Agenda | Dec 14,2019

Apr 28 , 2024

By Abiy Getachew

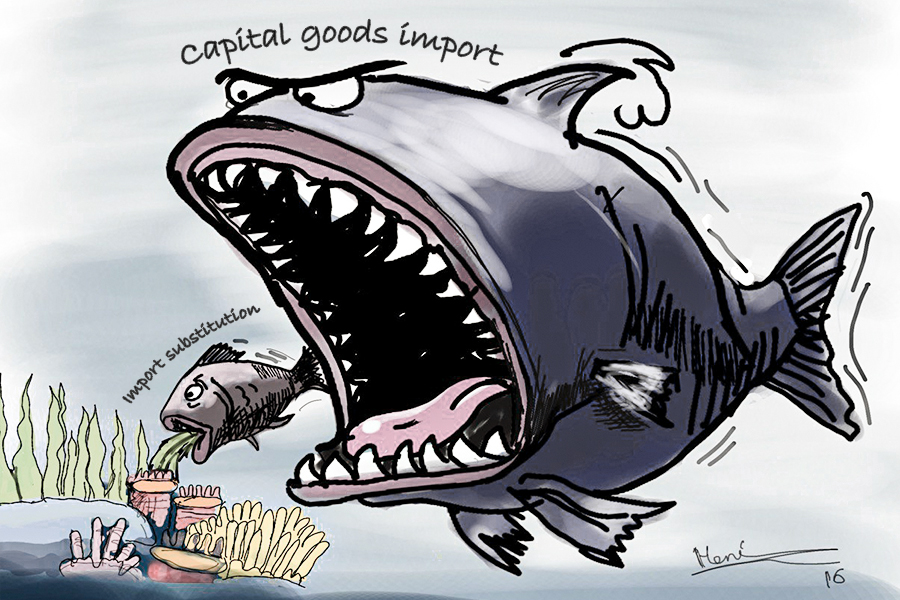

The recent directive unveiled by the Ethiopian Investment Board (EIB) marks a considerable shift in policy by the federal government. Its timing and scope opened several previously restricted sectors to foreign investors, with foreboding implications for domestic companies and consumers.

The directive notably welcomes foreign capital in the export of essential commodities, including raw coffee, khat, oilseeds, and pulses, albeit under specific conditions. It also allows foreign nationals and companies to engage in wholesale trade across a broad spectrum of sectors, except for fertiliser and petroleum imports, which remain exclusively in the hands of domestic investors. The policy change could not have come at a more critical juncture as Ethiopia strives to stabilise its currency and continues its negotiations with the International Monetary Fund (IMF) for a new loan program. Such economic measures are essential for maintaining the country's financial stability and promoting an environment conducive to investment and growth.

Drawing on the economic principle of comparative advantage, Ethiopia’s approach mirrors the liberalisation efforts of other African countries like Ghana and Nigeria, which opened their economies to foreign capital to catalyse growth and development in past decades. Ghana's economic reforms in the 1980s and Nigeria's in the 2000s reduced trade barriers and encouraged a more attractive climate for international investors. These countries leveraged their natural resources and consumer markets to attract foreign capital, propelling economic diversification and bolstering global competitiveness.

Ghana and Nigeria's success stories should provide a compelling cue for Ethiopia; embracing its comparative advantages could similarly enhance its economic stature on the world stage. The influx of foreign capital is expected to bring substantial investment and valuable expertise, setting the stage for increased productivity in domestic industries. Companies are now compelled to upgrade their competitiveness and operational efficiencies to thrive amid increased international competition. The environment should encourage a beneficial exchange of knowledge and skills between domestic companies and their foreign counterparts, potentially leading to progress in local expertise and business practices.

The impact on consumers is expected to be no less positive. The entry of foreign businesses will likely lead to greater product variety, enhanced quality, and more competitive pricing. Such changes are anticipated to elevate the consumer experience, providing them access to a broader array of goods at potentially lower prices. The dynamic of increased competition could drive down costs while promoting a culture of quality improvement in production.

However, the long-term effects of this shifting policy on domestic businesses and the broader consumer base are yet to be fully determined. As the market adjusts to the presence of international market actors, the ongoing interactions between investor activities, local economic conditions, and consumer preferences will play a crucial role in shaping the future economic landscape. Monitoring these developments will be key to understanding the enduring impacts of foreign capital on the economy and the public.

As policymakers pursue their ambitious economic reforms, foreign capital's indispensable role in driving growth and stability remains. This strategic move is expected to unlock numerous economic benefits for local businesses and consumers, setting the stage for a period of robust growth and enhanced competitiveness.

PUBLISHED ON

Apr 28,2024 [ VOL

25 , NO

1252]

Agenda | Dec 14,2019

Radar | Jul 17,2022

Fortune News | Feb 15,2020

Editorial | Nov 04,2023

Radar | Dec 01,2024

Radar | Dec 15,2024

Fortune News | Apr 04,2020

Fortune News | Apr 28,2024

Fortune News | Dec 25,2022

Fortune News | Jan 07,2024

My Opinion | 131590 Views | Aug 14,2021

My Opinion | 127946 Views | Aug 21,2021

My Opinion | 125921 Views | Sep 10,2021

My Opinion | 123545 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...