Viewpoints | Apr 22,2023

Jun 11 , 2022

By Tsegaye Yilma (PhD)

There are two approaches to regulating business activities. One is to throw the rule book at entrepreneurs no matter the circumstances. The other is allowing entrepreneurs to put their ideas into business by being pragmatic about lack of flexibility, writes Tsegaye Yilma (PhD) (tsegayey@gmail.com), an entrepreneur and development financing professional with more than a decade of experience in the Community Development Financing industry in the US.

If one is like me, they would constantly be looking to learn something from other countries that can make Ethiopia a better place to do business. There is a lot to gain by not repeating mistakes others made and building on others' strengths. We can learn a lot from our fellow African countries and any former socialist nation liberalising its economy to put the private sector at the forefront of economic transformation.

On this journey, a dragon flight to China is due. Given Ethiopia’s strong ideological and business ties with China, there is a lot we can learn from them. This is especially true when it comes to the role of regulators in the early years of technology companies such as Alibaba.

First, a question: All things constant, would Alibaba be what it is today had it been incubated under the Ethiopian regulatory environment?

Based on anecdotal evidence and personal observations, no, it would not. Ethiopian regulators are known for throwing the rules back at entrepreneurs and showing little flexibility. Sometimes, regulations are enacted with no consultation with the business community. This type of relationship creates a business environment full of uncertainty. It hampers business growth and innovation, particularly for business startups, which are inherently risky and have a higher probability of failure.

Without jumping into details on the regulators' motives and whether their decisions had benefited more people than they harmed, two incidents shed light on the frictions observed between businesses and regulators in Ethiopia. The first is the conflict between the National Bank of Ethiopia (NBE) and a local money transfer app called CashGo. The central bank ordered CashGo to cease operations, alleging it did not have the necessary valid permits to offer remittance services.

The other incident is the controversy between the Addis Abeba City Administration and ride-hailing companies, where the regulator required, among other things, that a vehicle be painted yellow and providers commit to driving at least for one year. The name of the directive itself tells how the regulators think: "Electronic Taxi Dispatch Services Control Directive." Mind the "Control" in the title.

Given these experiences, what is the lesson from China?

In the late 1990s, and early 2000s, many Chinese engineers and business managers returned to China, leaving behind high-paying and prestigious jobs on Wall Street and Silicon Valley to start businesses in China.

These Chinese engineers had business ideas, technical training, and relentless ambition. However, they lacked the capital to realise their dreams. Their companies had no profits, no proven business models to make a profit, and no real estate (or other assets) that could be pledged as collateral to find investors or take out bank loans in China. The banks flagged them as too risky for a loan, and there was no developed local venture capital (VC) environment to provide capital.

Worse still, China's stock exchanges had strict profitability requirements, which shut out most fast-growing tech firms. For example, to list on the Shanghai Stock Exchange, a firm had to show three years of profitability, which is impossible to meet for a tech startup that needs significant R&D, marketing, and infrastructure expenditure. Take Amazon. It took almost a decade for the world’s largest online retailer to record its first profitable quarter.

Therefore, American VC was the most viable alternative for these US-educated Chinese engineers. Let us go back to the early days of Alibaba and identify some lessons for Ethiopian regulators from their Chinese counterparts.

Alibaba got its VC from a Wall Street firm called Goldman Sachs (GS), which had a China-focused venture shop run by the Taiwanese American Syaru Shirley Lin. Lin was targeting startups founded by American-trained Chinese, who would sell into China’s vast market. Lin heard about a startup founded by an English teacher named Jack Ma, who did not meet her criteria of an American-trained Chinese, but she gave him a chance to pitch his business idea.

She met Ma in his apartment, serving as the company's headquarters and where Ma’s wife and dozens of employees were crammed and working like crazy. After the first in-person meeting, Goldman Sachs agreed to invest in Ma’s startup but only if the bank got more than half of the ownership of the company. After some back and forth, the two sides agreed on a fifty-fifty split, with the bank paying five million dollars for its half of the company, which Ma called Alibaba. Fifteen years later, Alibaba went public, making Goldman Sachs' five million investment worth close to 15 billion dollars.

