Viewpoints | Oct 12,2019

Jun 8 , 2024.

Ethiopia's businesses face an increasingly arduous task in securing loans, as capital emerges as one of the priciest commodities in the market. Borrowing costs are exorbitant, with commercial loan interest rates averaging around 20pc, making them among the highest in Africa. Comparatively, Zimbabwe’s rates are a staggering 70pc, Botswana’s a modest 6.5pc, and Kenya’s around 15.2pc. Even Angola, often cited for its high rates, falls slightly behind Ethiopia at 18.3pc.

Policymakers have failed to deploy monetary tools effectively to reduce the unbearable cost of capital. This failure is evident in the weighted average yield of annual Treasury Bills (T-bills), a crucial indicator of Ethiopia’s fiscal health and broader economic conditions. High T-bill yields suggest substantial compensation for buyers lending to the government, reflecting concerns about fiscal health and macroeconomic stability. They often signal a lack of confidence in the government's fiscal prudence or overall economic stability.

The economic environment, marred by internal conflicts and global economic uncertainties, deepens these concerns. T-bill buyers demand higher returns to compensate for perceived increased risks, driving up yields. As of December 31 last year, the yield on 364-day T-bills stood at 10.33pc in the fourth quarter of 2022/23, increased by 1.42 percentage points from the previous year, a considerable cost for debt servicing. The yield indicates that a large portion of the federal budget goes to interest payments on public debt, reducing the fiscal space available for essential expenditures such as healthcare, education, and infrastructure development.

The T-bill market, reformed a few years ago to better reflect market interest rates, saw substantial growth in the fourth quarter of the fiscal year 2022/23. The total supply of T-bills offered at bi-weekly auctions soared to 425.0 billion Br, marking an extraordinary 111.1pc annual increase. Demand for T-bills also rose, reaching 148.1 billion Br, a 23.3pc increase from the previous year. However, this rise in demand lagged behind the supply growth, indicating an oversupply relative to demand. The total amount of T-bills sold during the quarter was 141.2 billion Br, a 20.9pc increase from the previous year.

The surge reveals a robust expansion in the market, attracting considerable interest from both banks and non-bank institutions. The state-owned Commercial Bank of Ethiopia (CBE) remains the largest buyer, holding close to 109.4 billion Br in T-bills as of May 31, 2024. Non-bank institutions, including the federal pension fund and insurance firms, have emerged as dominant players, while private commercial banks acquired T-bills valued at 31.9 billion Br.

Nonetheless, the market lacks individual investors, with non-bank entities holding a larger market share than their banking counterparts.

The substantial increase in T-bill supply and the corresponding rise in yields have several macroeconomic implications. The increased issuance of T-bills allows the federal government to meet its short-term financing needs without resorting to more expensive or longer-term debt instruments. However, higher yields on government securities can crowd out private investment.

Such a high-yield environment influences the attractiveness of T-bills relative to other investment opportunities, potentially affecting capital allocation in the economy. By offering higher yields, T-bills become more attractive, helping to mop up excess liquidity from the market. Concerns about macroeconomic stability, including currency depreciation and balance of payments issues, contribute to higher borrowing costs.

The elevated cost of borrowing can also have a ripple effect on the broader economy. As the government channels more resources towards debt servicing, public investment in productive sectors may decline. This reduction in investment can slow economic growth and development, further exacerbating fiscal pressures and economic vulnerabilities. The increased cost of borrowing also has broader economic implications. It can crowd out public investment by limiting the fiscal space available for development projects and social programs. This is particularly concerning for Ethiopia, where government spending is critical in driving economic growth and development.

Reduced public investment can impede economic growth, worsening unemployment and deepening poverty.

High yields on T-bills often correlate with inflation expectations. Ethiopia’s economy has faced considerable inflationary pressures in recent years, driven by supply chain disruptions, rising global commodity prices, and domestic political instability fuelled by militarized conflicts. Persistent inflation undermines confidence, prompting businesses to seek higher returns to offset risks associated with inflation.

As inflation rises, central banks are compelled to increase benchmark rates, which pushes up yields on newly issued treasury bills to maintain their appeal and real returns for buyers. There is a positive correlation between inflation rates and treasury bill yields across many African countries. Central banks tend to issue treasury bills at yields closely mirroring their benchmark interest rates, which are raised to combat high inflation. Countries with soaring inflation, like Nigeria (16.24pc yield on 91-day T-bills) and Kenya (15.73pc), offer much higher yields on their treasury bills to attract investors and compensate for the elevated inflation and currency risks.

The lack of confidence, as evidenced by the high yield on Treasury Bills, has a self-reinforcing effect on the economy. As demand for higher yields persists, the government's borrowing costs increase, leading to higher debt servicing expenses and potentially larger budget deficits, now at a record high of four percent of the GDP. This can further erode confidence in the government's ability to manage its finances, perpetuating a cycle of high borrowing costs and fiscal strain.

