Agenda | Aug 23,2025

Oct 2 , 2024

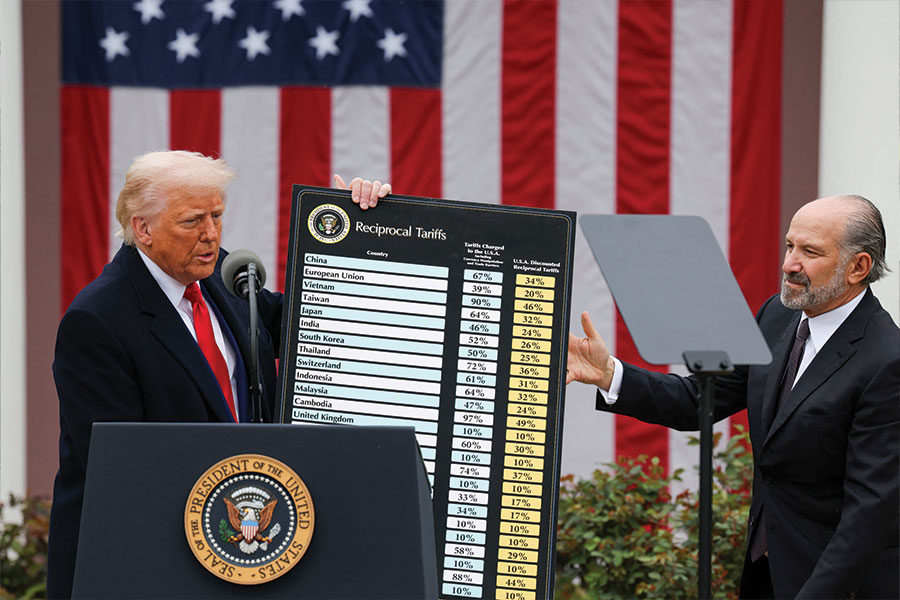

The National Bank of Ethiopia (NBE) has granted licenses to five private non-bank entities to operate in the foreign exchange market, in a groundbreaking move to liberalise a tightly regulated forex regime. This marks the first time such permissions have been extended beyond traditional banks, a potential turning point in addressing the acute foreign currency shortage.

The newly licensed operators - Dugda Fidelity Investment Plc, Ethio Independent Foreign Exchange Bureau, Global Independent Foreign Exchange Bureau, Robust Independent Foreign Exchange Bureau, and Yoga Forex Bureau - are expected to commence operations within a month. According to a statement released by the NBE today, these entities will offer services from spot transactions to various commercial forex activities.

The central bank's decision follows the latest directive issued this year governing non-bank entities in the forex market. These bureaus are permitted to handle up to 10pc of the daily forex auction limit set by the central bank, a cautious yet historical step toward opening up the market while maintaining regulatory oversight.

Ethiopia has been gripped by severe foreign currency depreciation and a chronic shortage of foreign exchange, issues that have impacted economic growth and inflated import bills. By allowing private non-bank entities into the forex market, the NBE aims to alleviate pressure on the Birr and provide more competitive rates for consumers.

According to market analysts, the introduction of non-bank players could reduce the parallel foreign exchange market, where rates have soared to unprecedented levels due to high demand and scarce supply.

The licenses are issued during heightened scrutiny over Ethiopia's foreign exchange reserves, which have sharply declined in recent years due to low export revenues and rising import bills. International financial institutions like the World Bank and the International Monetary Fund (IMF) have urged the federal government to implement reforms to beef up currency stability, including liberalising the forex market.

As these non-bank entities prepare to launch their operations, all eyes will be on the initial market response and the NBE's subsequent steps in managing the forex crunch. The move could either disrupt the status quo by injecting much-needed liquidity into the market or serve as a temporary measure in a system requiring deeper structural reforms.

Stringent capital requirements and potential pushback from established banks could affect the new entrants. They would also contend with a volatile macroeconomic environment and regulatory unpredictability that has characterised the financial sector.

Agenda | Aug 23,2025

Radar | Aug 03,2019

Fortune News | Nov 21,2018

Addis Fortune | Jul 03,2025

Fortune News | Jun 13,2025

Fortune News | May 31,2025

Viewpoints | Aug 10,2025

Radar | Jan 15,2022

Radar | Apr 24,2023

News Analysis | Nov 03,2024

Photo Gallery | 157153 Views | May 06,2019

Photo Gallery | 147441 Views | Apr 26,2019

Photo Gallery | 136024 Views | Oct 06,2021

My Opinion | 135300 Views | Aug 14,2021

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...