My Opinion | Sep 11,2020

Jan 18 , 2019

By Magaye Gaye

China-Africa relations have been beneficial to both countries. But the relationship can use more efficiency and transparency, writes Magaye Gaye (gmcconseils@gmail.com), a Senegalese economist.

China, the world's second-largest economy, is now the largest foreign economic power in Africa. The trade between the two amounted to 170 billion dollars in 2017. France, for instance, accounted for only 48 billion dollars in the same time.

China is the largest bilateral infrastructure backer in Africa, with a 50pc market share, according to a recent report by McKinsey & Company, a management consultant. China alone is doing more in this area than the African Development Bank (AfDB), the European Union, the International Finance Corporation (IFC), the World Bank and the G8 combined.

China has thus far focused on infrastructure, raw materials and mineral and oil resources. More and more, it makes safety its workhorse. To this end, it has signed funding agreements with the joint G5 Sahel force, for the Douala military depot in Cameroon, and for the African Union mission in Somalia.

The choice of these sectors is based on a strategic vision of economic expansion - more than 10pc average economic growth rate over the last four decades, although not all targets have been met - and a desire to secure its investments.

A fascinating aspect of the relationship is that contrary to popular belief that the Chinese government is interested in Africa, a recent report by McKinsey shows that of the more than 10,000 Chinese companies operating in the continent, an increasing number are private. A third of all these companies are engaged in manufacturing, facilitating Africa's estimated 500 billion in industrial output.

Chinese financial assistance generally presents soft loan conditions, often concessional with sometimes large donations, durations, differing rates and disbursement times more than satisfactory. It also has a policy of non-interference in the affairs of other countries, unlike its Western counterparts.

China's efficient export business model has the unparalleled financial capacity with significant foreign exchange reserves valued at 3.1 trillion dollars in July 2018. Devoid of a colonial past in Africa and an observer in the non-aligned movement, the nation, it can be argued, as well benefits from a positive image on the continent. At the strategic and geopolitical level, China had the intelligence to rely on Africa to build a solid alternative to Western countries through the BRICS.

If we reason in volume, there is enough to feel a sense of satisfaction about the relationship between China and Africa. However, the stakes and challenges are numerous.

The quality of China-funded projects leave somethings to be desired. China should insist that financing projects whose impact on poverty is not real are counterproductive. It would be better to be more demanding on the destination of its resources to promote inclusive growth that can encourage the establishment of a strong middle-class.

Africa, in turn, must be more demanding in terms of technology transfer.

Is it normal that nearly six decades after independence, China continues to build stadiums in Africa by its own companies?

It takes more sharing of experience and transfer of know-how. The weak role of Sino-African relations in developing African national value chains is a limitation. In this respect, China does not behave better than the others, and this is the challenge for Africa.

