Sunday with Eden | Nov 30,2019

Jul 2 , 2022

By Stephen S. Roach

I should have listened to Alan Greenspan – at least when it comes to currency forecasting. The former chair of the Federal Reserve once told me it was a fool’s game, with the odds of getting currency calls right worse than a successful bet on a coin toss. Two years ago, I ignored the maestro’s advice and went out on a limb, predicting that the US dollar would crash by 35pc.

After a tantalising nine percent decline in the second half of 2020, the broad dollar index – the real effective exchange rate as calculated by the Bank for International Settlements – has gone the other way, soaring by 12.3pc from January 2021 through May 2022. That puts the dollar 2.3pc above its level in May 2020, around the time I made this seemingly foolish call.

How did I get it so wrong?

Three factors shaped my thinking: America’s current-account deficit, Federal Reserve policy, and TINA (“there is no alternative”). I argued that the external deficit was headed for big trouble and that a passive Fed would do little to arrest the problem – effectively forcing the bulk of the current-account adjustment to be concentrated in a weakening currency rather than in rising interest rates. I also took a swipe at the TINA defence of the dollar and tried to make the case for euro and renminbi appreciation.

Basically, the Fed saved the dollar – aided and abetted by Russian President Vladimir Putin. The US current-account deficit, the crux of my fundamental case against the dollar, has in fact deteriorated dramatically over the past two years. The broadest measure of America’s international balance went from negative two percent of GDP in the first quarter of 2020 to -4.8pc in the first quarter of 2022, with the just-reported data for early 2022 revealing the second-sharpest quarterly deterioration since 1960. America’s current-account deficit has not been this large since mid-2008 in the depths of the global financial crisis.

My dollar-crash narrative hinged importantly on the possibility of an increasingly unstable post-pandemic current-account dynamic, with outsize federal budget deficits leading to a sharp compression of already-depressed domestic saving. The theory – actually, the national income-accounting identity – stresses that saving-short economies must import surplus saving in order to keep growing, and then run large current-account deficits in order to attract foreign capital. In the face of exploding budget deficits, the theory worked as expected: the net domestic saving rate plunged to zero in the middle two quarters of 2020.

Surprisingly, domestic saving has since rebounded, with the net national saving rate averaging 3.25pc in 2021 and moving up further to 4.2pc in early 2022. Over the post-pandemic period starting in the second quarter of 2020, however, the net domestic saving rate has averaged just 2.6pc of national income, a dramatic shortfall from the longer-term 45-year average of seven percent from 1960 to 2005. This matches up reasonably well with the sharp recent widening of the US current-account deficit.

History demonstrates that sharply deteriorating current-account balances are not a sustainable outcome for countries lacking domestic saving. Foreign creditors will demand concessions for lending their surpluses: higher returns (interest rates), cheaper financing (the currency conversion), or both. If one option is closed off, then the other channel bears the brunt of the current-account adjustment.

This is where the Fed saved the dollar. It certainly did not seem that way in 2020 and early 2021. During that period, the Fed was steadfast in maintaining its overly accommodative policy stance, even in the face of an emerging inflationary shock that it initially misdiagnosed as “transitory.” I viewed this intransigence as a good reason to believe that interest rates would remain uncomfortably low. As a result, the US current-account adjustment would be increasingly concentrated in the sharp depreciation of an overvalued dollar. My call for a 35pc correction in the dollar was in line with the 30pc average of three earlier large cyclical drops that had occurred in the 1970s, 1980s, and in the early 2000s.

When the Fed belatedly pivoted in late 2021, I should have done the same thing with my dollar call. Forward-looking financial markets correctly sensed that something had to give and moved well in anticipation of the Fed’s about-face; roughly half of the dollar’s 12.3pc appreciation since January 2021 occurred prior to the Fed’s conversion the following December. Putin’s saber-rattling and subsequent military aggression in Ukraine added a significant safe-haven bid to the dollar. The euro and even the renminbi fell, instead of rising, as I had predicted, and the Japanese yen collapsed, as the Bank of Japan was more than willing to accommodate an inflation surprise as an antidote to its third “lost decade.”

There are plenty of lessons to take from this episode. First, and most obviously, do not fight the Fed. The US central bank ultimately did the right thing; it has plenty more to do but now seems more willing to do it. Second, financial markets could not care less about theory. US monetary tightening is viewed less as a current-account funding concession by a saving-short US economy and more as a desperate effort to catch up with the yield curve. Third, the dollar’s exorbitant privilege as the world’s reserve currency is never clearer than during times of war. With the world in turmoil thanks to Putin, TINA is more seductive than ever.

Ultimately, of course, it all boils down to how much of this has already been discounted by forward-looking financial markets. I suspect that the Fed’s call and the TINA factor are already in the price of an overvalued dollar. I do not believe the same can be said about the dire US balance-of-payments prognosis. I know – that is what I said two years ago.

PUBLISHED ON

Jul 02,2022 [ VOL

23 , NO

1157]

Sunday with Eden | Nov 30,2019

Commentaries | Apr 06,2024

Editorial | Jan 29,2022

Radar | Jan 21,2023

My Opinion | Oct 26,2024

Viewpoints | Jul 18,2020

Fortune News | Nov 25,2023

View From Arada | Oct 09,2021

Radar |

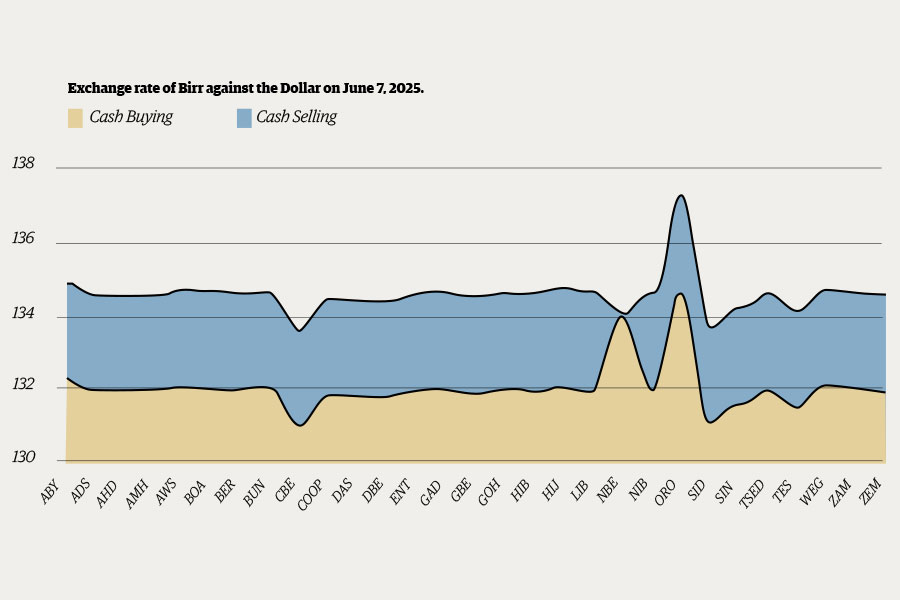

Money Market Watch | Jun 08,2025

My Opinion | 131981 Views | Aug 14,2021

My Opinion | 128369 Views | Aug 21,2021

My Opinion | 126307 Views | Sep 10,2021

My Opinion | 123925 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...