Viewpoints | Jan 05,2019

Jul 30 , 2022

By Amil Aneja , Eliamringi Leonard Mandari,

The remittance industry will flourish best when the regulatory framework is sound and predictable. Ethiopia is taking steps in this direction, which can be instructive for other countries going forward, write Amil Aneja and Eliamringi Mandari, programme lead and lead remittance policy specialist, respectively, at UNCDF's Migration & Remittances portfolio.

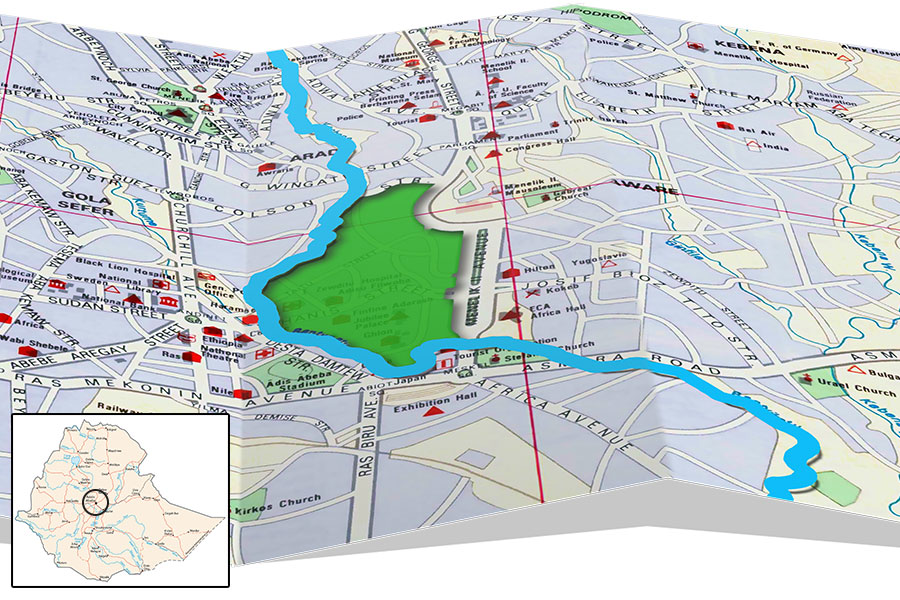

An estimated 1.3 million Ethiopian migrants globally send about five billion dollars back to Ethiopia every year, accounting for more than five percent of the country’s GDP and about one-quarter of its foreign exchange earnings. At the household level, remittances are a vital source of income for recipients, and their size and scale provide productive investment opportunities contributing to Ethiopia’s long-term development.

Transfers made by individuals for altruistic motives – mainly to support family members or charitable purposes – are what traditionally make up the remittances in Ethiopia’s balance of payments. This altruism may include the desire to support not only individuals but also Ethiopia’s socio-economic development – survey results indicate that this is a significant motivating factor for diaspora investors. There are, however, other motives. An increasing share of remittances to developing countries are for investment purposes, motivated by higher returns than those available to migrants in the countries they reside in, and a desire to return eventually to their countries of origin. The plan to return home may be facilitated by the direct purchase of housing, investment to ensure income streams on their return, and maintaining ties through investments that will ease reintegration.

This unique combination of altruism and investment calls for the careful design of products that cater to motives and policies that address the challenges faced by the diaspora. Significant barriers to migrants realising their dreams back home include bureaucratic hurdles, the high cost of transfers to Ethiopia, a lack of reliable investment information, poor business infrastructure, insecure property rights, currency risks and an underdeveloped financial sector. These issues need to be addressed by policy efforts to optimise remittances and in close consultation with the diaspora.

The remittance industry, like any other, is likely to flourish best when the regulatory framework is sound, predictable, non-discriminatory and proportionate. A conducive and enabling regulatory framework is the foundation for competitive market conditions for non-bank financial service providers, including supporting access to domestic payment infrastructures. Such a framework should lead to lower remittance costs, increased cross-border remittance flows through formal channels, and expanded use of digital financial services.

A new directive is opening up the remittance market. The National Bank of Ethiopia (NBE) has continued to implement regulatory reforms to facilitate the transition of remittances from cash-based to digital channels and from informal to formal ones, all of which create opportunities for a broader suite of migrant-centred financial products that can be linked to remittances.