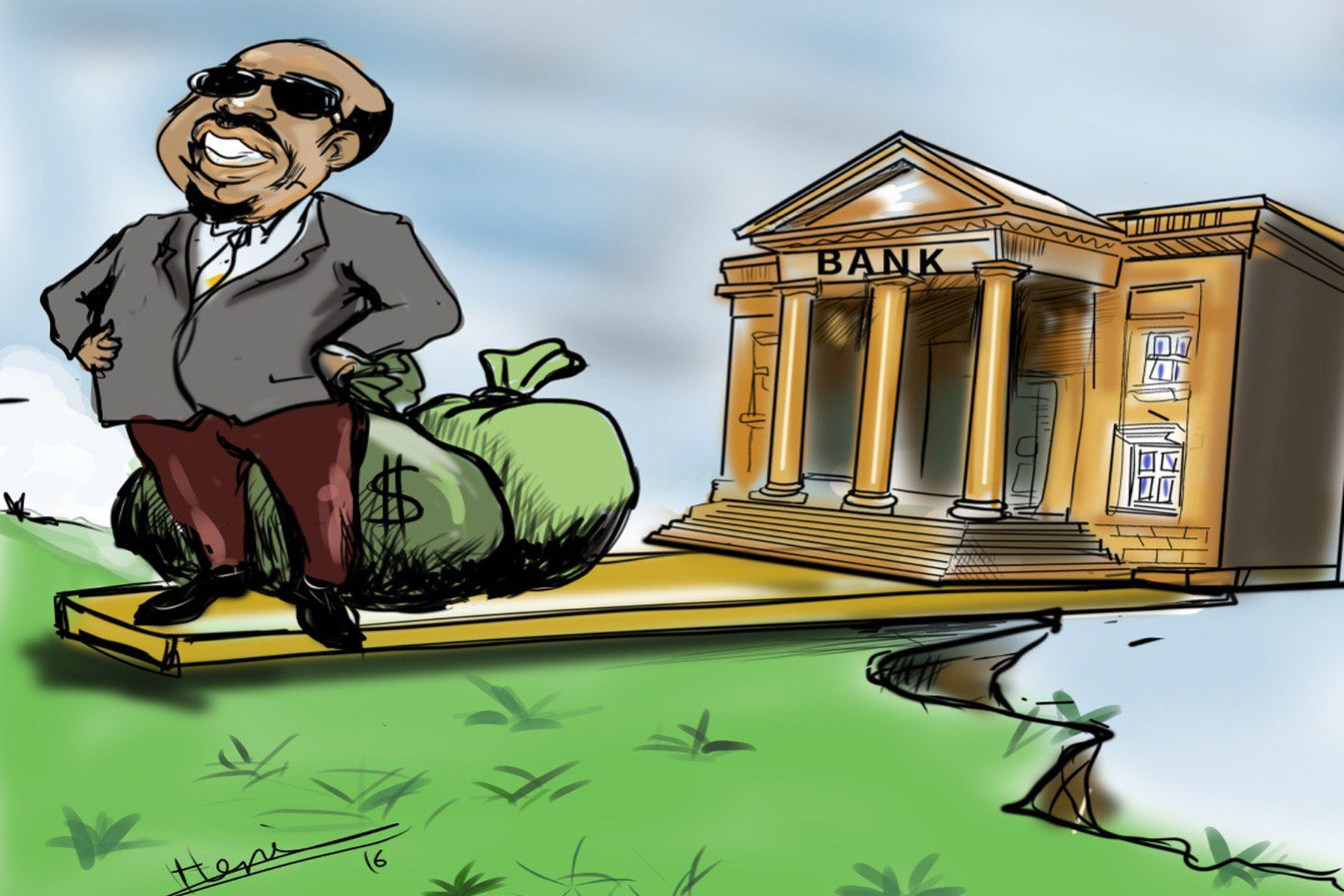

Chinese policy in Africa could be likened to a policy of predation, since it does not help to transform the structure of African economies. But the fault is not only in China. Our countries and their business communities do not have the capacity and the initiative to channel Chinese investment opportunities to the interests and priorities of our economies. We have very weak institutional capacity to control foreign direct investment and put it at the service of our productive capacities.

Both partners should also take care of the risk of over-indebtedness. Public debt in sub-Saharan Africa accounted for 45pc of gross domestic product (GDP) at the end of 2017, an increase of 40pc in three years. Of this total, China appears by far the biggest creditor.

The case of Mozambique is still in everyone's minds. When the country declared itself in default in January 2017, it had confessed to the existence of a debt hidden in its books. More transparency is needed in the relationship.

It is equally desirable that the two partners develop more joint ventures in the industrial field in general, and the processing of local raw materials in particular. These can help solve the nagging issues of youth employment; China and Africa must jointly take advantage of opportunities like African Growth and Opportunity Act (AGOA) and the Everything but Arms program of the European Union. Playing the relocation map of Chinese companies with a high demand for labour is also worth exploring.

Limiting infrastructure-versus-oil barter and normalising trade relations by placing them in transparent tendering and monetisation procedures are also challenges.

Problems related to corruption, the need to better cooperate in the promising field of technological innovation and to further strengthen their monetary cooperation through integration of the yuan in monetary systems must be taken into account. This latter aspect is amply justified in view of the upward trend in trade flows between China and Africa.

PUBLISHED ON

Jan 18,2019 [ VOL

19 , NO

977]

My Opinion | Sep 11,2020

Radar | Jun 17,2023

Fortune News | Aug 08,2020

Radar | Jul 11,2021

Fortune News | Mar 14,2020

Delicate Number | Jun 21,2025

News Analysis | Apr 27,2025

Fortune News | Apr 19,2025

Editorial | Apr 20,2024

Fortune News | Feb 27,2021

My Opinion | 131584 Views | Aug 14,2021

My Opinion | 127940 Views | Aug 21,2021

My Opinion | 125915 Views | Sep 10,2021

My Opinion | 123539 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...