure and sustainable environment for medical professionals and the general populace, ultimately leading to a healthier, wealthier population.

Home to over 100 million people, Ethiopia appears to be entangled in a healthcare paradox that contrasts sharply with models observed in countries like China and Kenya. The healthcare dilemma lies in the limited access to medical insurance, a reality that besets someone I know and who resigned from his municipal job seven years ago due to benign prostatic hyperplasia (BPH).

A father of three, his condition, which lingered untreated for years due to financial constraints, illustrates the dire state of healthcare. Once he received surgery, a procedure that took only 30 minutes, it revealed the inefficiencies and barriers within the current system. Medical costs are prohibitively high when weighed against average incomes. The existing insurance products often lack premium financing and innovation, making them inaccessible to the majority. Insurance coverage is a mere 0.3pc of the GDP, much lower than that of African counterparts such as Kenya, Egypt, Morocco, and South Africa.

A recent visit to Kenya showed me that the East African country has a much more vibrant medical insurance ecosystem, supported by a blend of private insurance options and government-run schemes like the National Health Insurance Fund (NHIF), integrated with Public-Private Partnership (PPP) services. The array of choices supports Kenyan citizens and empowers healthcare providers with a broader range of financial tools. However, the situation there is far from perfect.

Despite a more robust healthcare financing framework, Kenyan physicians were on strike during my visit, advocating for better compensation. They seemed determined to voice their misgivings on the broader regional challenges of ensuring that healthcare systems reach and adequately support the people.

No less acute is the financial struggle for healthcare professionals in Ethiopia. Monthly salaries could dip as low as 200 dollars, pushing specialists and subspecialists to sometimes use crowdfunding for their life-saving treatments. The climate of financial insecurity contributes to a pervasive sense of despair within the medical community.

Federal health officials could take a cue from global best practices by promptly implementing Social Health Insurance (SHI) to protect formal sector workers and centralising the Community Based Health Insurance (CBHI) pool to enhance service delivery. Such measures could improve the financial health of hospitals, which in turn would address the long waiting periods for receivables and integrate more efficiently with private service providers.

The private sector also has a critical role to play. Moving beyond traditional fee-for-service models to introduce prepaid healthcare services could align more closely with global healthcare trends. There is room for innovation in the insurance products offered.

Our efforts in this domain are gaining momentum. The National Bank of Ethiopia's focus on enhancing health and life insurance leadership is promising.

We recently won recognition in the FSD Africa’s Bimalab’s 2023 Pan African InsurTech Accelerator Program, alongside Kacha, for designing a successful healthcare premium financing pilot. This initiative is part of a broader transition towards establishing Family Tena Life Insurance, set to become Ethiopia’s first dedicated health and life insurer. This collaboration among hospitals, medical professionals, and passionate advocates aims to make healthcare available and affordable.

These initiatives should be more than business development. They should assist in building a more sustainable healthcare system that enhances the security and quality of life for all Ethiopians. By improving the financial underpinnings of healthcare, Ethiopia can better equip its medical professionals, enhance access to basic facilities, and address the risks associated with healthcare needs.

Indeed, the economic implications of these healthcare reforms extend beyond the immediate benefits to patients and providers. By reducing the need for healthcare tourism through investments in local tertiary care facilities funded by private pension contributions, Ethiopia could retain considerable financial resources within its borders. Such strategic shifts in healthcare financing and insurance could pave the way for healthier, more prosperous Ethiopians.

The path forward is not merely advisable but essential. As the experiences of countless show, the cost of inaction is measured in human lives and missed economic opportunities. Through collaborative efforts between the public and private sectors, Ethiopia has the potential to transform its healthcare ecosystem, ensuring that all its citizens have access to the care they need and deserve.

PUBLISHED ON

May 11,2024 [ VOL

25 , NO

1254]

Commentaries | Apr 04,2020

Agenda | Aug 29,2020

Fortune News | Jan 25,2020

My Opinion | Apr 29,2023

Commentaries | May 25,2019

Radar |

Radar | Aug 06,2022

Fortune News | Oct 21,2023

Editorial | Jan 02,2021

Fortune News | Nov 21,2020

My Opinion | 108821 Views | Aug 14,2021

My Opinion | 105219 Views | Aug 21,2021

My Opinion | 104030 Views | Sep 10,2021

My Opinion | 103320 Views | Aug 07,2021

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

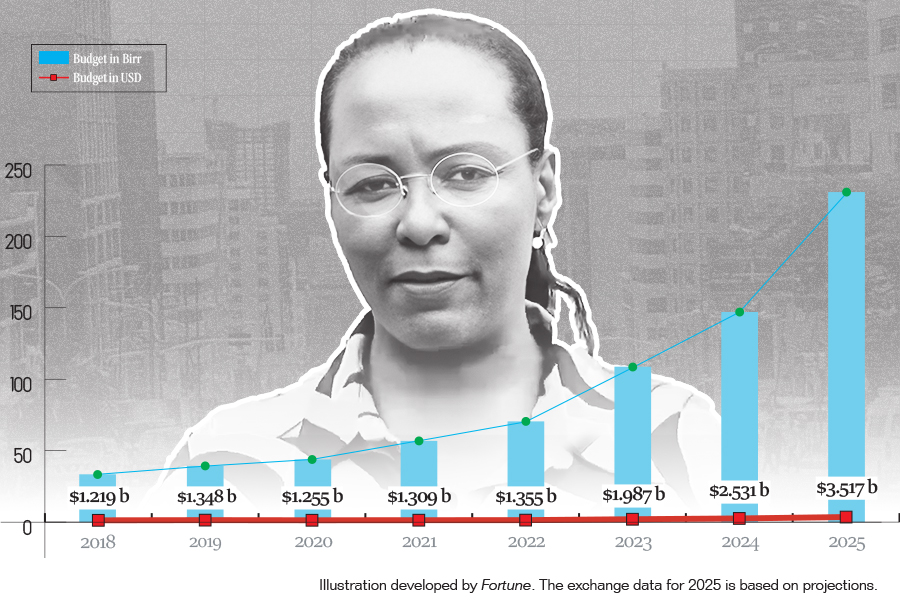

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...

Jul 21 , 2024 . By TIZITA SHEWAFERAW

Mayor Adanech Abebie's Administration faced an audit report that unveiled a startling...

Jul 21 , 2024 . By AKSAH ITALO

Brook Taye (PhD), director general of the Ethiopian Capital Market Authority, has tak...

Jul 21 , 2024 . By AKSAH ITALO

Ethiopia's horticulture, a major source of foreign currency and employment, is facing...

Jul 21 , 2024 . By AKSAH ITALO

Commercial banks are now permitted to acquire equity shares in capital market service...