Fortune News | Jun 07,2025

Feb 16 , 2019

By Eyob Tesfaye (PhD)

Following his stunning ascendancy to the highest office in the nation, the charismatic Ethiopian Prime Minister, Abiy Ahmed (PhD), has continued to exhilarate his fellow citizens with his thrilling political reforms and many headline-grabbing bold moves. High hopes are also pinned on his administration`s ability to turn the nation’s economic fortunes around and to deliver on his twin promises of job creation and good governance.

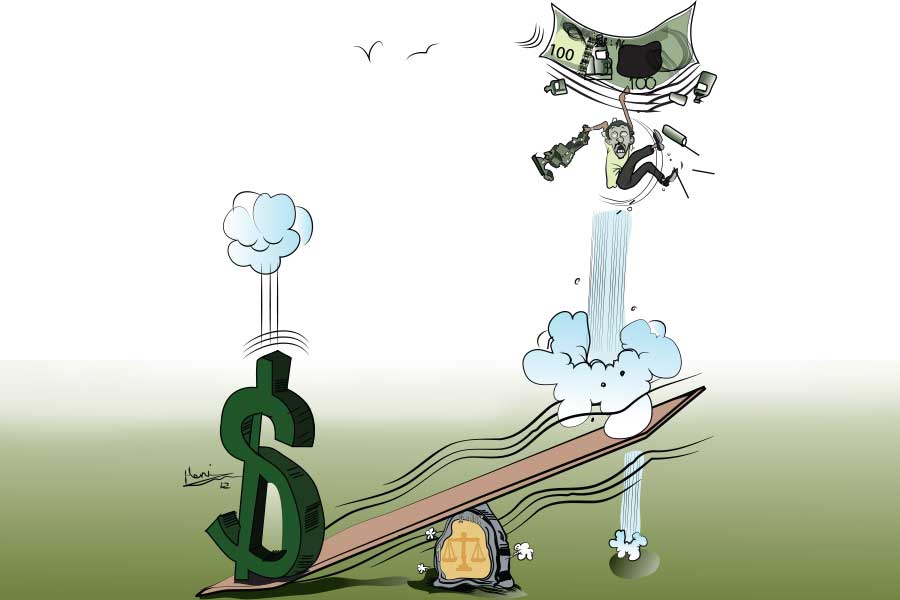

While some of his actions elate the mood of the majority, the Prime Minister has a long way to go before he starts to deliver on some of his promises. The current administration inherits an economy battered by persistent runaway inflation, increasing external and internal debts, forex shortage and ballooning deficits in trade and balance of payments, rising non-performing loans and high unemployment.

The economic malaise emanates primarily from a hugely overambitious development programme and macroeconomic mismanagement. The economy has been bedevilled for a long time by a continuously eroding currency subjected to a Keynesian delusion that excessive fiscal expansion helps to propel growth. The excessive fiscal expansion in the name of pursuing a high and speedy growth has resulted in a severe macroeconomic imbalance that has delivered the economy to an early stage of a tailspin.

Indeed, monetary adventurism helps public spending to play an important role to push growth without mobilising adequate revenues. But this has led to enormous internal and external borrowing and a debt saga.

It is a classic case whereby the unholy alliance between monetary and fiscal policies exacerbates the macroeconomic imbalance. Reviving a troubled economy, battered with severe macroeconomic disequilibrium, is an uphill task that requires patience and adequate time.

Abiy's administration needs to act decisively as it has already received a strong mandate from the majority of the populace - avoid bestowing political favours on any coalition partners and avoid being constrained by them. It must move fast to use its political capital in pushing for comprehensive reform agenda.

It would be naive to continue to apply the same recipe with the same ingredients and using the same set of utensils in the hope of getting a different dish. The Prime Minister needs to develop a policy playbook of his own; and, his first and immediate task should be to address the macroeconomic disequilibrium to bring it into balance.

Macroeconomic outcomes are the aggregate results of microeconomic activities. The administration`s general economic philosophy should thus be oriented mainly to creating a friendly and enabling environment for individual economic agents.

Gross domestic product (GDP) is an aggregation of outputs of goods and services by thousands of private producers. No doubt government actors are contributing to the GDP, coming mainly from the infrastructure and key industrial sectors. The state`s participation could be justified on at least three grounds: market failure, filling the infrastructure gap and in helping overcome global competition. The latter is known as the infant industry argument.

