Radar | Oct 24,2020

Nov 5 , 2022

By ASSEGED GEBRMEDIHN

Business leaders that have spent much of their careers putting on blinders need to adjust to the digital world. The way customers and business transactions are handled should flow with the dynamics. Although decades have passed since the global digital economy was unravelled, Ethiopia is stuck on manual services.

Company heads direct their employees to go for market share systems against competitors while focusing on a single portfolio. The current business performance indicates that new ways should be implemented. Enhancing an industry share from growing competition increases the market share, viewed from the vantage point of profitability and cash flow. Market share without using a disproportionate amount of inventory extends the duration of accounts obscured. This void would gradually lead the business to close as it can not satisfy customers.

The growth concept allows companies to maintain their strategic position as long as they meet their obligations and distribute dividends. An adequate capital with an effective strategy may help businesses survive in a particular economy; it is not guaranteed in times of uncertainty.

The 21st Century requires "rethinking growth" from every dimension of business.

Adequate capital, knowledge repository and technology are challenges for experts to develop the best growth model. Models in the globalization era have become obsolete and returned to shelves regardless of the time spent crafting them. Creating the same model as Bill Gates and Mark Zuckerberg would not cut it in the vigorous business world. It should be different.

The dynamics of technology imply that today's top practices lead to dead ends. Following a rapid change in the continent, particularly in East Africa, Ethiopia opened some of its services to foreign investors. It is a controversial policy move, and its rationale remains somehow debatable.

I understand and strongly support the government's intention, courage and determination. The central bank's role in having the country's best interest at heart is evident. Bankers and insurance firms should begin the search for the right merger, acquisition, and strategic alliance between domestic and international capital. Subsidiary banks, exchange agents and reinsurers have worked with domestic banks for over five decades to facilitate letters of credit.

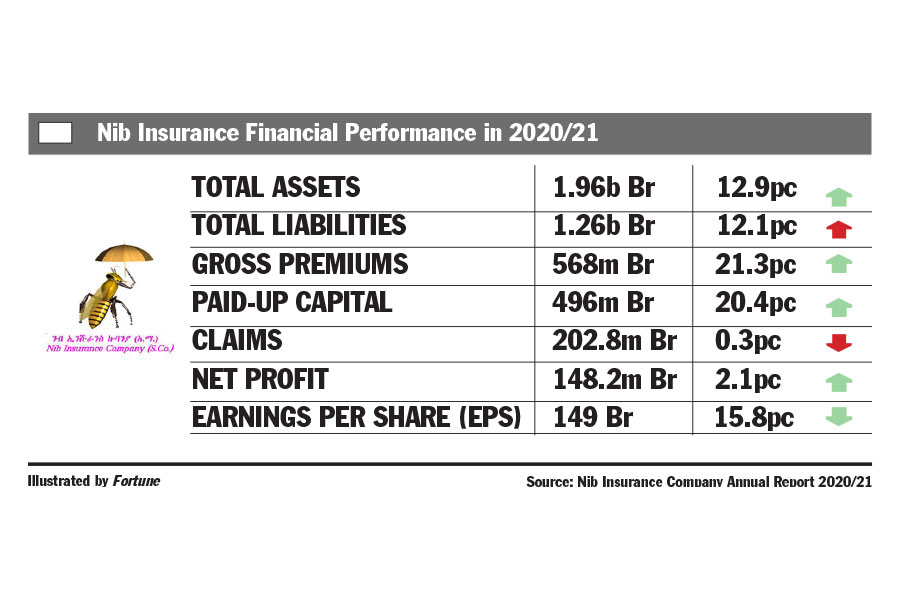

It is time to consider freeing the banking industry from the directive that limits growth and minimum adequate capital ratio. The mindset of leaders, particularly the board of directors, should place more time and attention on growing regional markets than the usual focus on earnings per share and dividends. The industry's priority should be raising shares and increasing capital and how businesses grow their assets after mergers.

The antidote is rethinking growth before getting swallowed by the bigger fish. The Ethiopian financial sector's traditional methods are becoming purposeless as they persist in following the old models. Their business will not survive if their strategy fails and they cannot maintain customer satisfaction.

Rethinking is not just about acquiring new knowledge but advancing to the future. If not, no policy saves the sector from dying. It is crucial to rethink growth by giving special attention to customers.

PUBLISHED ON

Nov 05,2022 [ VOL

23 , NO

1175]

Radar | Oct 24,2020

Commentaries | Sep 08,2024

Fortune News | Mar 19,2022

Editorial | Apr 15,2023

Fortune News | Jan 01,2022

Viewpoints | Mar 04,2023

Fortune News | Jul 13,2024

Fortune News | Nov 21,2020

Editorial | Jul 29,2023

News Analysis | Mar 02,2024

My Opinion | 132038 Views | Aug 14,2021

My Opinion | 128435 Views | Aug 21,2021

My Opinion | 126362 Views | Sep 10,2021

My Opinion | 123981 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...