Jun 17 , 2023.

As Ethiopia teeters on the precipice of a fiscal tightrope, clouds of worry are gathering for the country's economic custodians. The lurking spectres of a severe foreign exchange crisis, burgeoning external debt obligations and stagflation - a potent cocktail of soaring living costs amid an economic slowdown spiking unemployment rates - loom large.

A look into the recently proposed budget bill offers an intriguing dichotomy: one of fervent optimism offset by potential pitfalls. Anticipated public spending surges paint on a veneer of dogged determination, robust revenue forecasts and an envisaged equilibrium in budgeting. Nevertheless, the foundations of these assumptions raise eyebrows.

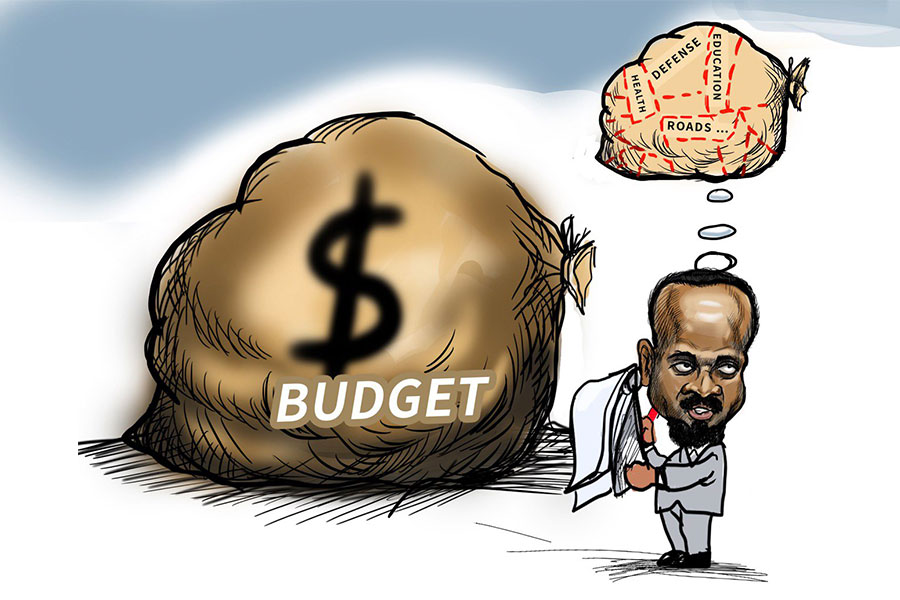

The juggernaut of Ethiopia's fiscal direction lies in the hands of Finance Minister Ahmed Shide. His ability to transmute his sanguinity into tangible outcomes through managing inflation, bolstering domestic production, enhancing domestic revenue collection and judicious external debt management will be crucial in steering a cautiously realistic budget.

Ahmed's latest budget proposal resonates with audacious aspirations and hopeful growth prospects, promising economic resilience and a bounce back from past self-inflicted economic faltering. With a projected expenditure of 801.7 billion Br, marking a modest 1.91pc rise from the present fiscal year, the budget displays a restrained approach towards economic growth.

However, the Finance Minister and his cohorts must heed the lessons of past economic missteps. Ambitious ventures based on shaky premises could incite public frustration.

The projected expenditure blueprint reveals a substantial allotment to recurring expenses such as administration and social services. A 228.3 billion Br lodged under the nebulous "Others" category stirs curiosity about such allocations' nature and potential implications.

Although over 90pc of the allocation under this category may comprise debt serving, the ambiguity, nonetheless, should be clarified.

Around 203.4 billion Br is apportioned to capital expenditure, the lion's share of which is understandably earmarked for economic development - a pivotal lever in enhancing the country's growth narrative. Nevertheless, this tale has a downside. Federal capital expenditure investments have dwindled from 10.3pc of the GDP in 2010/11 to a meagre 2.9pc this year. Ethiopia is investing less in sectors with promising returns today than it did a decade ago.

The proposed budget displays a noteworthy emphasis on federal subsidies to regional states and an endeavour to achieve Sustainable Development Goals (SDGs), suggesting efforts to maintain equilibrium in regional growth.

A cursory glance at the proposed budget could yield an impressive picture: expected revenues, foreign grants, and external borrowing precisely mirror the proposed expenditure, thus projecting an optimistic image of fiscal balance. However, the adage that even the best-laid plans often go awry merits consideration.

