Editorial | Oct 28,2023

Jul 13 , 2025

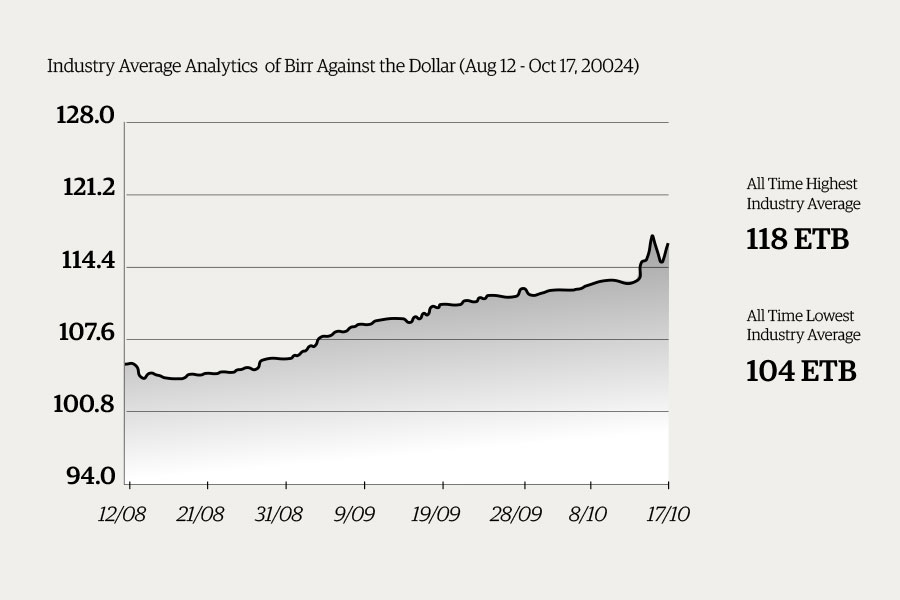

For two decades, policymakers relied on a playbook that mixed state-funded construction booms, cheap bank credit, and a tightly managed exchange rate. Holding the Birr (Brewed Buck) artificially high kept imported fuel and food affordable, giving the appearance of price stability.

Nonetheless, beneath the surface, trade gaps widened, with goods imports exceeding exports by roughly three to one, while a thriving parallel market quoted the Birr at almost twice the official rate. Foreign-currency debt piled up.

By 2024, the contradictions snapped. Facing thin reserves and growing pressure from creditors, policymakers let the currency float. The Brewed Buck tumbled, and the promised soft landing never arrived.

Officials called the step “a long-overdue correction” meant to lure investment and restore credibility. Ordinary Ethiopians sensed little of that logic at the checkout counter. Prices of teff, cooking oil, and minibus fares skyrocketed, while paychecks remained unchanged, turning a routine trip to the market into an exercise in triage.

The story is familiar to any country that has allowed its currency to have price discovery before erecting shock absorbers.

Egypt offers one of the sharpest lessons. When Cairo let the pound float in 2016, it lost nearly half its value within weeks; inflation shot above 30pc. The government cushioned households by expanding cash-transfer programs, stuck to tight monetary policy, and embedded the float in a broader package backed by the International Monetary Fund (IMF).

The pain was real, but policy sequencing was coherent. By 2018, the economy had steadied enough for investors to return.

Argentina displays the other extreme. The Peso was floated in 2018 during gaping budget deficits and political gridlock. Capital fled, consumer prices spiralled, and bond investors deserted a market they no longer trusted. Absent fiscal restraint or a credible monetary anchor, depreciation fed on itself and reform collapsed.

Interestingly, Ghana sits somewhere in between. The Cedi has weakened by more than 80pc against the Green Buck during the past two decades, yet progress on tax collection, better-targeted subsidies, and transparent reserve management has kept investors engaged for long stretches.

Even so, global rate hikes revived debt distress and inflation, demonstrating that a floating currency remains fragile without robust buffers.

Nigeria, more recently, tried to merge its multiple exchange windows in 2023. The Naira sank, and consumer prices climbed more than 33pc. With no clear monetary framework and inadequate fiscal transparency, the move rattled business sentiment instead of calming it.

Sadly, Ethiopia appears to be risking the repeat of the Nigerian script.

Admittedly, the Birr had been overvalued, discouraging exports and distributing scarce dollars through opaque channels. Aligning the official rate with the street made sense on paper. But a float is a safety valve only when it is part of a reinforced chassis.