The high cost of borrowing also influences external perceptions of the country's economic management. International investors and rating agencies closely monitor yields on government securities as indicators of economic health and stability. Elevated yields can lead to downgrades in credit ratings, raising borrowing costs further and limiting access to international capital markets.

The government’s reliance on short-term borrowing through instruments like T-bills raises concerns about refinancing risk. Short-term debt needs to be rolled over frequently, exposing the government to the risk of changes in market conditions and investor sentiment. Last year alone, T-bills worth 115.9 billion Br were redeemed, resulting in an outstanding amount of 338.5 billion Br, a 6.7pc annual increase.

Suppose market conditions deteriorate and confidence wanes further; the federal government may face difficulties rolling over its debt at favourable terms, leading to higher borrowing costs or a potential liquidity crisis.

Undoubtedly, the high yield on T-bills reflects deeper economic ordeals that require comprehensive and coordinated policy responses. Policymakers would do the economy well if they deployed various monetary and fiscal policy tools, including effective debt management and measures to restore confidence and ensure sustainable economic growth. Tightening fiscal policies and enhancing public financial management, while demonstrating a commitment to fiscal discipline, can signal their ability to manage debt sustainably and maintain macroeconomic stability.

Effective inflation management can stabilise the Birr against a basket of major currencies, reduce the need for high yields, and create a more conducive environment for investment.

Implementing structural economic reforms to diversify the economy and reduce dependency on volatile sectors can beef up resilience. Engaging in debt restructuring negotiations with creditors, particularly for high-interest or non-concessional loans, can address immediate fiscal burdens. Collaborative efforts with international financial institutions and development partners can provide the necessary support for managing debt sustainably.

Enhancing domestic revenue mobilisation through tax reforms and improved compliance can reduce reliance on borrowing. As European businesses in Ethiopia recently urged, expanding the tax base and improving tax administration can generate additional resources for public investments and debt servicing. Providing clear and consistent information may not be a forte for Ethiopia's public institutions and leaders. However, it helps address uncertainty and reassures the market about the government's commitment to stability.

Ultimately, addressing Ethiopia's high cost of borrowing requires various approaches that combine prudent fiscal management, structural reforms, and transparent communications. Policymakers can restore confidence, attract investment, and pave the way for sustainable economic growth.

PUBLISHED ON

Jun 08,2024 [ VOL

25 , NO

1258]

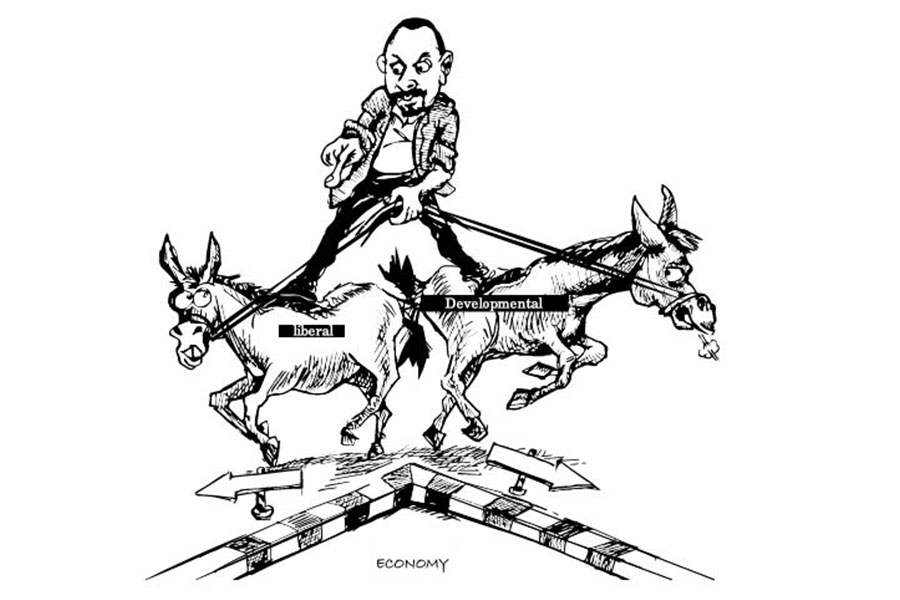

Viewpoints | Oct 12,2019

Radar | Apr 30,2022

Commentaries | Feb 25,2023

Radar | Apr 12,2020

My Opinion | Jul 17,2022

Editorial | Dec 11,2020

Radar | Feb 27,2021

Verbatim | Mar 09,2024

Agenda | Feb 17,2024

Viewpoints | Dec 23,2023

Photo Gallery | 175451 Views | May 06,2019

Photo Gallery | 165672 Views | Apr 26,2019

Photo Gallery | 156013 Views | Oct 06,2021

My Opinion | 136819 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

Oct 18 , 2025 . By BEZAWIT HULUAGER

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...