Covid-19 | Jun 13,2020

Jul 13 , 2020

By Atsebaha Abay

At the forefront of the fight against COVID-19, we need to have two types of soldiers. One is obvious: committed health workers within a strong health system. The other, less discussed, are efficient bankers within robust financial institutions, writes Atsebaha Abay (atsebahaabay@gmail.com), a banking professional with 29 years of experience working in various positions at the Development Bank of Ethiopia (DBE).

The world is at war against a very dangerous enemy - the Novel Coronavirus (COVID-19). This enemy is a sharp, two-edged sword. On the one side, it takes the lives of individuals and paralyses the health system. On the other, it shakes the financial system to its core, overwhelming the whole economy.

It should be evident that at the forefront of the fight against COVID-19, we need to have two types of soldiers: committed health workers within a strong health system and efficient bankers within robust financial institutions.

But where, in the economic sector, are the banks situated to provide the best support in the fight against COVID-19?

The global experience as the virus has been ravaging much of the world can help answer this question. Critical to understand about the virus is that it heavily affects key sectors such as manufacturing, agro-processing, medicine, pharmaceuticals and horticulture. All of these are important and even strategic to Ethiopia’s national economy.

Another global lesson is that it is small and medium-sized enterprises (SMEs) that take the brunt of the devastation. The same lesson also shows that, if effectively supported, SMEs are key instruments in bolstering the economy to withstand the COVID-19 crisis and build resilience.

Due to their poor access to finance and liquidity, SMEs cannot sustain the sort of economic shock that larger enterprises can take. This spells bad news for SME's contribution in creating employment opportunities and the concomitant boost to domestic consumption by driving the demand for goods and services.

Unless SMEs are supported to remain solvent, the damage to the economy will be profound. It then follows that if the government and financial institutions want to curb unemployment and boost local demand, they have to shelter the SMEs from shocks. This is why many countries and their financial institutions are giving priority to SMEs in the fight against COVID-19. The means to addressing this challenge should thus be to concentrate efforts on parts of the economy that are detrimental in their structural importance.

For the banks, fighting COVID-19 is not only about liquidity provision to economic sectors, the reduction of interest rates or the re-scheduling of loan repayments. Banks' contributions need to also come from the protection and the consistency of the services they provide despite the challenges COVID-19 poses.

They may need to revise their operational procedures - for instance taking local policies into consideration - and develop contingency plans based on different severities under different scenarios of the pandemic. For instance, the Tigray Regional State has mandated that anyone that goes there needs to be quarantined for 14 days.

How will these banks conduct their regular due diligence, monitoring, follow-up and auditing tasks over the coming months? During such a pandemic, how would banks ensure their operational continuity? Should they revise their operations, for example from on-site to off-site monitoring when it comes to follow-up and auditing, or postpone it?

A combination of these methods could work. They could also assign districts or branches to conduct such tasks on behalf of the business units in the headquarters.

High credit risk with soaring default rates are the other challenges facing banks during COVID-19. Increasing defaults lead to stress, while an increase in NPLs (non-performing loans) draws banks into loss territory. In turn, both of these lead to reduced fresh loans and the holding back of future investments. In such a situation, banks should conduct prudent asset valuations, particularly for those equity-stressed ones to reflect current equity loan proportions and improve the quality of their credit portfolio.

This would entail having to revise strategies in NPL reduction, credit risk management, early warning of key indicators including stress testing by incorporating lessons learned from the leading financial institutions during COVID-19. Banks would also need to review their rules, regulations and directives in a way that sufficiently addresses the upcoming financial downturn.

Operating under the COVID-19 pandemic also requires fast, accurate and timely reporting systems, particularly on key parameters, as well as taking fast and appropriate decisions including incorporating lessons learned from the problems.

In their attempt to fight COVID-19, leading banks around the world have also applied strict measures to ensure the safety and health of their employees and customers. They have provided constant disinfection of offices and equipment, including vehicles, and the preparation of furnished emergency isolation rooms in their headquarters and branches. Our banks should take the global lessons and implement them as their strategy in their fight against the pandemic.

The banks could also attempt to make life better for the employees who have family members working in health facilities. They can develop a working strategy, for instance, where they are allowed to work off site or in a shift basis after collating which employees have family members working in health centres and hospitals. This could be a relief to health professionals seeking to combat the virus.

What needs to happen is clear. In such challenging times, the government should avail sufficient and cheaper long-term financing to the banks while development partners assist in providing additional funds and develop collateral guarantee schemes. This will help banks protect strategic parts of the economy.

Similarly, banks need to develop quick and frequent self-assessment systems with early warning systems that help them examine their risk exposure status to COVID-19. This will help them respond in real time to arising crises.

PUBLISHED ON

Jul 13,2020 [ VOL

21 , NO

1055]

Covid-19 | Jun 13,2020

Viewpoints | Jun 01,2024

Viewpoints | Apr 13,2019

Fortune News | Aug 12,2021

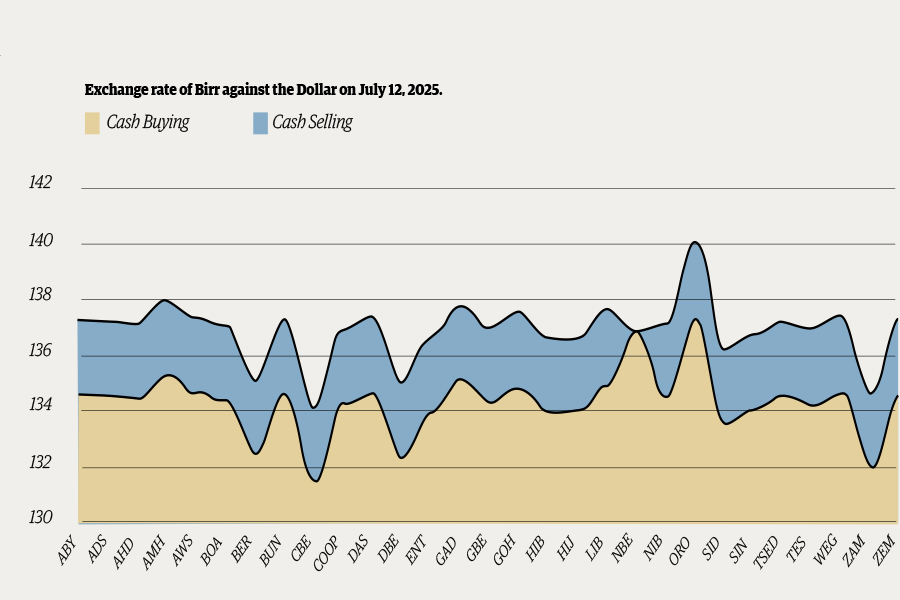

Money Market Watch | Jul 13,2025

News Analysis | Mar 16,2024

News Analysis | Mar 23,2024

Radar | Oct 20,2024

Radar | Oct 27,2024

Commentaries | Dec 07,2019

Photo Gallery | 174712 Views | May 06,2019

Photo Gallery | 164933 Views | Apr 26,2019

Photo Gallery | 155166 Views | Oct 06,2021

My Opinion | 136719 Views | Aug 14,2021

Editorial | Oct 11,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Oct 12 , 2025

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...