To improve formal remittances, a directive issued by the NBE came into effect on October 1, 2021. It aims to improve the operations of the formal remittance transfer system in Ethiopia by reducing remittance costs and improving access to cost-effective, reliable, fast and safe services that benefit migrants. It also aims to set a conducive and transparent legal framework and use the innovative mechanisms and infrastructures by payment instrument issuers to facilitate inbound remittances through formal channels.

Under the previous directive, remittance service providers could partner only with commercial banks. This kind of bank-dependent arrangement where the regulator does not directly recognise remittance service providers can stifle innovation. Banks typically focus on providing traditional services and do not usually consider the demand-side perspectives in remittance product developments that could cater to the financial needs of migrants.

Under the new directive, payment instrument issuers can now provide remittance services in partnership with international remittance service providers. The directive also permits using application programming interfaces (APIs) so that services can operate between international and local remittance service providers and prohibits exclusive conditions in these agreements.

Enabling international remittance service providers to partner with in-country non-bank financial service providers and allowing the use of APIs could help address the bank-dependent model’s limitations. Disintermediating the remittance value chain helps reduce the remittance transaction costs and incentivises digital remittance service providers to innovate and develop migrant-centred products and services.

Despite these supportive developments, the NBE appears to be gradually opening up the remittance business to non-bank financial service providers. The directive enables only those payment instrument issuers licensed under another directive, posing challenges for start-ups. Firstly, the minimum paid-up capital of 50 million Br (around a million dollars), contributed in cash and deposited in a blocked account with a bank, could be a barrier for these companies. Secondly, the scope of eligible institutions is limited by the new directive (only banks, the Ethiopia Postal Service, payment instrument issuers and any other financial institution determined by NBE). However, the NBE may consider expanding this scope in the future.

The NBE has also amended the directive on foreign currency accounts for non-resident Ethiopians. The central bank says this amendment will incentivise the Ethiopian diaspora to maintain foreign currency accounts at home, encouraging domestic investments. The amendment should also support the foreign exchange reserve and ease the country’s balance of payments, encouraging foreign direct investment. It allows three types of accounts (whereas only savings accounts were permitted under the previous directive): fixed or time deposit accounts, which take the form of deposit certificates issued in the name of the depositors with a minimum maturity period of three months; current accounts, from which withdrawals may be made at any time; and non-repatriable Birr accounts, which are savings deposit accounts that can be used for local payments only. Importantly, no income tax is payable on any interest earned on foreign currency in fixed deposit accounts. These savings can be used as collateral to receive credit from domestic banks in the local currency.

The amended directive also introduces the entity of “diaspora international remittance service provider” authorised to provide inward remittance services in agreement with a bank, the Ethiopian Postal Service or any other financial institution to be determined by the NBE. This enables any business registered and licensed in a foreign country and owned by non-resident foreign nationals of Ethiopian origin or non-resident Ethiopians to provide money transfer services. Diaspora international remittance service providers will also have the right to retain and use 45pc of the foreign currency inflows.

This amended directive is a positive move towards building more opportunities for migrants and their families to save and invest in their home country by securing their savings separately from the money they remit home. It also incentivises the newly allowed diaspora international remittance service providers to partner with in-country remittance service providers. Since the directive came into operation in November 2020, 23 banks are now offering services, and almost 30,000 accounts have been opened, with more than 86 million dollars deposited by the end of June 2022.

Ethiopia is taking many steps to implement crucial reforms that will benefit remittance flows, migrants and communities, and inward investment. Multilateral institutions such as the UNCDF are supporting NBE in these efforts and believe that the Ethiopian experience holds valuable lessons for other nations as the policy agenda on remittances takes on heightened urgency.

PUBLISHED ON

Jul 30,2022 [ VOL

23 , NO

1161]

Viewpoints | Jan 05,2019

View From Arada | Nov 02,2024

Fortune News | Mar 30,2024

Fortune News | Sep 26,2021

Commentaries | Jul 10,2020

Fortune News | Aug 18,2024

Featured | May 03,2024

Fortune News | Oct 13, 2024

Fortune News | Jan 14,2023

My Opinion | 131819 Views | Aug 14,2021

My Opinion | 128203 Views | Aug 21,2021

My Opinion | 126147 Views | Sep 10,2021

My Opinion | 123767 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...