Nov 4 , 2023

By Raghuram G. Rajan

While higher capital requirements can theoretically enhance stability by providing a cushion against losses and reducing the likelihood of bank runs, such requirements do not necessarily curb risk-taking, as evidenced by smaller banks engaging in risky commercial real estate lending. A certain level of capital requirement is necessary to prevent panic and loss. Still, regulators must find a balance in capital regulations to ensure safety without hindering financial activity, argues Raghuram G. Rajan, a professor of Finance at the University of Chicago Booth School of Business, in this commentary provided by Project Syndicate (PS).

Partly in response to the banking failures of March 2023, US regulators now want to impose higher capital requirements on banks with over 100 billion dollars in assets. But this is a puzzling choice, considering that some of the most egregious risk-taking recently has been found among smaller banks.

Some of the proposed changes – such as requiring banks to include unrealised gains and losses from certain securities in their capital ratios – are overdue. By and large, however, CEOs of large banks are not pleased. Jamie Dimon of JPMorgan Chase, for example, has blasted the proposal for stricter capital rules, warning that it could prompt lenders to pull back and thereby stymie economic growth. Before we dismiss such outbursts as self-serving “bankerspeak,” we should ponder the role that bank capital serves and whether regulators are moving in the right direction.

Long-term “patient” financing, such as equity, counts as bank capital. Unlike demand deposits, it does not have to be paid back in the short run.

If banks can be brought down by uninsured depositors rushing for the exit, is it not obvious that more capital means fewer runs, and thus a more stable banking system?

Unfortunately, the problem is more complicated than that. Yes, if we have two equally risky banks, one with more capital financing than the other, the one with more capital has a higher probability of survival. But we cannot assume that these two institutions will take the same risks, nor can we ignore the consequences of higher capital requirements for overall financial stability and the economy.

Obviously, more financing through capital issuance reduces run-prone borrowing (bank leverage). It also provides a loss-absorbing buffer; since banks’ losses will have to eat through capital before reaching depositors, banks can withstand small accidents. Supervisors will have time to react if they see bank capital eroding. With supervisors also demanding that banks hold capital in proportion to the risk of their activities, capital serves as a budget for risk-taking.

Because investments in bank capital are very sensitive to bank risk, a minimum capital requirement acts as a kind of entry ticket: only banks that can convince investors that they will not take undue risks can raise capital at a reasonable cost. And since banks typically generate capital through retained profits rather than new equity issuances, capital regulation allows profitable banks to grow while restraining loss-making banks. Finally, given its importance, the level of a bank’s book capital gives the public a way to gauge its performance.

These are all good reasons for regulators to insist that banks hold reasonable amounts of capital. Before the 2008 financial crisis, some banks operated with capital as low as two percent of assets, making them accidents waiting to happen. In contrast, big banks came through the March 2023 episode relatively unscathed, though other regulations clearly helped.

The question, then, is whether raising capital requirements is appropriate today.

We can immediately dismiss one rationale for doing so: capital gives a bank’s board (or the equity holders they represent) more skin in the game, thus a greater incentive to limit risk-taking. Anyone who has served on the board of a large bank knows that board members are entirely dependent on what they are fed by management. It is a pipe dream to think they will restrain a cowboy executive team. As the US Federal Reserve’s report on the collapse of Silicon Valley Bank (SVB) shows, sometimes even supervisors are unaware of the risks a bank is taking, or are unable to stop it when they see it.

Capital regulation often fails to limit a bank’s pursuit of tail risks that earn profits in good times. Those earnings will add to its capital and allow it to take more risks – at least until the bad times come.

Finally, as more capital gives bank management a longer leash, higher capital requirements may come with an offsetting cost. The farther off the reservation management goes, the greater the losses for investors before a run finally closes the bank.

