Radar | Sep 19,2020

The nascent Islamic banking sector is facing a steep uphill climb as its newest entrants grapple with substantial first-year operating losses. Among these, Hijra Bank, one of the country’s first fully-fledged Islamic banks, incurred a loss of 143 million Br in its inaugural year, generating palpable shareholder discontent during its median annual general assembly.

A glance at the Bank’s balance sheet may portray a concerning forecast. However, Dawit Keno, Hijra’s founding president, believes these are merely birthing pains of an ambitious newcomer. He pointed to a steep surge in operational expenses due to a bold expansion strategy, which saw the launching of 40 branches within a year as a primary reason behind the income-expense mismatch. The Bank spent 166.25 million Br on wages for its 413 staff and administrative expenses while earning an income of a meagre 19.1 million Br. Yet, Dawit contends these high-cost investments in technology and overheads are critical to reaching an underserved clientele.

Despite teething troubles, Hijra Bank attracted over 134,845 customers for its Sharia-compliant services during its first year.

Analysts argue that Hijra Bank must find a way to recoup these initial expenses through an efficient growth strategy. Dawit, however, maintains a bullish outlook, expressing confidence that this assertive spending will deliver returns in the long run.

“It was used for interest-free financing,” Dawit told Fortune.

A veteran with 30 years of banking experience, Dawit is no stranger to the field. Studied economics as a post-grad at Addis Abeba University, he started his career at the state-owned Commercial Bank of Ethiopia (CBE). Subsequently, he rose to the position of Vice President.

A factor that seems to favour Hijra Bank is its high liquidity, with cash and bank balances making up 42.93pc of total assets and 69.08pc of total liabilities. However, analysts stress that this liquidity must be leveraged towards income-generating activities. Dawit shares this sentiment and suggests that these resources will be channelled into interest-free financing.

Hijra amassed total assets of 2.28 billion Br, despite the challenging first year. Although the Bank’s interest-free financing of 839.7 million Br fell short of its competitor - ZamZam’s - performance, it nonetheless disbursed 370.84 million Br, in addition to a Mudarabah investment of 440 million Br. Hijra Bank also mobilised 1.33 billion Br in savings over the operational year.

An analysis of the Bank’s interest-free financing-to-saving ratio, however, highlights an impending challenge. At 27.79pc, Hijra’s ratio is half that of ZamZam. Dawit attributes this gap to the three-month head start that ZamZam had over Hijra.

Islamic banking is relatively new in Ethiopia, a country of over 114 million, with a significant portion practising Islam. Drawing parallels with the success of Malaysia’s Islamic banking sector, which represents about 30pc of its total banking industry, the potential that lies with Ethiopia is massive.

Historically, regulatory resistance posed significant obstacles to the launching of Islamic banking. However, the ascension of Prime Minister Abiy Ahmed (PhD) in 2018 brought a notable shift in this trend, with the inception of ZamZam and Hijra banks as fully Sharia-compliant banks. They were later joined by Shebelle and Rammis banks, further diversifying the nascent sector.

Despite this progress, Islamic banking in Ethiopia is not without its challenges. Research conducted in 2021 revealed significant hurdles, including a poorly structured legal framework, a lack of accounting standards, and the absence of a secondary market for Islamic financial products. According to the researchers, Suadiq Mehammed and Ahmed Nasser, policy responses to these problems must address both institutional and operational aspects, focusing on robust training and research, addressing the scarcity of profit-sharing financial sources, and improving deposit mobilisation.

Practical issues, like a lack of branches in prominent business areas such as Merkato, also added to Hijira’s performance woes during its inaugural year, says Bilal Mohammed, a manager of Nejashi Branch manager, near Olympia roundabout. He noted that this limitation pushed customers towards conventional banking outlets for withdrawals and payments, thereby exacerbating the situation.

