Life Matters | Jun 10,2023

Jul 22 , 2023

By Hintsa Andebrhan

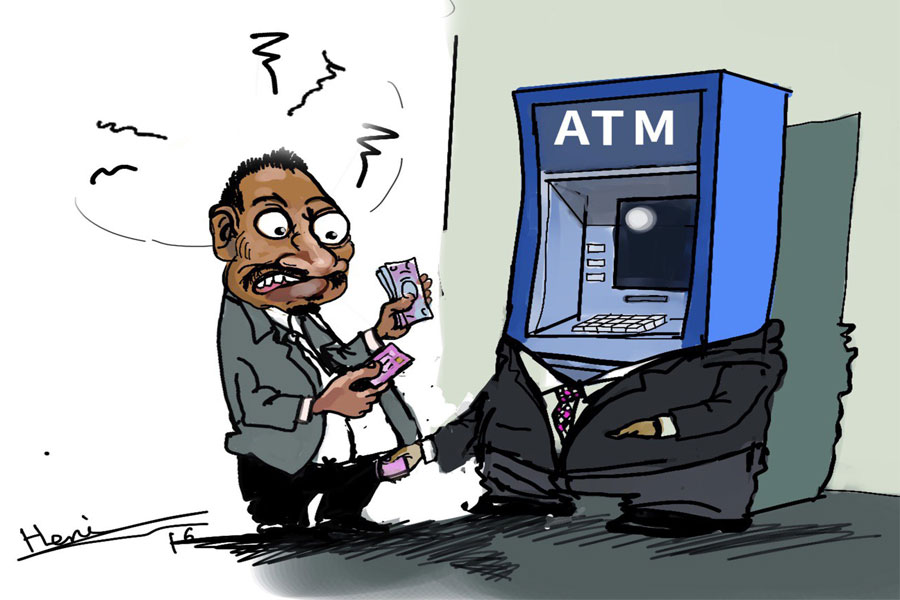

At the recent Paris Finance Summit, the world stood on the precipice of a novel epoch, two rival monetary orbits glinting at its edges. The international community, it appears, is at a critical juncture, teetering on the brink of a struggle for financial domination. In this volatile milieu, only countries with robust economic policies dare tread the arduous path.

At the fulcrum of these geopolitical machinations was Ethiopia's Prime Minister, Abiy Ahmed (PhD), a leader whose presence, while noticeable, was marked by a surprisingly tepid critique of the International Monetary Fund (IMF) and World Bank, the very emblems of the Bretton Woods monetary order.

Abiy's key points included a call for the fulfillment of pledges, a push for enhanced liquidity access, a rallying cry for scaling up Multilateral Development Banks (MDBs), and an appeal for immediate debt relief. His cause, however, revealed an apparent acquiescence to the incumbent economic order and its associated rules - a position that many in Ethiopia may view as a gamble.

Notably, the Summit brought into sharp relief the underlying tensions simmering in the Global South. A clear distinction was made by South Africa and Kenya, whose leaders have grown weary of international financial institutions that treat them as subordinate entities.

Kenya's President, William Ruto (PhD), emphasised the call for an equal partnership, articulating the need for a new financial architecture. This sentiment found an echo in several developing economies from Latin America to Asia, all expressing disenchantment with the hegemony of dollar trades.

The Summit laid bare a silent but palpable specter: Brazil, Russia, India, China, South Africa, a.k.a the BRICS, and its New Development Bank (NDB). It is not just the emergence of a new bank that alarms Washington and its allies; rather, it is the idea of a new currency that seeks to upend the Dollar's supremacy. Recent developments, such as China's petro-Yuan agreement with Saudi Arabia, and the Yuan and Ruble-based energy trade agreement between China and Russia, signify a significant thorn in the side of the US-led liberal economic order.

American economist Jeffrey D. Sachs (PhD) poignantly captured the mood, noting the inability of American leaders to deliver cogent policies at the Summit. In this milieu, the US-centric financial entities, the IMF and World Bank, stand on the verge of a watershed moment. They must either reform their bureaucratic structures or face the onslaught of a new currency championed by the BRICS.

The implications of these shifting tectonic plates are not lost on Ethiopia.

While the country's current economic strategy remains opaque, there is a pressing need for a robust economic policy to navigate this incoming 'war of economies.' The new global order looming over the horizon is not about simple trade-offs but about having a nuanced and complex policy. It is also about states safeguarding their sovereignty while advancing their interests. It is incumbent upon Ethiopia's Prime Minister and his administration to fashion an economic strategy that would shield Ethiopia and secure its populace's social and economic well-being in this evolving world order.

PUBLISHED ON

Jul 22,2023 [ VOL

24 , NO

1212]

Life Matters | Jun 10,2023

Fortune News | May 18,2019

Radar | Jul 21,2024

Radar | May 06,2023

Editorial | Oct 28,2023

Life Matters | Sep 07,2019

Agenda | Mar 05,2022

Editorial | Jan 14,2023

Radar | May 26,2021

Editorial | Mar 09,2019

My Opinion | 131507 Views | Aug 14,2021

My Opinion | 127863 Views | Aug 21,2021

My Opinion | 125841 Views | Sep 10,2021

My Opinion | 123471 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...