Editorial | Oct 15,2022

Jul 11 , 2025

Ethiopia officially launched its first securities trading platform today, marking a moment in the country’s financial history. The Ethiopian Securities Exchange (ESX) began operations with the public registration and trading of government treasury bills (T-bills) on its secondary market.

The inaugural event took place at the Sheraton Addis Hotel today, where financial sector officials gathered to ring the ceremonial bell, signaling the start of a new era in the capital markets.

ESX CEO, Tilahun Kassahun (PhD), presided over the ceremony as representatives from Gadda Bank and Wegagen Bank, the first two financial institutions registered on ESX, rang the inaugural trading bell.

According to Finance Minister Ahmed Shide, the importance of the launch, noting that the move from physical to dematerialised T-bills, represents a more efficient way to manage public liquidity. He described the instruments as a "positive-yield investment opportunity" that could help diversify sources of domestic financing.

Jointly organized by the Central, ECMA and the ESX, the event marks Ethiopia’s formal entry into securities trading, to mobilise domestic capital, expanding financial access, and fueling long-term growth.

Mamo Mihretu, governor of the National Bank of Ethiopia (NBE), said that traditional capital sources, taxes, loans, and grants, are no longer sufficient, making a formal capital market a strategic necessity.

For Hana Tehelku, director general of the Ethiopian Capital Market Authority (ECMA), the debut of T-bill trading is the “fruition of regulatory groundwork” and an important step toward building an inclusive investment ecosystem. She hopes to see that the listing of government bonds instill confidence in corporate issuers and help pave the way for corporate bonds in the near future.

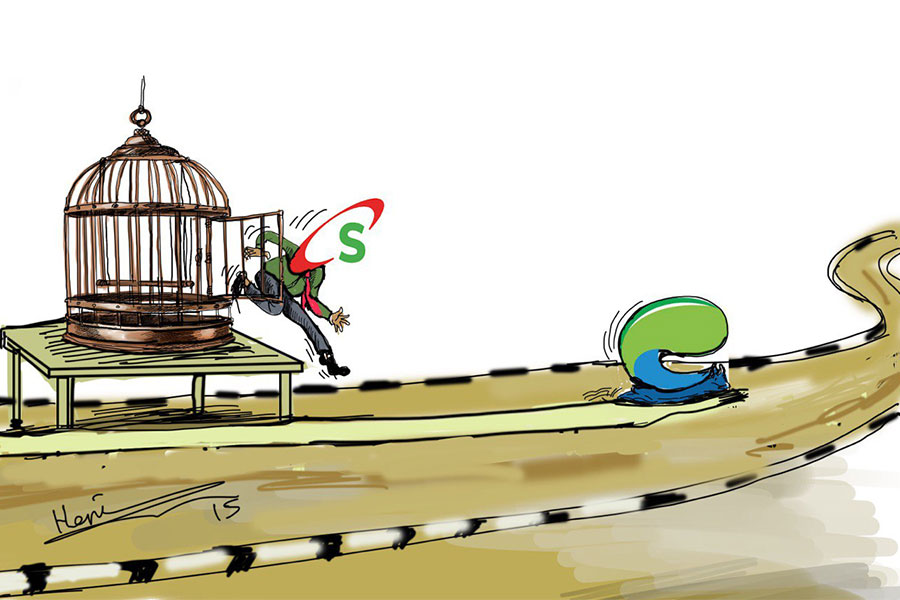

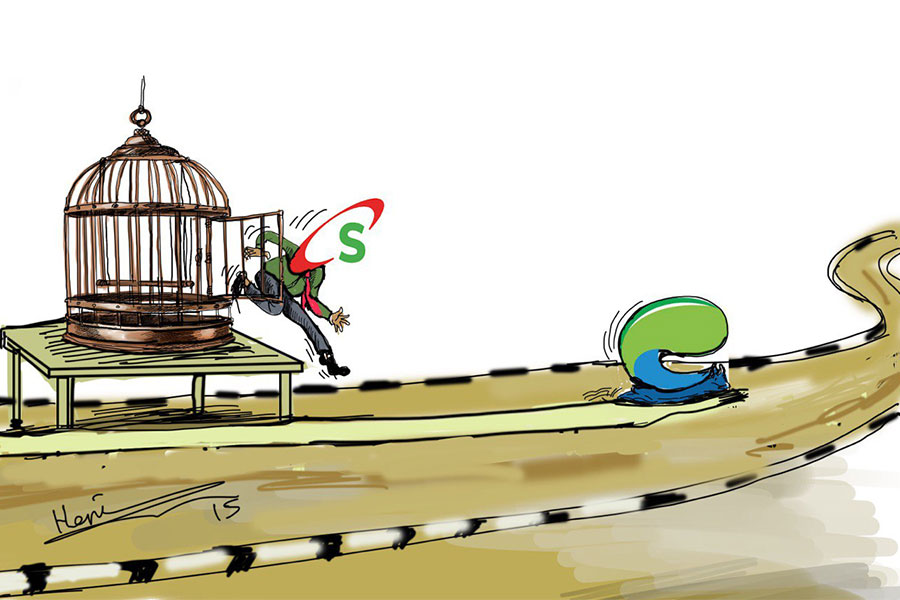

Editorial | Oct 15,2022

Fortune News | Apr 02,2022

Editorial | Mar 14,2020

Viewpoints | May 14,2022

Fortune News | Oct 25, 2024

Fortune News | Apr 20,2019

Radar | Feb 18,2023

Viewpoints | Sep 06,2020

Editorial | Mar 11,2023

Fortune News | Dec 08,2024

Photo Gallery | 141394 Views | May 06,2019

My Opinion | 134160 Views | Aug 14,2021

Photo Gallery | 131652 Views | Apr 26,2019

My Opinion | 130723 Views | Aug 21,2021

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Aug 16 , 2025

A decade ago, a case in the United States (US) jolted Wall Street. An ambulance opera...

Aug 9 , 2025

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand....