Fortune News | Jan 11,2020

An embargo on clearance procedures for cargoes imported through partitioned foreign currency permits came into effect this week, sending ripples through the manufacturing landscape. The new regulatory edict, restricting the utility of a single forex permit for multiple purchases, is creating turmoil among manufacturers troubled by a demanding business environment.

A directive issued three years ago, which prohibits requesting forex for more than two pro forma invoices under a single import application, had already tightened the operational space for businesses. Industry experts argue that the conflation of this credit cap with forex droughts has already placed industries in a dire situation.

Yoseph Getachew, a business consultant, cautioned against overlooking the broader economic implications of the sudden regulatory change. He criticised policymakers for often being reactive and urged the Customs Commission to address internal ethical issues and inefficiencies before imposing burdensome regulations on the public. Yoseph advocates for developing realistic procedures through inclusive public discourse, emphasising the need to consider the long-term impact on the manufacturing sector.

"It's an anxiety-fueled decision," he told Fortune.

Manufacturers are in commotion. They have traditionally relied on the flexibility of using a single permit to source imports from various global suppliers. The new policy, their leaders argue, considerably narrows this flexibility, aggravating the struggles of industries suffering from input shortages due to limited foreign exchange availability and production constraints linked to conflicts in various parts of the country.

Mintesinot Lemma, president of the Ethiopian Plastic & Manufacturers Association, has been vociferous in voicing the damaging impact of the restrictions on the sector's already precarious situation.

"It'll limit the utility of a forex permit obtained after a lengthy wait," he told Fortune.

The plastic and rubber manufacturing sub-sector, a significant contributor to industrial outputs, is particularly hard hit. Mintesinot warned nearly half of the approximately 4,000 companies in this sector are teetering on the brink of closure. These firms struggle to balance revenues with soaring production costs while operating at less than two-thirds of their capacity. The sub-sector's annual import requirement for raw materials exceeds 400,000tns, a demand Mintesinot believes is untenable under the new single permit regime.

The 41-member Association recently penned a letter to the central bank, urging a revised arrangement. This plea has reached the corridors of the Customs Commission and the ministries of Finance and Industry, pressing on the situation's urgency.

The Customs Commission has been at the forefront of advocating for these new restrictions. A month ago, its Commissioner, Debele Kebeta, called on the central bank to ban partial shipments under a single permit, blaming rampant misuse. Tracking individual shipments had become increasingly challenging under the old system, according to a high-ranking official who spoke anonymously. The repeated use of a single permit beyond its intended purpose had reportedly led to under-invoicing of shipments and a rise in contraband trade. The official insisted on imposing enhanced regulatory capabilities and transparency to impede corruption.

Following the Commissioner's request, regulators at the National Bank of Ethiopia (NBE) ordered the 32 commercial banks to decline requests for partial utilisation of bank permits. The order aligns with the broader financial crunch, marked by constrained liquidity and diminished forex mobilisation.

However, this policy shift has sparked contrasting outlooks within the central bank. While some of its officials assert that the new system will not adversely impact manufacturers, others seem to deflect responsibility onto the Commission. Vice Governor Fikadu Digafe stated that the central bank's role was to facilitate communications with commercial banks at the Commission's behest.

"We simply conveyed their request," the Vice Governor said.

However, Yenehasab Taddese, the foreign exchange director, believes the manufacturers' uproar derives from a misunderstanding, asserting that applying for separate permits for each shipment is equivalent to partitioning a single permit for multiple uses.

"Manufacturers have it confused," she said.

The chemical manufacturing sector, which requires a diverse range of over 200 chemicals for producing items like detergents, soap, and paint, is another casualty of the policy shift.

Leaders of the Ethiopian Chemical Products Manufacturers Association, representing 51 members, have pleaded for a difference between their legitimate business needs and those allegedly abusing the partial bank permits. Its General Manager, Seleshi Ayalew, warned of a severe business disruption if immediate intervention from the authorities is not forthcoming. He argued that importing all the necessary inputs through a single letter of credit is impractical.

"All businesses should not be put in a single basket," he told Fortune. "Something needs to be done before manufacturers crumble."

Logistical challenges compound these issues. Manufacturers often rely on the availability of shipping containers for imports, making it difficult to bring in all required materials under a single permit. The practice of partitioning permits has, in the past, enabled businesses to manage inventory effectively and ensure timely delivery.

One of the most prominent voices in the industrial sector expressing concern over the new regulations is Unilever Ethiopia. A global conglomerate with annual sales exceeding 60 billion euros, it has been operating in Ethiopia for eight years. It relies on imports of 150 types of raw materials from around 70 suppliers globally.

Degsew Amanu, the corporate affairs head, cautioned that the inability to ship the full value of materials under a single permit could severely disrupt their supply chain. The restriction on permit utility, according to Degsew, poses a significant operational challenge for the company, which manufactures 10 product lines in Eastern Industrial Park, in Dukem town, 35Km southeast of the capital.

Says Degsew: "This might create a shock in our operations."

The consequences of the policy extend beyond the manufacturing sector to the banking industry.

Girum Tsegaye, former president of Berhan Bank, acknowledged that while banks might find relief in reduced operational burdens, businesses are left in a precarious situation. He echoed the anxiety among firms that have secured letters of credit permitting partial shipments, only to find themselves constrained by the new enactment.