At that time, one of the challenges for Alibaba to secure the bank’s investment was Chinese law forbidding foreign ownership of website-based businesses. This legal restriction on its face would have killed China’s digital economy in its infancy. The Goldman Sachs team had three choices. The first was to push the Chinese government to change the requirement, which would undoubtedly take time and may not even succeed. The second was to abandon the opportunity, which was too good to pass up. The third and the last choice was to find 'workarounds' to the regulation. The bank team chose the third option.

The detail of the workaround option by the bank and many VCs that invested in Chinese technology companies and the responses by the regulators is an essential lesson for Ethiopia. The Wall Street lawyers used a business structure known as Variable-Interest Entity (VIE). In this structure, the ownership of the VIE is by a Chinese entity without a foreign equity ownership (the operating company). The operating company is usually owned by its founders and will obtain all necessary licenses and approvals to conduct business in China. The VIE is controlled by a multinational enterprise structure (the control company) that will have both Chinese and foreign investment and shareholders.

The control company is usually incorporated in the Cayman Islands to obtain foreign investments. The foreign investment in the Cayman entity will be channelled into the China-based operating company in the form of a loan to get around the Chinese government's prohibition. Then, to give foreign investors the sorts of rights that they expect from venture deals, Silicon Valley’s lawyers execute a series of side contracts between the different entities. The operating company grants control rights to its foreign creditors, simulating the influence of an equity stake. The operating company also agrees to pay interest on its foreign loan in amounts that vary according to the business's success, which resembles a dividend payment. Finally, all parties agree to resolve all disputes under New York law. Alibaba and other Chinese companies used this workaround and raised foreign investment, and grew to be where they are today.

But where were the Chinese regulators when the lawyers cooked all these shenanigans to circumvent their regulations designed to protect the interest of the Chinese people, whatever that means?

One possibility is that the Chinese regulators were not savvy enough to understand what was transpiring. But a regulatory environment that oversaw double-digit economic growth for consecutive decades and took hundreds of millions of people out of poverty is not likely to be unsophisticated to understand what was happening. In addition, their recent crackdown on Alibaba’s monopoly is evidence of their sophistication and ability to throw punches if needed.

The answer lies in Chinese regulators' awareness that there is no local capital to support these startups. They had two choices: to hold their ground and let these startups perish due to lack of capital or swallow their pride and allow the startups to go behind their back and raise the money they need to grow their businesses. Even though they did not approve or endorse the financing setup with the foreign VCs, the Chinese regulators chose to turn a blind eye and allowed the startups to secure funding.

I see two possible approaches to regulating business activities. The first is for regulators to lay out the rule of the game by taking lessons from other countries if available and tweaking them to fit local conditions. The catchword is ''tweaking.” The type of adjustments regulators make depends on multiple factors; however, the adjustments will determine the type of business environment of a country.

Countries like Ethiopia, with communist and command economic backgrounds, are usually nervous about letting market forces take the driver's seat. Therefore, they put regulatory conditions on economic activities, mostly with little input from the business community. This results in an unfriendly business environment, particularly for innovative and technology-based startups.

The alternative approach lets entrepreneurs put their ideas into business with little worry about what the regulators would do to their efforts. Under this business environment, regulators come onto the scene to address emerging issues and put regulations in consultation with the stakeholders. This approach gives startups sufficient time to build experience and resources to address regulatory concerns much better than if they had to account for the regulatory requirement at the inception of their businesses. The multiple congressional hearings in the US on social media companies regarding personal data handling is a good example of how regulators address identified issues in consultation with the businesses.

The Chinese regulators had the rule book to manage technology startups; however, they used pragmatism to overlook certain 'transgressions' and allowed Alibaba and similar technology startups access to foreign investment. If there is only one thing Ethiopian regulators can learn from their counterparts in China, it would be to be pragmatic in enforcing regulations. They need to have an open mind to accept that some of their requirements may hinder business growth and impact the overall business environment in the country. Sometimes this may mean turning a blind eye when businesses come up with innovative approaches to work around regulations that are burdensome to follow.