Financial analyst Abdulmenan Mohammed (PhD), based in London, observed that Hijra Bank might need several years to post substantial returns. It is a view shared by Nebiyu Nesru, one of the 10,000 founding shareholders, who believes the significant initial investment is a strategically wise move, despite the delayed returns.

“I wouldn’t expect a decent return in the next three years,” Nebiyu told Fortune, adding that improved policy and legal frameworks would help bolster the products offered by Islamic banks.

He also advocated for Hijra Bank to expand its capital base and prioritise employing experienced staff to enhance institutional competitiveness.

In response to these challenges, Hijra’s shareholders agreed during its first general assembly, to increase its capital to six billion Birr to bolster the capital base, exceeding the central Bank’s minimum capital requirement of five billion Birr that all private banks must meet by 2026.

This move follows Hijra’s initial subscribed capital of 1.2 billion Br and 543.1 million Br in paid-up capital. The plan aimed to increase paid-up capital to 979.93 million Br, but the Bank’s total paid-up capital and non-distributable reserves totalled only 862.52 million Br due to the significant loss incurred.

Despite these fiscal challenges, Hijra’s capital adequacy ratio was an impressive 232.58pc. While such a surplus of capital is a positive indicator, it needs to be utilised efficiently and strategically, according to Abdulmenan.

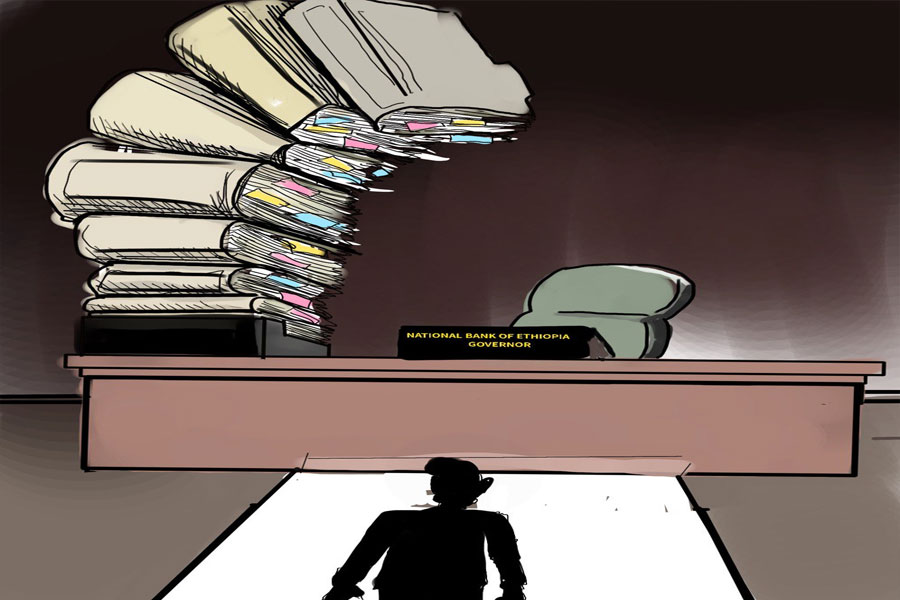

The Bank’s first-year performance has raised questions about Hijra’s growth scalability and ability to convert capital and liquidity into profitable ventures quickly. Analysts warn that the Bank executives’ decision to finance a significant expansion through an ambitious capital may not yield immediate returns due to the niche market nature of the Islamic banking sector and existing regulatory challenges.

Hijra’s management will need to exhibit both strategic insight and perseverance to steer the Bank towards profitability, according to the analyst.

PUBLISHED ON

Jul 01,2023 [ VOL

24 , NO

1209]

Radar | Sep 19,2020

Editorial | Jan 28,2023

Radar | Nov 27,2018

Radar | Mar 19,2022

Fortune News | Oct 24,2020

Radar |

Fortune News | Oct 05,2019

Radar | Aug 07,2021

Radar | Aug 11,2024

Fortune News | Feb 09,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...