Exclusive Interviews | Jan 05,2020

Aug 6 , 2022

By Asseged G. Medhin

Insurance companies have long competed solely on pricing. Customer satisfaction, especially in claims management, is an area to build on, writes Asseged Gebremedhin, an insurance professional with over a decade of experience in finance.

Delivering a superior customer experience takes more than developing a mobile app or adding a call center staff. It requires significant investments, relentless improvements, and collaboration across customer channels and business functions.

Improving customer satisfaction can be an engine of profitable growth, but it demands a common vision and new levels of coordination across organisational silos. It is the core of growth, including for insurers, especially during claims management; the pain of customers should always be spelt in daily activities of clam officers, supervisors, claims managers and deputy CEO of operations.

Digital tools are unlocking new opportunities for insurers. For example, unlike in Ethiopia, more than four-fifths of shoppers engage a digital channel at least once throughout their shopping journey. Carriers can find new ways to engage customers efficiently and effectively with personalised messages, and improve speed, service, and consistency to raise satisfaction. Many commercial insurance buyers value online interfaces with self-service features and the ability to track the status of interactions in real-time instead of making inquiries by phone, email, or through their brokers.

In Ethiopia’s case, it is hard to find an end-to-end claims service that measures gaps in the service, so there is a risk of penalty due to poor customer service. Without addressing fundamental issues of customer relationship management, automation is meaningless.

Clearly, companies that offer best-in-class customer experiences grow faster and more profitably. To reach this level, insurers must relentlessly improve customer journeys across channels and business functions. The difference between excellent and poor customer service has always been clear, and businesses on the wrong end of this spectrum usually pay the price. This is as true for insurance as for any other customer-facing business.

Today, the consequences of subpar service are amplified by the speed and reach of social media. One poorly handled claim, one mistake captured on a smartphone, can escalate quickly into a brand-damaging crisis. This is just one reason firms across all industries should increase their focus on providing great customer experience. Providing a strong customer experience is not just about reducing the risk of customer service mishaps. It is increasingly a way for companies in competitive markets to distinguish their brands.

The airline industry is a good point of comparison with insurance. Both are highly regulated and highly competitive, and carriers in both industries find it increasingly difficult to differentiate their products without lowering prices.

Airlines all use the same planes, serve similar food, and match prices. Personal lines insurance is becoming similarly transparent. Due to the Internet, aggregators, and social media, shoppers know more than ever about coverage, prices, and services. The major principle of insurance, which is the principle of utmost good faith, is embodied in claims management. The higher the quality of claims management, the higher the return. Insurers can overcome barriers and deliver exceptional customer experiences by aligning on the type of experience they want. Experts disagree on some fundamental elements of this issue. Some believe fewer customer touch points are better, while others say more interactions create more opportunities to add value and build loyalty.

Both can be correct, depending on particular customer segments and their journeys. Customers with complex insurance needs might want a higher-touch approach during sales and onboarding. Also, the more value there is at stake in a claim, the more time customers are willing to spend in live interactions during the first notice of loss. For example, many carriers overlook that speed of resolution is as important as employees’ courtesy, empathy, knowledge, ease of communication with the insurer, prompt service and professionalism.

In Ethiopia, unless claims management service is institutionalised, sustained improvements cannot be achieved. Customer satisfaction is possible only if the entire company - from top executives to the front line - is aligned around the effort and the rollout is rapid. Promoting strong executive ownership and a clear mandate for cross-functionality need a be roadmap. System integration needs to occur, especially in central measurement architecture that continuously reports customer intelligence to the relevant operational KPIs, allowing feedback and improvement.

A team-based management practice with regular performance dialogues about customer satisfaction between top management and operational leaders is the second most important task in the journey of quality claims management. It is alright to insist on change, but what needs to be changed should be drilled into executives' minds.

Proactive change management with compelling “change stories,” recognition from top management, regular interaction with real customers to gather feedback, and new approaches to attracting customer-centric talent are all necessary. It is crucial to remember that neither the board nor the executive first meets the customer. It is the employee! Thus, there should be access to provide training on new skills, and “navigators” and “champions” to carry the change to individual departments and make it stick.

Insurers ought to have no doubt in their minds. Superior claims service ultimately leads to greater customer satisfaction. It is the key to winning the competition.

PUBLISHED ON

Aug 06,2022 [ VOL

23 , NO

1162]

Exclusive Interviews | Jan 05,2020

Fortune News | Apr 16,2022

Exclusive Interviews | Jan 05,2020

Fortune News | May 08,2022

Viewpoints | Jul 09,2022

Commentaries | Oct 16,2020

Exclusive Interviews | Jan 05,2020

Agenda | May 17,2025

Exclusive Interviews | Jan 05,2020

Commentaries | Jul 13,2019

Photo Gallery | 157387 Views | May 06,2019

Photo Gallery | 147675 Views | Apr 26,2019

Photo Gallery | 136270 Views | Oct 06,2021

My Opinion | 135306 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

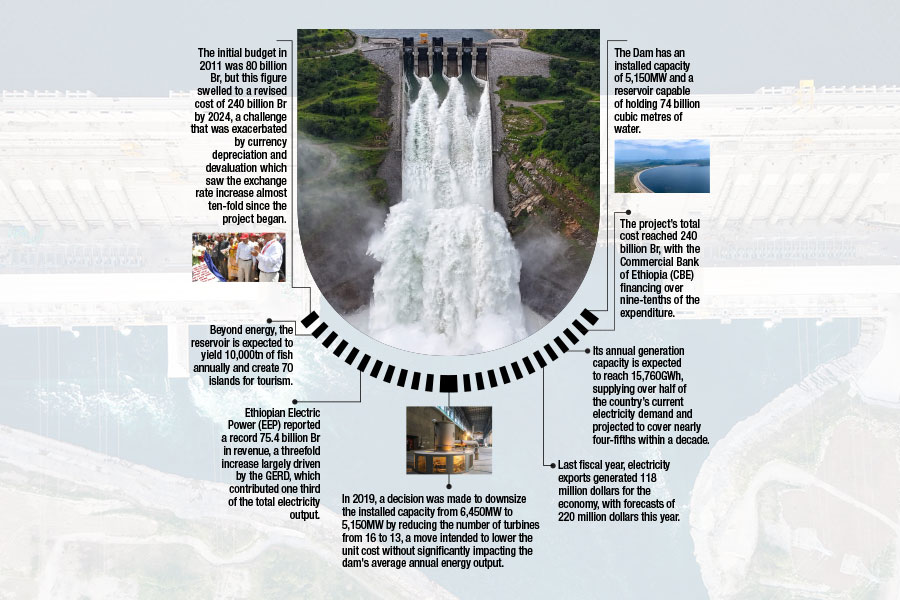

Sep 15 , 2025 . By AMANUEL BEKELE

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...