Just think how much more value the SVB management team would have destroyed – with the connivance of the board and supervisors – if uninsured depositors had not pulled the plug on its inglorious reign by demanding their money. This is not to suggest that SVB’s uninsured depositors were an alert group of stakeholders. On the contrary, they had little idea of the risks that were building. But once they caught a whiff, the party was over.

Bank runs can also have a salutary effect if bank management, knowing the extreme penalty associated with excessive risk, manages prudently. Viewed in this light, the occasional depositor run is a feature of the system, not a bug to be eliminated by raising banks’ capital requirements. By effectively insuring all uninsured deposits after the March mini-crisis, the Fed and the US Department of the Treasury prevented a wider bank panic. But they also kept a lot of incompetent bank managers in place by turning uninsured depositors into passive onlookers – and, indeed, into capital.

While we do not want banks to be so thinly capitalised that small losses and accidents can precipitate panic and much larger losses, we also must recognise that, beyond a certain point, more capital can facilitate mismanagement. At the end of the day, higher requirements can make capital costlier, potentially inhibiting banks’ ability to finance growth – as Dimon warns. And if activity migrates to other institutions with lower capital requirements, the system will not have been made safer.

This risk is not merely hypothetical. A big problem facing US regulators today is that smaller banks picked up now-shaky commercial real estate lending that larger banks had avoided, owing to the latter group’s higher capital requirements. It remains to be seen how these smaller institutions will manage the coming loan losses.

Sensible regulation depends on knowing when a tool loses effectiveness and becomes counterproductive. More is not always better.

PUBLISHED ON

Nov 04,2023 [ VOL

24 , NO

1227]

Editorial | Mar 19,2022

Editorial | Mar 16,2019

Radar | Apr 08,2023

Fortune News | Sep 11,2020

Editorial | Apr 24,2021

News Analysis | Jul 01,2023

Viewpoints | Jan 07,2023

Fortune News | May 14,2022

View From Arada | Nov 26,2022

Films Review | Sep 10,2022

My Opinion | 131656 Views | Aug 14,2021

My Opinion | 128020 Views | Aug 21,2021

My Opinion | 125983 Views | Sep 10,2021

My Opinion | 123607 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

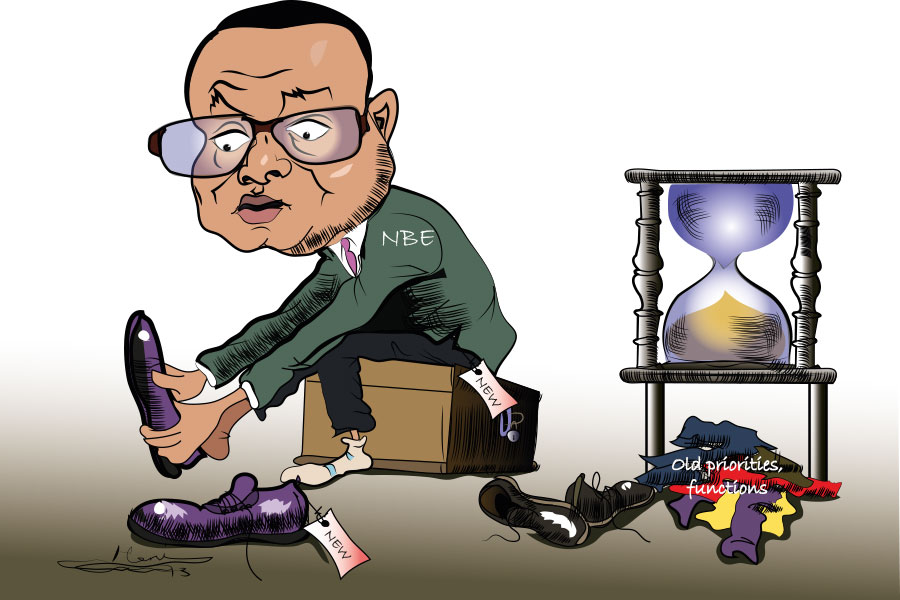

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...