Federal authorities launched the reform with no sizable safety net, no timeline toward an inflation-targeting central bank, and little explanation to citizens. The result is a cost-push inflation that has driven up the prices of fuel, food, and medicine for large swaths of the public, while wages remain far behind.

The fiscal impact is equally profound. Because most public borrowing is denominated in foreign currency, each weaker Birr forces more local-currency revenue to service external debt. The Finance Ministry now warns that interest and principal could swallow more than half the federal budget, squeezing funds for schools, clinics, and roads and leaving little for the capital projects that once drove growth.

Officials concede the status quo cannot be sustainable. Some regional states have already delayed projects for lack of counterpart funding, stirring fresh social tensions.

To turn depreciation into recovery, policymakers need to put in place the scaffolding that most of their peers tried, successfully or not, to erect. Targeted cash assistance would mitigate the initial inflationary impact, particularly in urban areas where food and fuel comprise a significant portion of household expenditures.

A hard target for consumer prices, announced and defended by the National Bank of Ethiopia (NBE), would anchor expectations. Domestic revenue mobilisation the federal tax take is under 10pc of GDP, among the lowest in sub-Saharan Africa should fill the hole left by costlier debt service.

None of these steps requires novel theories. They require political will.

Security is the other missing pillar. Sporadic violence and unresolved regional conflicts erode investor confidence, disrupt domestic supply chains, and render monetary tightening alone ineffective in taming prices. Without reliable and safe transportation, steady electricity, and predictable farm output, demand may cool, but food inflation continues to climb. Fixing those bottlenecks is as important as any communiqué issued by the Central Bank.

Federal political leaders and their policy advisors still have options available to them. Emergency support could be financed with concessional loans tied to transparent benchmarks on spending and revenue. Credible fiscal rules, such as imposing a firm ceiling on the primary deficit, would provide strong assurance to markets that resorting to the printing press is not only undesirable but unequivocally off the table as a fallback option. Officials also need to communicate, early and often, that they are steering the process. Silence invites speculation, which in turn feeds the parallel market that the float was meant to eliminate.

Floating the Brewed Buck may have been inevitable. The hardship that followed was not. Delay, poor coordination, and inefficient social investment ensured that the costs were borne by those least able to bear them.

Experience from Cairo to Buenos Aires demonstrated that exchange rate liberalisation is never a silver bullet. Only when it is bolted to fiscal restraint, monetary credibility, social protection, and crucially peace does it deliver the competitiveness its architects promise.

The question now is whether Ethiopia can muster the discipline to match its policy daring. Markets reward reform only when it rests on trust, coherence, and widespread political legitimacy. The Birr has been left to float; the economy cannot afford to drift with it.

We have withheld the identity of the author upon request.

PUBLISHED ON

Jul 13,2025 [ VOL

26 , NO

1315]