It is in the business of states to want to see an increase in the quantity and quality of GDP by as high a growth rate as is consistent with overall economic and financial stability. Deploying existing excess capacity, expanding current capacity, undertaking new investment and improving technologies in production are some of the tools states use to ensure the expansion of the GDP. Investments in the form of expanding existing production capacity and technological improvements require national savings and resources in skilled labour, land, entrepreneurship and capital equipment.

A gap in national savings and investment could compel states to print currency notes and into desperation for external debt. The outcome of this is inflation, exchange rate depreciation or devaluation, foreign exchange shortage and debt burden.

Macroeconomic policy and strategy making should thus be aimed at both domestic balances in the areas of domestic savings and investment as well as revenue mobilisation and controlling public expenditure. Introducing the right monetary expansion should aim in ensuring growth in real GDP. On the external side, a balance needs to be maintained in the areas of exports and imports as well as in the overall balance of payments.

Macroeconomic policymaking should also aim at the full deployment of real and financial resources. High labour force participation and land utilisation rates and full exploitation of export potential should be emphasised, for low unemployment and efficient utilisation of land, as well as the increasing share of exports in GDP, are most desirable.

However, it is wise not to interpret an internal and external economic balance in its narrow sense. Balance does not, in this context, mean something in its permanent form. It only refers to a sort of short-term dynamic imbalance which gives rise to stable long-term equilibrium.

A short-term gap in national savings and domestic investment is expected to result in long-term equilibrium between the two macro variables.

What then should the macroeconomic philosophy of Abiy`s administration be?

It should be an economy where the private sector is the dominant agent in the production cycle, but in which the government plays a significant role, particularly in the clear-cut situations of market imperfection. The state should continue to play its legitimate role in putting in place infrastructure and other public goods in critical industries and activities where joint ventures with foreign investors is likely to boost global competitiveness.

Such a philosophy should be based on the realisation that macroeconomics is not just a simple aggregation of microeconomic activities, but also the sum total of the dynamic relationships between and among several microeconomic activities. The judicious regulation, as well as provisions of directions and coordination of these individual activities, is the natural responsibilities of the state as an overarching institution.

The first order of business should be to establish a national economic advisory council alongside the existing macroeconomic team. Its members could put in place the required macroeconomic framework.

Leading macro-economic agencies - including the ministries of Finance, Agriculture, Trade & Industry, as well as the central bank and the national planning commission should be staffed by experienced professionals whose record show their demonstrated competence. Most importantly though the focus should be on the central bank, a federal monetary agency that is in desperate needs of restructuring to regain its profound analytical and technical capabilities. Staffing it with the best brain - whether from the local or imported labour market - is no doubt long overdue.

Heading a central bank requires astounding intellect, competence and self-confidence, according to Alan Greenspan, a former chairman of the US Federal Reserve.

He was not talking about some of the bank “governers” who were known for their subservient nature because they displayed little intellect and assertiveness, except turning the institution into a mockery, when he said, "the job requires a nose, intuition, vision and a belief in monetary management to keep the economy in the right direction."

No less crucial is what goes on the fiscal policy front. It plays an increasingly important role in Ethiopia, where decisions should be synchronised with monetary policies to tame inflation, smoothen business cycle, ensure adequate public and private investments, and narrow the income gap. There are already encouraging reforms on the fiscal front that could bolster revenues and bring sanity through the reduction of wasteful expenditures.

To see productive expenditures in public investments, a project study and appraisal institution should be set up by the federal government with the responsibilities to ensure no public investment begins without the availability of adequate financing and monitoring capacity.

Steps to reverse the severe macroeconomic imbalance and ensure stability call for further actions to solidify macroeconomic resilience. It includes bolstering the foreign exchange reserve, putting in place a responsive monetary policy that moderates credit expansion, further deepening of revenue and expenditure reforms and the introduction of comprehensive financial sector reform measures.

The macroeconomic prudential reform measures should also be accompanied by structural reforms to lift productivity and potential growth, improve the regulatory environment and enhance land and capital factor markets.

PUBLISHED ON

Feb 16,2019 [ VOL

19 , NO

981]

Fortune News | Jun 07,2025

Viewpoints | Mar 21,2020

View From Arada | Jun 08,2024

Fortune News | Mar 19,2022

In-Picture | Mar 16,2024

Editorial | Aug 29,2020

Fortune News | Dec 04,2021

Viewpoints | Nov 23,2024

Radar | Nov 20,2023

Editorial | May 14,2022

My Opinion | 132272 Views | Aug 14,2021

My Opinion | 128692 Views | Aug 21,2021

My Opinion | 126600 Views | Sep 10,2021

My Opinion | 124206 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...