Viewpoints | Jul 22,2023

Apr 3 , 2021

By Christian Tesfaye

In such times, it would be akin to incredulous to claim that Ethiopia is any sort of country with a prosperous or even viable future. Darkness seems to be all around; fear and anxiety press on citizens. A general sense of insecurity is in the air; it feels as if violence has been privatised and regularised to the point that death could be lurking on any corner. It is a sad, sad reality.

Yet again, millions and millions of people wake up each day with a hope that the next one would be better. They hope, they dream and thrive. They attempt to innovate, create wealth and, if possible, make a profit. They have the potential to go much further if they are given a chance.

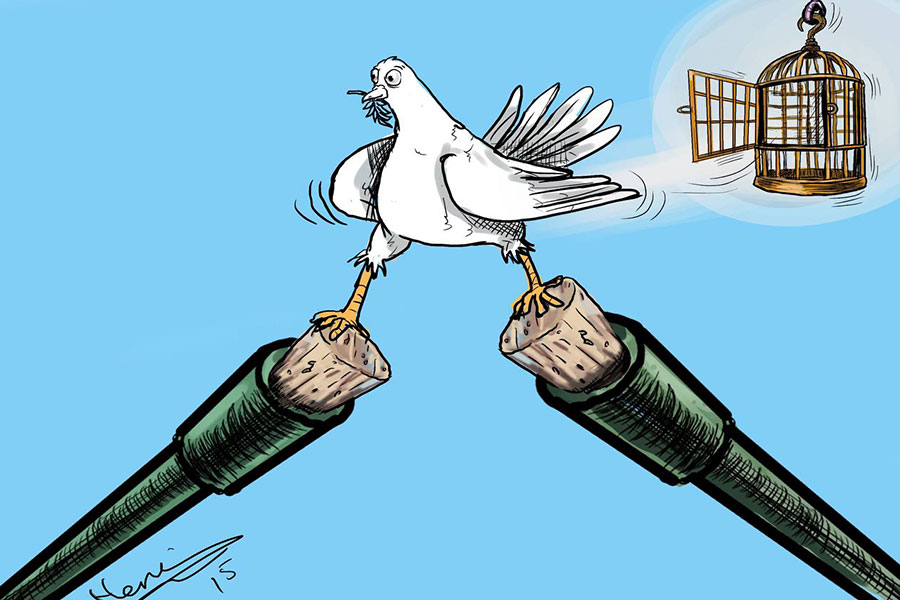

In many ways, the battle is to save the economy from the broken political system – it is to develop not because of but despite our political class. If anything, the national discourse over the political situation has gone into depths that are nearly irredeemable, especially since the start of the war in Tigray Regional State. There are no more sober or centrist voices in the political space. Instead, it has become a cesspit for the exchange of insults and malice. There is a good possibility that there may be no positive future with Ethiopia's practice of politics, at least not with this generation of political elites.

But is it possible to have a country that develops economically despite its callous political class?

One only hopes. Here at least, there is ground to build on and opportunities that could be derived. Economic reforms being implemented to make “doing business” in Ethiopia easier are highly encouraging. Take the value of the Birr that is slowly being moved toward a market-clearing rate, which could do wonders for the manufacturing sector. It discourages imports - with a priority in foreign currency allocation given to the import of the likes of raw materials - while incentivising export and consumption of locally sourced and produced goods.

Another major change with a positive outcome will be the introduction of a capital market. Currently, there is minimal incentive to save, given the negative deposit interest rate in real terms, but little available avenues for investing in productive sectors. A capital market will make the connection between savers and entrepreneurs and businesses much smoother. More critically, it will provide alternative access to capital, instead of only banks, for businesses.

Perhaps the most exciting industry today is telecom, a sector that has long been kept on a tight leash by the government. Non-financial institutions have just been allowed to engage in mobile banking. The rush to become the dominant market player has already begun. Sunpay Solutions entered the business with 100 million Br in capital late last month. In the same month, ArifPay raised 140 million Br to become a digital payment platform.

The knock-on effect of this is already obvious, as evidenced by the rise in digital service provision. Platforms such as Awtar, Avetol, Bana Muzika and Habesha View are some of the streaming services that have recently entered the market owing to the incentive provided by the growth and formalisation of electronic payments.

Many countries have grown despite their politics, not because of it. Politics is not a problem that confines itself to issues of elections or representation. It pours over into every part of our lives, even in the bedroom, as the postmodernists are loathe to let us forget.

This is not a defeatist argument for relinquishing the political space to extremist voices, the generals and the armed combatants. But sometimes, it could be the wrong tactic to keep fighting - for liberal democracy, in our case - when the risk could be wiping out all potential elsewhere.

PUBLISHED ON

Apr 03,2021 [ VOL

22 , NO

1092]

Viewpoints | Jul 22,2023

Life Matters | Jan 13,2024

Sunday with Eden | Mar 16,2019

Radar | May 12,2024

Editorial | Nov 05,2022

Sunday with Eden | Jul 01,2023

Viewpoints | Apr 29,2023

Commentaries | Aug 20,2022

Fortune News | Apr 29,2023

Radar | Sep 14,2024

My Opinion | 131548 Views | Aug 14,2021

My Opinion | 127903 Views | Aug 21,2021

My Opinion | 125879 Views | Sep 10,2021

My Opinion | 123510 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...