Radar | Jul 08,2023

Foreign multinational companies will be permitted to use their own forex to import selected commodities, pending an approval from the macroeconomic committee, chaired by Prime Minister Abiy Ahmed (PhD).

A six-page directive was drafted by the Ministry of Finance to privilege foreign companies to use franco valuta licenses to import wheat, edible oil, sugar and some selected industrial inputs and commodities. Tabled to the macroeconomic committee, the directive was drafted following a green light from the Ethiopian Investment Board in November, 2019.

Expected to be approved in a few weeks time, the directive will give foreign companies the right to venture into a trading business that was previously exclusively reserved for local companies.

Before proposing the engagement of foreign companies in the import of basic food and industrial commodities, the Ministry of Finance conducted an assessment that pointed out the economic benefit of acceding foreign investors into the business, according to Abebe Abebyehu, a commissioner at the Ethiopian Investment Commission.

"It will be instrumental in the effort of fighting inflation and addressing the foreign exchange crunch," Abebe told Fortune.

The headline inflation rate, which is overwhelmingly increasing due to food inflation, reached 19.5 pc last month. It is deemed to be one of the highest in the past five years, in which food inflation has shot up to 22.7pc.

The Investment Commission will grant an investment license for these companies, while the Trade Ministry will issue a business license to them. The Trade Ministry will also select both private and public institutions that will engage with the distribution of the commodities. However, if the importers decide to distribute the goods themselves, the Ministry will have to review their distribution channels and approve.

The Commercial Bank of Ethiopia, on the other hand, will review documents of the importers including letters of credit, cash against documents and import licenses. CBE will also transfer the foreign currency of the companies back into their countries.

"It also aims to increase the availability of goods to the low-income consumer as well as address the scarcity of goods," said Eshete Asfaw, state minister for Trade & Industry.

At the end of November, the Ministry of Finance announced a request for an expression of interest, inviting multinational companies to supply 1.5 million to two million tonnes of wheat, 480 million to 550 million litres of cooking oil and 250 million to 350 million tonnes of sugar. The companies will import and distribute the commodities at their own cost.

The companies are required to agree on a term that allows them to repatriate their expenses between a year and two years of the date of the import. The Ministry also gives preferences to those who are willing to invest their profits in the country.

The draft directive set five criteria to evaluate and select the bidding companies. Audit reports, utilisation of the revenue from the sales of the commodities, selling price, experience in the business and the time to import the commodities are the criteria.

Out of the 100-point grading system, revenue utilisation accounts for 75 points, while selling price has the second-highest value at 10 points. Audit report, experience, and the duration the companies need to import the commodities have five points each.

Companies that are willing to invest the full revenues in the country will get the full 40 points. Those who will invest the revenue partially will be awarded 25 points depending on the percentage of the investment. The number of years they take to repatriate the money to their country of origin is weighted at 10 points.

Such measures will give some short-term breathing room for the government by easing pressure on food import bills that would otherwise be paid by the limited forex reserves, according to Getachew Woldie (PhD), an economist with 15 years of experience who works and lives in Canada.

But he says that the initiative should be coupled with long-term solutions to lessen the rampant food price inflation.

"Increasing productivity, addressing key macroeconomic problems that are related to monetary and fiscal policies, strengthening exports, as well as exchange rate policies, are more critical than short-sighted interventions," Getachew said.

He also added that it should also be noted that these foreign companies eventually get paid in foreign exchange.

Getachew also cautions the government to make sure that the distribution of commodities at subsidised prices does not disincentivise domestic producers.

PUBLISHED ON

Jan 25,2020 [ VOL

20 , NO

1030]

Radar | Jul 08,2023

My Opinion | Jan 27,2024

Radar | Jul 21,2024

Agenda | Aug 24,2019

Fortune News | Jun 20,2025

Fortune News | Apr 06,2019

Viewpoints | Aug 07,2021

Fortune News | Jul 12,2021

Commentaries | May 24,2025

Editorial | Jun 11,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

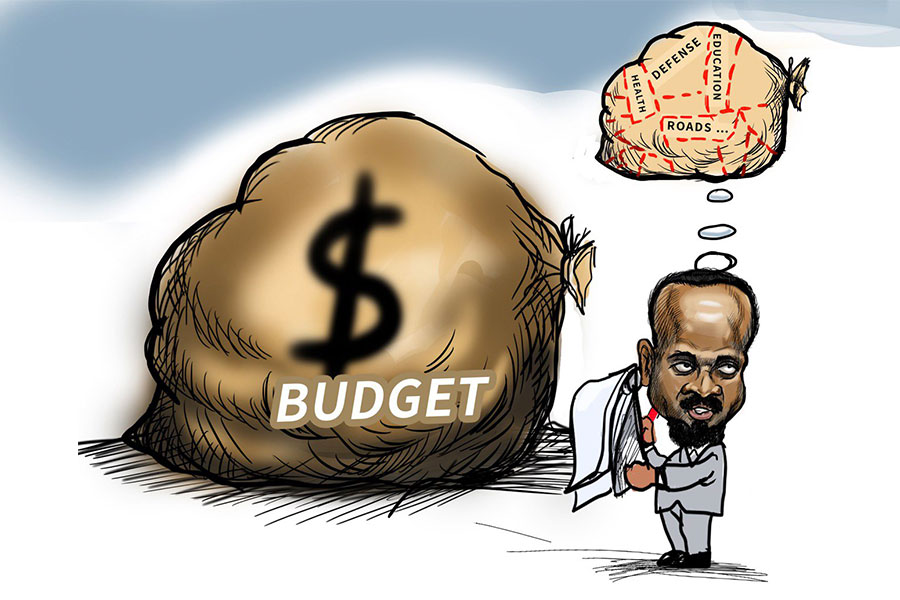

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...