Viewpoints | Jul 01,2023

Nov 5 , 2022

By Eden Sahle

A friend introduced me to a foreign company owner. The company has an annual turnover of 100 million euros, close to what Ethiopia aspires to save by restricting the imports of certain items.

The IMF forecast for next year shows that the foreign currency reserve would allow the country to buy essential items such as fuel, fertilizer, and medicines. With the untapped investment potential hindered and wasted by an unpredictable environment that scares prospective investors, the country cannot afford to lose opportunities that bring foreign currency. But talking with the company owner I met recently; it was apparent that he was hesitant to invest in Ethiopia due to security uncertainties.

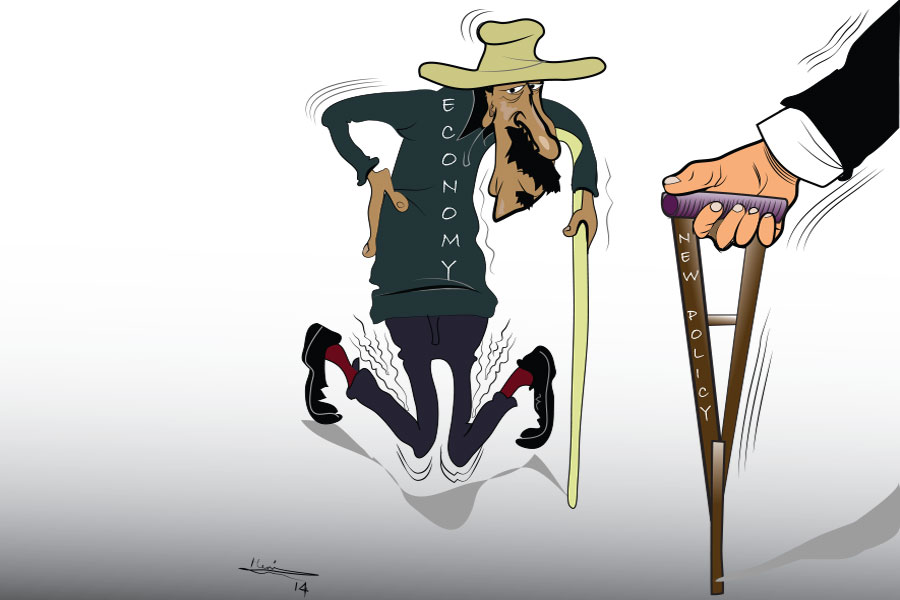

Without fixing the massive macroeconomic imbalance, the government cannot aspire to ensure economic growth, which remains a fantasy, if not political rhetoric. Ethiopia's dwindled access to foreign currency is limited to primary products' exports and stagnant foreign direct investment.

The last fiscal year's data shows 18 billion dollars in imports and four billion dollars in exports, most of which account for unprocessed agricultural outputs. The massive and historical foreign currency crisis is caused by a mismatch between import and export bills. It requires drastic policy shifts and export diversification more than banning items in an attempt to ease the macroeconomic pain.

Beauty stores are forced to close their doors permanently; fashion trend followers also pay devastating prices. The heavy impact of the ban on small-scale businesses and street hawkers' is ignored. The ban seems random and not a response to adequate research as it failed to present the impact to sellers and buyers as well as its short- and long-term impact on the economy.

Those with a sweet tooth will miss the taste of chocolate, chewing gum and cornflakes going back to what feels like the stone age in the 21st Century, while firearms and luxury vehicles of public officials remain untouched. But the biggest puzzle is how effective banning these items would be for the struggling economy.

The ban opens new doors for domestic companies to produce commodities locally and sell them with less foreign competition. It can also create new export opportunities for intraregional markets. According to World Bank data, the high dependency on imports and lack of access to loans kept the exports per capita below that of other African countries. Increasing exports per capita to a level that can support the ballooning import bills would be a game-changer for the persistent foreign currency drought.

Given the country's reliance on primary goods exports, textiles and shoes, there will not be sufficient margin to bring a massive export increase in the short run. The heavy impact of the foreign currency shortage undermined several companies from producing at full capacity. Nevertheless, it is time to start working on a long-term solution.

Crafting new strategies and encouraging domestic and foreign investors to bring diversification and production of export commodities can ease the economic pressure. Constraints on foreign exchange must be reduced to consistently attract international and local investments prioritizing industries that add value to leverage competitive advantages. Strengthening existing production capacities and facilitating businesses is vital to balance capital flows and paying for the growing demands.

The policy must shift from the failed state-led development model that cannot generate substantial foreign currency to promoting foreign direct investment opportunities. The headache for the government is bringing peace and creating a healthy predictable business environment. With skyrocketing prices, the road to the future will not be cheap, but warping the devastating war-related cost is the first step.

PUBLISHED ON

Nov 05,2022 [ VOL

23 , NO

1175]

Viewpoints | Jul 01,2023

Commentaries | Feb 01,2019

Sunday with Eden | Mar 23,2019

Viewpoints | May 23,2021

Sunday with Eden | Mar 02,2019

Viewpoints | Aug 18,2024

Life Matters | Aug 10,2024

Editorial | Nov 13,2021

My Opinion | May 11,2024

View From Arada | Aug 14,2021

My Opinion | 131586 Views | Aug 14,2021

My Opinion | 127942 Views | Aug 21,2021

My Opinion | 125917 Views | Sep 10,2021

My Opinion | 123541 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...