Exclusive Interviews | Jan 05,2020

Dec 4 , 2021

By Asseged G. Medhin

The risk premium of investment should consider, among all other things, political risks. Insurers are the first and the foremost to deal with it, and their response to political risks will determine their future strategy, writes Asseged Gebremedhin, an insurance professional with over a decade of experience in finance.

Human beings have always faced manmade and Act of God (AOG) risks. Traders of old faced weather conditions, sea perils and navigation problems and thus hedged their risks by putting together funds with a probability of paying out. This wonderful achievement left its mark on the development of modern insurance theories, principles and philosophies.

We may now in Ethiopia be in a state of bewilderment and dilemma to manage risks caused by political issues. The notion is that of every bit of risk that disturbs the normal courses of action. This does not just apply to businesses but individuals as well. The goal of life, among other parameters, is measured in terms of health, peace, longevity and the pursuit of happiness. The risk caused by war is one of the most fundamental in disrupting the day-to-day. It affects national policymaking and all other business objectives.

Insurance is thus becoming more attractive and even lucrative to provide acute solutions to secure business interruptions due to fundamental risks, including war. We need to accept prevailing conditions and their impact based on rationalising existing political violence and terrorism risk and extend coverage to bring back the business community to its normal track.

Insurers will benefit. This is partly because their image will be maximised whenever they respond to an immediate solution but manageable risks by designing new insurance policies. The impact of war may give an opportunity for new insights. It also presents an opportunity to question whether to follow Western views of emerging risks and the mechanism of managing them only by their bits of advice. By strengthening the Ethiopian Re, the national reinsurance company, it is possible to reduce the influence of foreign insurers and secure against risks caused by disturbances in the supply chain.

Both the government and insurance companies must engage in troubleshooting proactively in risk management, reversing broken supply chains and advising the business community. This will be quite a change from the past. Losses incurred due to war are traditionally not covered by insurance. But things are changing lately.

In the West, before the September 11, 2001, terrorist attacks, the war exclusions in most liability insurance policies applied only with respect to contractually assumed liability, on the theory that private persons and organisations could not otherwise incur liability in connection with war. Post-911, "war and terrorism" were quickly added to liability policies.

War risk insurance is coverage provided on losses resulting from events such as war, invasions, insurrections, riots, strikes and terrorism. It is offered as a separate policy as it is excluded from standard insurance policies due to the high risks. Now, some portion of mega risks are better managed than before due to increased demand and level of insurance service – insurers' and reinsurers' appetite is opening up. We need to see things differently, too.

Ethiopia is a growing nation. Any missing link in the chain creates unrest and irregularity. A good example is war, and the actions of the government alone cannot mitigate this. All stakeholders, including insuring companies, need to take it at its face value and work around it to design a recovery plan and craft new policies. Investors want a convenient environment, lower costs, high returns and improving quality. All of these can be disturbed with political risks and it falls to stakeholders to address them. Unrest, civil commotion and riots damage everything and leave spoilage marks for future equity as well as distortion of brands. Political risk should thus be managed from the insurance perspective.

Both foreign and direct investors invest a huge amount of money by taking business risks considering the weighted average cost of capital. The risk premium of investment should consider, among all other things, political risks. Insurers are the first and the foremost to deal with it, and their response to political risks will determine their future strategy. It should rise to the challenge of revising policy terms and conditions.

No matter how rough the road is, Ethiopia can push forward. It is doing it now, and it could do it better if the insurance sector does better at managing risk.

PUBLISHED ON

Dec 04,2021 [ VOL

22 , NO

1127]

Exclusive Interviews | Jan 05,2020

Fortune News | May 16,2020

Radar | Mar 04,2023

Fortune News | Nov 27,2021

Agenda | Jul 11,2021

Radar | Apr 01,2024

Exclusive Interviews | Jan 05,2020

Fortune News | Nov 20,2021

Commentaries | Jan 12,2019

News Analysis | May 06,2023

Photo Gallery | 155669 Views | May 06,2019

Photo Gallery | 145944 Views | Apr 26,2019

My Opinion | 135187 Views | Aug 14,2021

Photo Gallery | 134443 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 15 , 2025 . By AMANUEL BEKELE

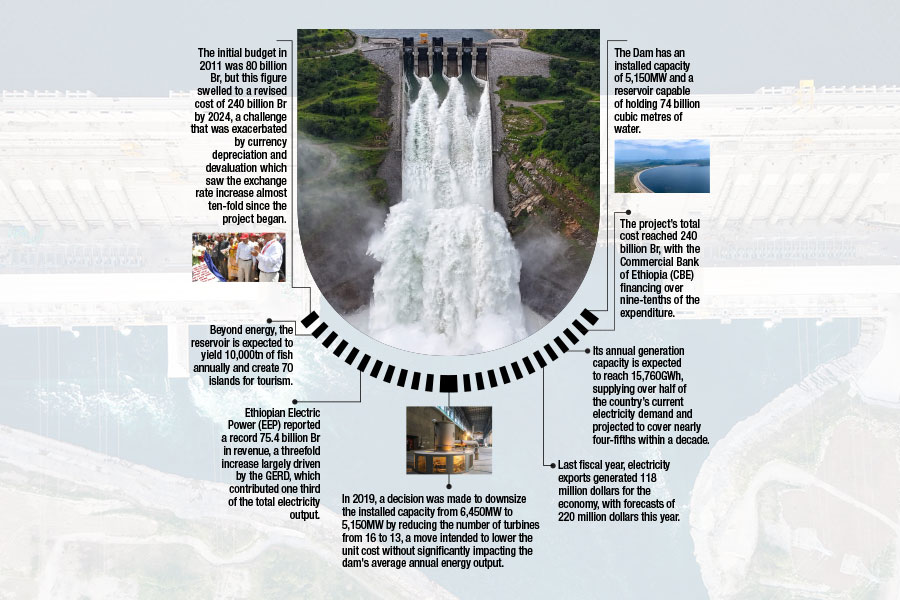

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Sep 13 , 2025 . By BEZAWIT HULUAGER

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...