The architects of the bill appear to be leaning heavily on domestic revenue collection. With an estimated 479.5 billion Br, last year's revenue will be significantly outpaced. While this may signify a renewed focus on tax collection, the potential economic fallout of political instability, the lingering effects of the COVID-19 pandemic, global inflationary pressures and escalating geopolitical tensions could render this forecast overly optimistic.

Growing reliance on external assistance and borrowing also deserves scrutiny.

With expected foreign aid at 41.1 billion Br and substantial dependence on both foreign and domestic borrowing, Ethiopia's economic landscape seems to be inching towards an escalating debt burden.

This potential hike in Ethiopia's indebtedness could trap the country in a deleterious cycle of debt, interest payments and economic strain, leaving it susceptible to global financial volatility. Without a pact with the International Monetary Fund (IMF) for a new program package and short of debt restructuring agreements with bilateral and multilateral creditors, Ethiopia’s annual external debt servicing is projected to double to four billion dollars in two years.

This burgeoning debt burden could curtail essential public expenditure, thereby leading to long-term fiscal strain.

It is equally important to scrutinise the macroeconomic assumptions underpinning this audacious budget bill. The projected GDP growth rate of 9.2pc (though seemingly revised down to 7.5pc), an inflation rate of moderately double-digit, and a reduction in import growth all signal a rosy outlook that might not reconcile with the reality.

Indeed, the previous year's figures sketch a different picture - a lower GDP growth rate, significantly higher inflation, and substantial import growth. This paints a stark contrast to the optimistic projections for the coming year.

The optimism around inflation management, in particular, appears to be walking a treacherous tightrope. Achieving a target of 11.9pc, particularly when contrasted with the current year-on-year rate of 33pc, would be no minor accomplishment. If unfulfilled, as history suggests, the implications could be severe, eroding purchasing power and fuelling living costs, hurting particularly the fixed-income group on the economic ladder. This can only reverse decades of gains in reducing the portion of society under abject poverty.

Similarly, while commendable, the GDP growth target demands considerable effort, given the recent economic missteps and the prevailing political instability. The future growth trajectory of Ethiopia will largely hinge on its capacity to steer through these turbulent political and social currents.

While the ambitious budget bill may set the ethos for the coming fiscal year's budget, it is vital that such aspirations are firmly grounded in reality. Policies that effectively manage inflation, augment domestic production, improve tax collection efficiency, and build a robust economic framework should underpin Prime Minister Abiy Ahmed's Administration growth strategy.

Minister Ahmed and his budget planners might harbour hopes that these projections materialise. However, the pragmatists among them should recognise the necessity for a contingency plan in case they do not.

A striking feature of the budget bill is the expected reduction in import growth to 10.2pc, down from the previous year's 25pc. This could hint at a predicted surge in domestic production, signalling a shift towards import substitution. However, concerns that domestic production may not keep pace merit careful consideration. The outcome could be a double-edged sword, precipitating potential shortages or price hikes, which could further stoke the flames of inflation.

The Administration would instead ensure that its ambitious budget does not compromise long-term fiscal sustainability. Prudent borrowing, with an eye on potential future liabilities, will be critical.

As the budget faces legislative voting in the coming weeks, a call for transparency is in order. Legislators should demand that the Finance Minister elucidate the mysterious 'Others' category in the budget bill, which makes up a substantial portion of the recurrent expenditure. The taxpaying public and development partners deserve to know these allocations to maintain confidence in the Administration's fiscal plan.

The federal government's budget bill reflects the Administration's resolve to tread a path of economic recovery and development. It embodies bold strides towards growth, which must be taken cautiously. The hope is that these ambitions materialise, steering Ethiopia towards a future of fiscal stability and economic prosperity. Amid this optimism, however, it is essential to heed the warning signals flashing on the country's fiscal dashboard.

PUBLISHED ON

Jun 17,2023 [ VOL

24 , NO

1207]

Radar | Jun 24,2023

Editorial | Jun 11,2022

Life Matters | May 18,2019

Fortune News | Feb 19,2022

Fortune News | Apr 22,2022

Fortune News | Jun 09,2019

Radar | Jun 03,2023

Sunday with Eden | Dec 11,2020

Sunday with Eden | Apr 13, 2025

Viewpoints | Mar 20,2021

My Opinion | 131673 Views | Aug 14,2021

My Opinion | 128039 Views | Aug 21,2021

My Opinion | 126001 Views | Sep 10,2021

My Opinion | 123622 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...