Advertorials | Jul 24,2024

Oct 19 , 2024

The International Monetary Fund (IMF) has approved a 340.7 million dollar disbursement to Ethiopia, marking the first installment of a four-year, 3.4 billion dollar credit facility to stabilise the fragile economy.

The IMF Executive Board completed its first review of the program yesterday, acknowledging progress under the second edition of the Homegrown Economic Reform (HGER) agenda despite pressures in transitioning to a flexible exchange-rate regime. The IMF is expected to provide immediate relief to Ethiopia's acute balance-of-payments pressures, heightened by lingering foreign exchange shortages.

"The authorities have made commendable progress toward a market-clearing exchange rate," said Bo Li, IMF deputy managing director.

According to Li, the gap between official and parallel exchange rates has bridged, a disparity that had previously hindered investor confidence and trade.

Since the program's approval in July, Ethiopian authorities have targeted inflation control, liberalized the foreign exchange market, and imposed tighter monetary policy. The National Bank of Ethiopia (NBE) has begun phasing out deficit financing of the federal government, a move the IMF Board praised. The NBE has also revamped Treasury-bill markets and introduced open-market operations.

However, the IMF, in a statement it issued following the Board’s meeting yesterday, October 18, 2024, flagged unmet foreign exchange demand, cautioning that economic agents are still adjusting to the new regime.

Says the IMF: “While the supply of foreign currency is slowly improving, persistent mismatches in demand show the need for deeper reforms to sustain growth and bolster investor confidence.”

Deputy Director Li insisted the authorities should maintain the reform momentum, especially as they negotiate with international creditors to restore debt sustainability. Ethiopia’s negotiators are in talks under the Group of 20's Common Framework to restructure external debt, projected to hit 29pc of the GDP this year.

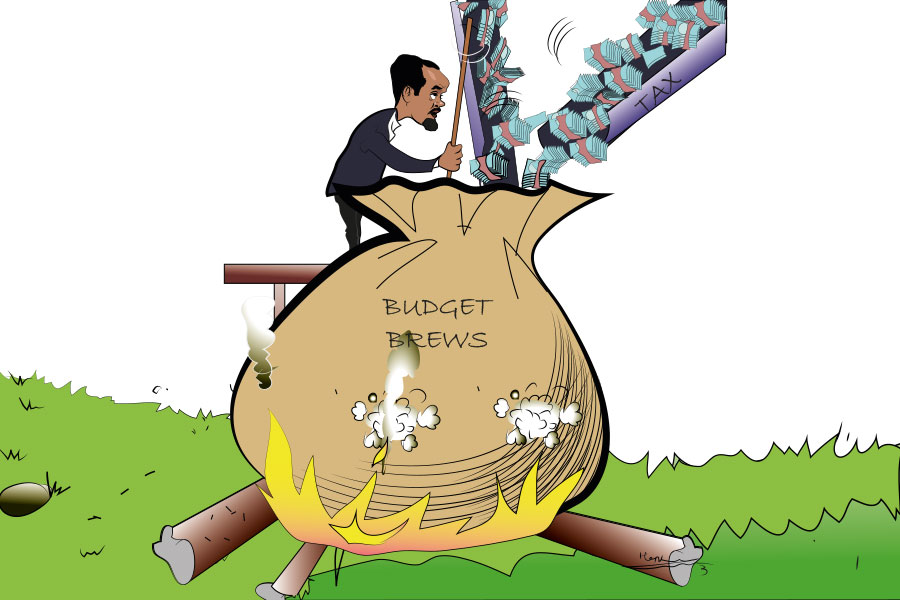

As part of the deal with the IMF, the authorities have committed to boost domestic tax revenue, reinforced by the approval of a new value-added tax (VAT) law designed to expand the revenue base and streamline exemptions.

“These measures, along with plans to expand social safety nets, aim to mitigate the social impacts of the economic overhaul, which could leave vulnerable groups exposed without targeted support,” said the IMF statement.

The first disbursement sets the stage for the authorities to stabilise the economy, but uncertainties loom. As the government strives to meet IMF benchmarks and recalibrate its financial systems, the next review is expected to be crucial to ensuring that Ethiopia’s fragile recovery gains traction during times of increasingly volatile economy.

Advertorials | Jul 24,2024

Radar | Aug 20,2024

Viewpoints | Sep 03,2022

Radar | May 28,2022

Editorial | Jun 12,2021

Commentaries | May 27,2023

Fortune News | Dec 25,2021

Agenda | Jul 07,2024

Radar | May 27,2023

Commentaries | Apr 15,2023

Photo Gallery | 176473 Views | May 06,2019

Photo Gallery | 166689 Views | Apr 26,2019

Photo Gallery | 157207 Views | Oct 06,2021

My Opinion | 136913 Views | Aug 14,2021

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...