Commentaries | May 03,2025

Aug 7 , 2021

By Asseged G. Medhin

Companies that understand the genuinely compelling need for transformation amid emerging uncertainty will be leaders in their respective industries for years to come, writes Asseged Gebremedhin, deputy CEO of Global Insurance.

Amid unpredictable financial markets, blurred fiscal and monetary policies and economic lockdowns, asset owners across the developed world have needed to adapt quickly. They face significant challenges in building and managing their portfolios in today’s new normal. Everything is under the spotlight – from how one sets return targets and manages liquidity to assessing external factors that would protect one from a crash.

Such dynamic risks faced in economically and politically stable countries are only multiplied several fold by a developing economy such as Ethiopia, where one finds the financial sector seriously affected by particular and fundamental risks.

The nature of risk is becoming dynamic, and it leaves no room to manage under traditional ways. This is in both the political and economic spheres. Countries like Ethiopia should review every link in the value chain. The impact of COVID-19 and the ever-changing interest of multinational companies demands for goods and services from developing countries has created a complicated and complex international system that is difficult to navigate. Our current problem of inflation partially emanates from such trade risks due to escalating global shipping costs.

With the proper integration of financial policy, procedures and directives, the government can reverse the burden of inflation and associated gaps in the informal economy. Meaningfully employed and reviewed accordingly, active engagement with the economy can make a difference.

The same advice goes for business leaders. Understanding how the rules of investing have changed and proactively engaging in the biggest portfolio risks, which can become opportunities managed smartly, are key. One needs to comprehend what the highest returns will be in the capital market due to be introduced in Ethiopia and seriously follow the trend of markets. As Ethiopia’s financial sector is highly traditional, where the process of choosing and investing in markets is archaic, a capital market by itself will not do much to improve the business case.

We need to be more flexible and take targeted risks instead of dwelling on the possibility of loss. Volatility will continue, either because of politics or inflationary pressure. It is no time for passivity, and the best defence is offence, even against uncertainty.

In the face of challenging economic times, pressing regulatory changes, and increased competition for market share, insurance companies are particularly struggling to maintain their balance. The time does not allow insurance companies to navigate traditionally as the storm of technology shrinks their gross written premium. Such a competitive landscape is shifting, though, and will favour insurance companies who take advantage of today’s market to position for long-term future business.

Capitalising on the current challenge and turning it into real opportunity will require new strategies to leverage human capital and increase productivity. Customer retention, underwriting effectiveness, customer service response and claim cycle times are all areas due for greater dynamism. We should keep in mind that the Ethiopian insurance has always been a highly regulated industry. New regulations and legislations are proposed and adapted on a regular bases.

In some cases, when the sector faces some immerging risks and ill practices, regulatory bodies do not waste time issuing directives to protect against any unexpected developments. We have many directives directly related to operational, financial and marketing business processes. Traditional leadership has not helped these circumstances thanks to operational inefficiency as they do business in a reactive way.

Recently, regulatory bodies have come to demand more sprightly processes that can evolve and adapt on a continuous bases, but that also offer varying levels of control over how they are executed. In the Ethiopian insurance sector, a single directive affects the overall process in typical insurance companies that are not ripe for transformation.

Insurance companies that understand the genuinely compelling need for this transformation and that have advantage of the tools available to increase operational efficiency and improve critical insurance processes will be leaders in the industry for years to come.

PUBLISHED ON

Aug 07,2021 [ VOL

22 , NO

1110]

Commentaries | May 03,2025

Advertorials | Jun 05,2023

Verbatim | Apr 04,2020

Sponsored Contents | Mar 28,2022

My Opinion | Aug 18,2024

Radar | Jul 20,2019

Fortune News | Oct 21,2023

Radar | Jan 19,2019

Commentaries | Dec 10,2018

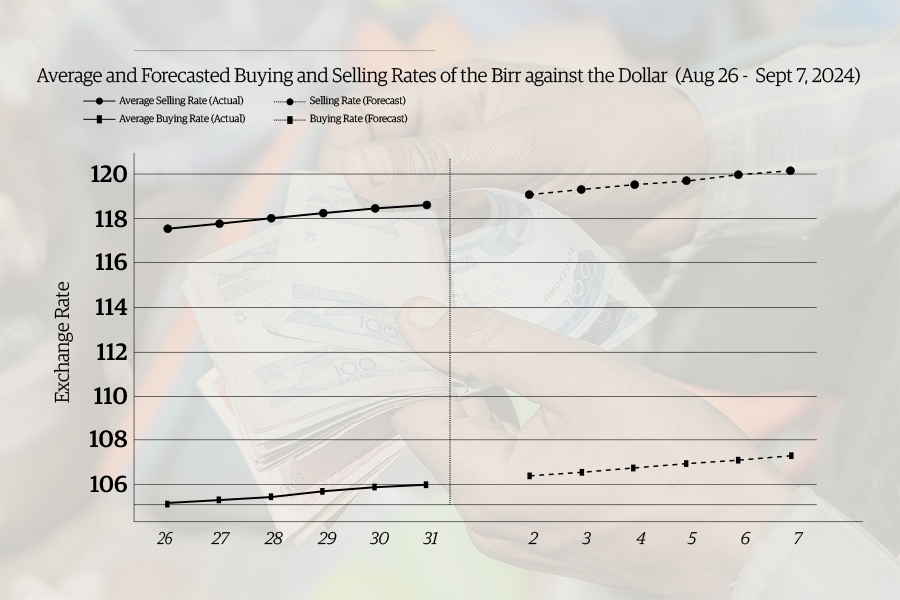

Money Market Watch | Sep 01,2024

My Opinion | 131819 Views | Aug 14,2021

My Opinion | 128203 Views | Aug 21,2021

My Opinion | 126147 Views | Sep 10,2021

My Opinion | 123767 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...