Editorial | Oct 28,2023

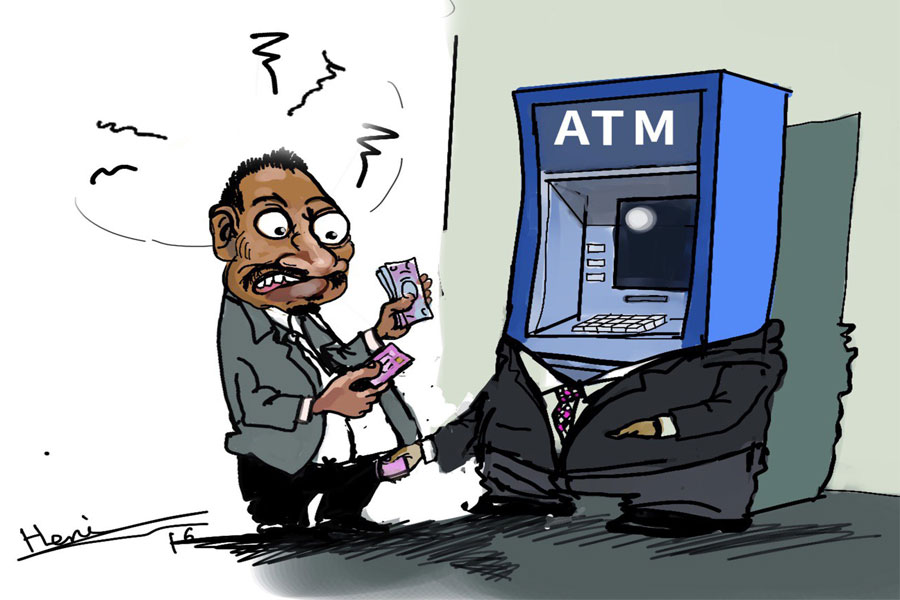

Money Market Watch | Jul 13,2025

Fortune News | Dec 15,2024

Editorial | Nov 27,2021

Agenda | Mar 07,2020

Sunday with Eden | Oct 11,2025

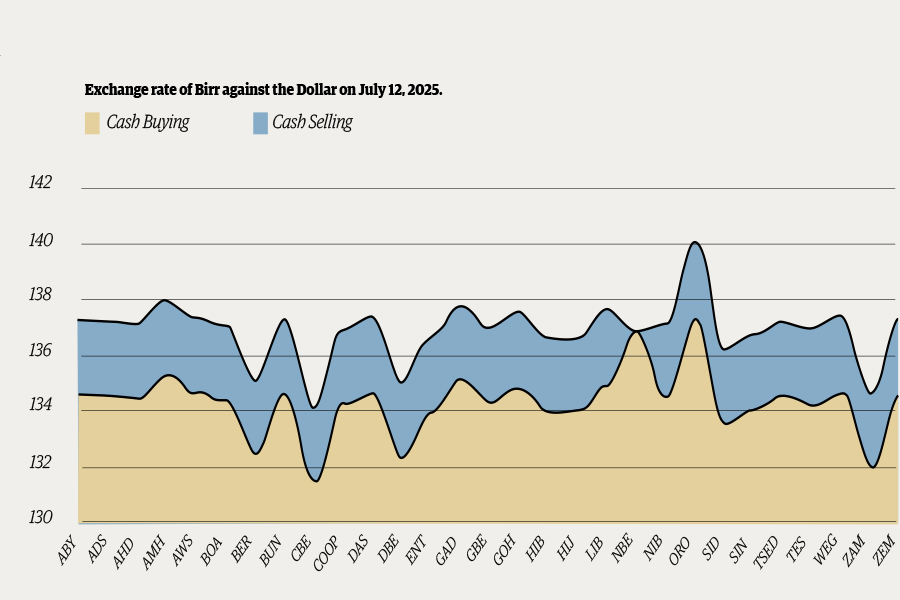

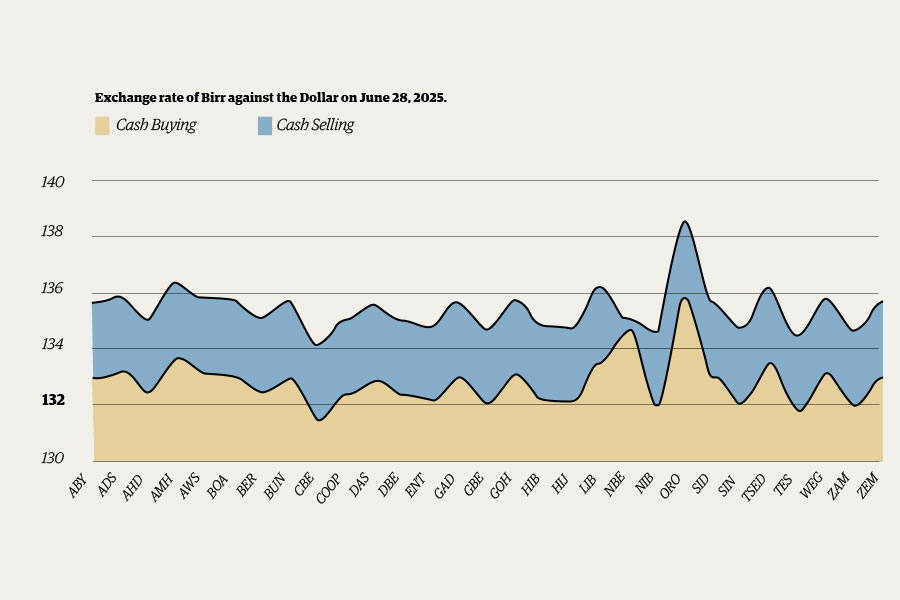

Money Market Watch | Jul 06,2025

Editorial | Aug 03,2024

Money Market Watch | Oct 20,2024

Fortune News | Oct 21,2023

Photo Gallery | 177294 Views | May 06,2019

Photo Gallery | 167501 Views | Apr 26,2019

Photo Gallery | 158143 Views | Oct 06,2021

My Opinion | 136980 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 26 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...