PUBLISHED ON

Nov 18,2023 [ VOL

24 , NO

1229]

Fortune News | Jan 11,2020

Fortune News | Jun 12,2021

Fortune News | Jun 03,2023

Commentaries | Jun 24,2023

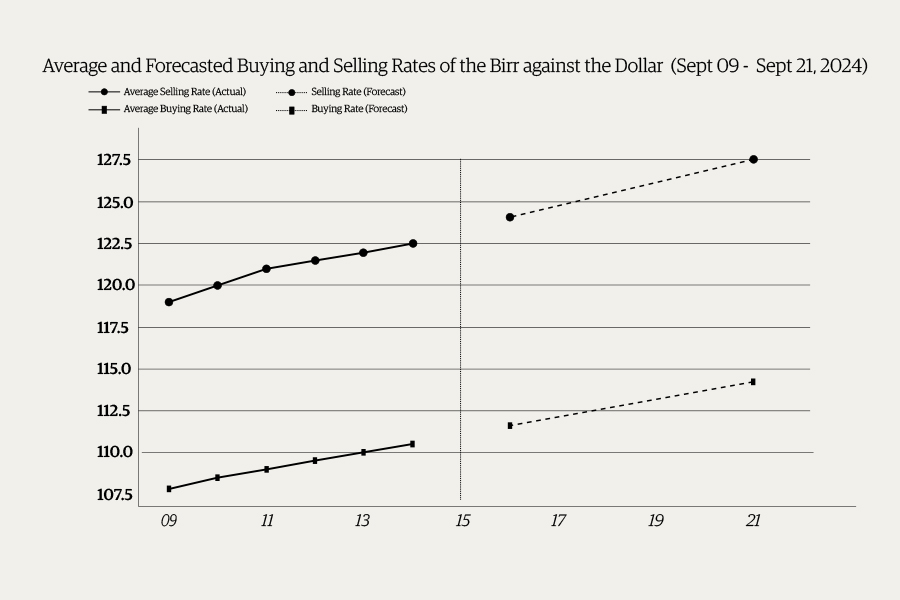

Money Market Watch | Sep 14,2024

Fortune News | Mar 14,2020

Fortune News | Jan 25,2020

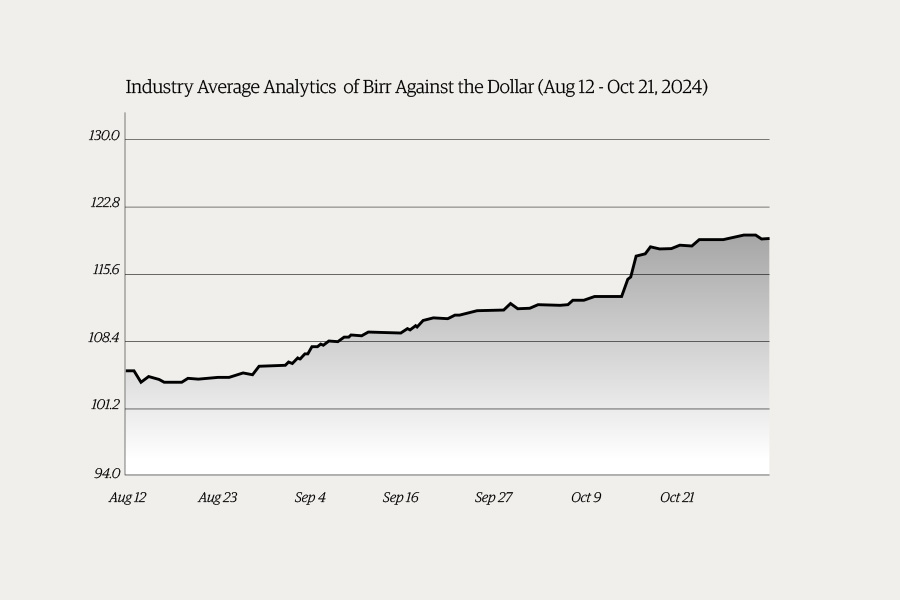

Money Market Watch | Nov 03,2024

Fortune News | Aug 18,2024

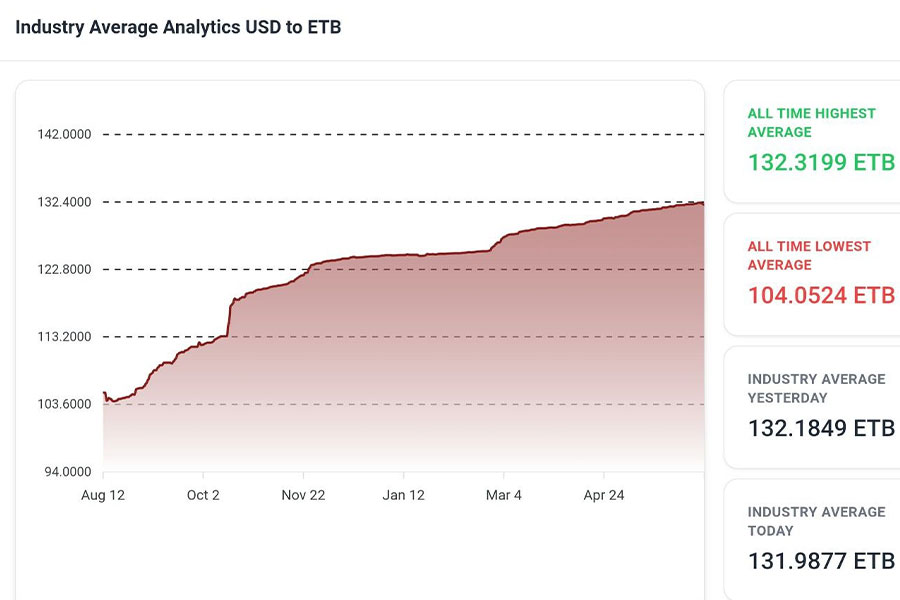

Money Market Watch | Jun 15,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...