PUBLISHED ON

Jun 11,2022 [ VOL

23 , NO

1154]

Viewpoints | Apr 22,2023

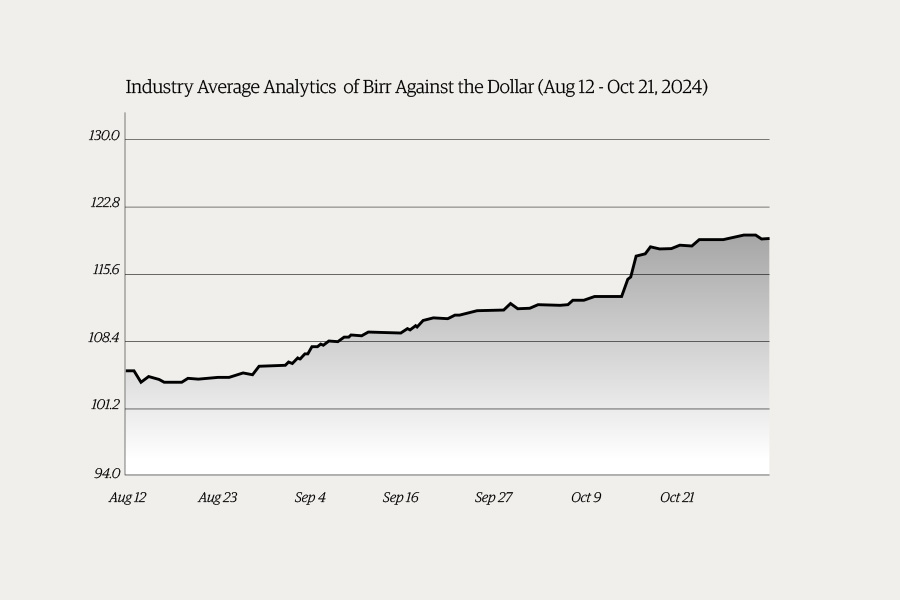

Money Market Watch | Nov 03,2024

My Opinion | Jul 18,2021

Editorial | Mar 16,2024

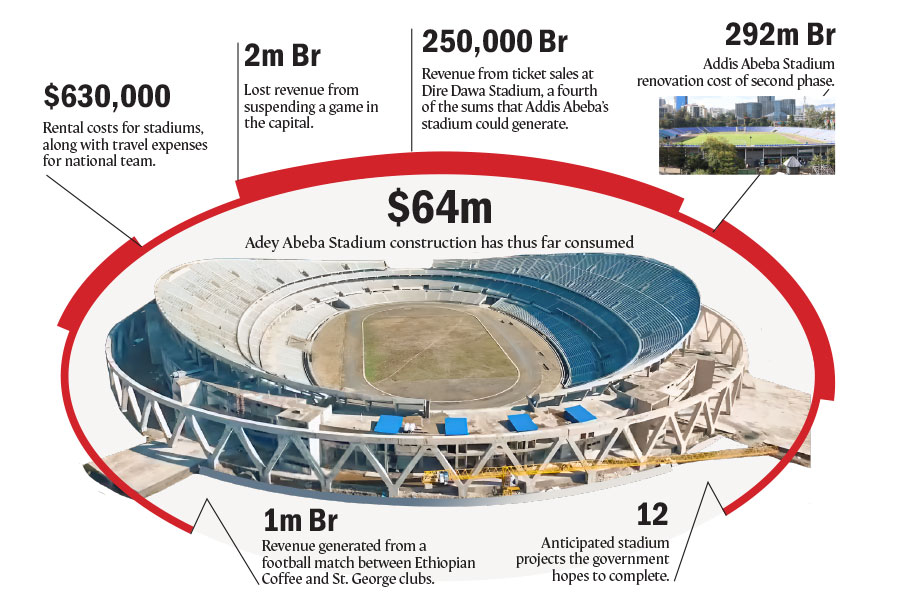

Fortune News | May 15,2021

Radar | Oct 02,2021

News Analysis | Jan 05,2020

News Analysis | Jan 05,2020

Fortune News | Oct 27,2024

Viewpoints | May 08,2021

My Opinion | 131548 Views | Aug 14,2021

My Opinion | 127903 Views | Aug 21,2021

My Opinion | 125879 Views | Sep 10,2021

My Opinion | 123510 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...