Editorial | Jan 04,2020

Prospective investors interested in exploring minerals in the Oromia Regional State can receive concessions for small-scale mining from the regional administration.

A pilot programme restructuring procedures, where concessions were exclusive to enterprises established by unemployed youth, brought a change of policy by the Oromia Mineral Development Authority. Close to 49 investors have received permits to mine for coal in 49 quarry sites located in Dedo, Sekoro, and Boto Tolay in the Jimma Zone, 400Km southwest of Addis Abeba. The concessions are valid for five years.

The Authority has finalised the pilot programme launched three months ago before moving into full implementation across all 21 zones in the regional state, according to Zewdu Tadesse, director of mining licensing. Re-established in 2019, the Authority is mandated with issuing small-scale and artisanal mining permits and competency certificates. It gives permits to enterprises established by unemployed youth, businesses, and investments in private-public partnerships.

Since 2019, the Authority has issued 3,700 permits.

The regional administration has conducted a feasibility study teaming with the regional revenues, land administration, environmental protection bureaus, and the Jimma Zone Mining Bureau. Previously, the administration had issued small-scale coal mining concessions valid for two years to enterprises set up by unemployed youth. However, prospective investors were seen as reluctant to involve owing to instability in the regional state.

Despite the uncertainty, a few investors chose to partner with local enterprises.

ATMS Coal Mining Plc has entered into a partnership with Wuka Gudina Enterprise, established by 101 members. The duo has been mining coal for over a year on one hectare of land in Doba Wereda. The venture produced 3,000tn of coal, disclosed Ahmed Tebik, general manager of ATMS Coal Mining.

Incorporated in 2014, Kuyu Cement was one of the buyers of coal mined by ATMS and the enterprise. Its plant in the Shewa Zone requires 300tn daily to produce 1,500tn of cement. The plant is operating at 30pc capacity, according to Berhanu Gebru, supply manager.

The plant paid 2,300 Br for a tonne of coal before it stopped sourcing the mineral from the partnership. Berhanu blamed "poor quality" for the decision.

Over the past six months, Kuyu Cement has been sourcing the coal from Tenkara Mining Plc for a higher price of 3,000 Br a tonne.

The Authority helps youth enterprises operating without partners to invest in providing machinery and equipment. But the issue of quality remains big.

Melaku Mekuria, an engineering geologist, observed that the main reason behind the low quality of locally-processed coal is the absence of coal washing and purifying plants.

"Granting investors concessions might fill this gap," he said.

Unwashed coal has an average energy production capacity of 2,500 kilo-calories a kilogramme. Washed coal can generate 4,000 kilo-calories of power.

The authority is aware that cement plants complain about the poor quality of the coal supplied to them, according to Zewdu.

The primary coal users are cement plants and steel and metal companies that depend heavily on carbon-intensive fuels.

The Oromia Regional State, where vast coal reserves are believed to exist, is not alone in granting concessions to small-scale coal mining operations with a combined production capacity of half a million tonnes. Three regional states, including Benishangul-Gumuz, see the active involvement of such companies.

Despite the availability of enormous coal reserves, production remains small. In the Yayu coffee forest alone, 560Km southwest of the capital, 230 million tonnes of coal reserves have been discovered by China National Complete Plant Import & Export Corporation. Preliminary studies conducted by experts from the Ethiopia Geological Survey identified potential deposits of 600 million tonnes of coal, mainly in the Oromia, Benishangul-Gumuz and Amhara regional states.

Industrial-scale coal mining operations have yet to emerge.

Coal production by small-scale miners has been lingering at around half a million tonnes annually, representing over half of the 19 cement plants' demand. They have an annual production capacity of 18 million tonnes of cement. The plants source the remaining coal from abroad, causing the country to spend 275 million dollars a year on coal imports.

Desperate to save the precious forex spent on coal imports, federal authorities granted concessions to eight companies two months ago. With a combined registered capital of six billion Birr, these companies are expected to produce 4.2 million tons of coal annually in the next decade. They have committed to start production by the end of the year.

While issuing concessions to large-scale coal mining is a mandate of the federal government, regional states are responsible for granting permits to small-scale coal extraction. Under the new scheme implemented by Oromia regional authorities, prospective developers have 70pc of the share in the business, while 30pc goes to residents where the concessions are found. Where the concession is farmlands, the owners receive 20pc, and 10pc of the revenues go to residents in the area.

However, developers are required to partner with enterprises established by the youth. They are required to meet criteria, including 30pc in working capital, acquiring machinery, feasibility studies and environmental impact assessments. Developers are also compelled to pay a licensing fee of 8,000 Br and 500 Br for land registration. The capital required can vary based on the findings of the feasibility studies but can go as high as 50 million Br.

Concessions sites are limited to five hectares. The previous arrangement had set the area ceiling at one hectare for youth enterprises.

PUBLISHED ON

Apr 22,2022 [ VOL

23 , NO

1147]

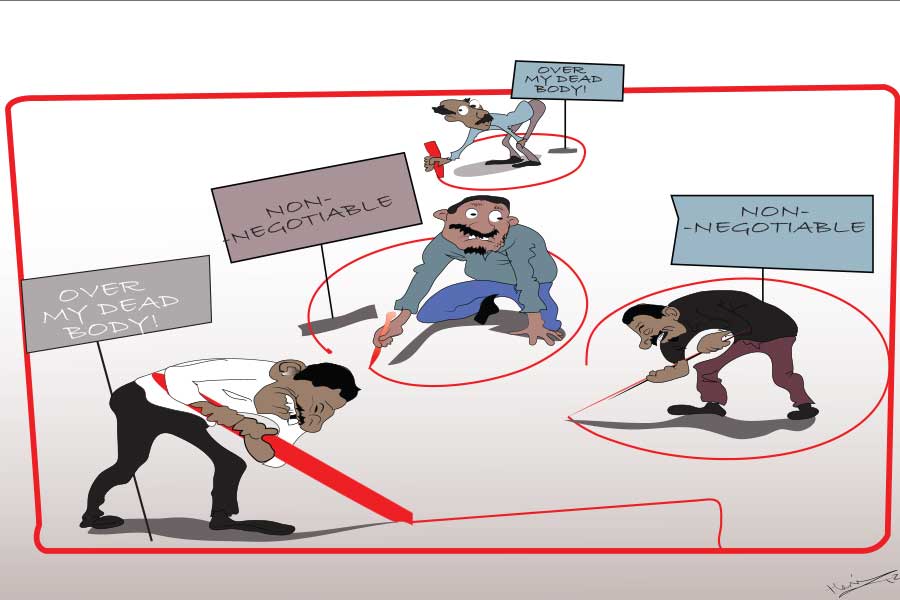

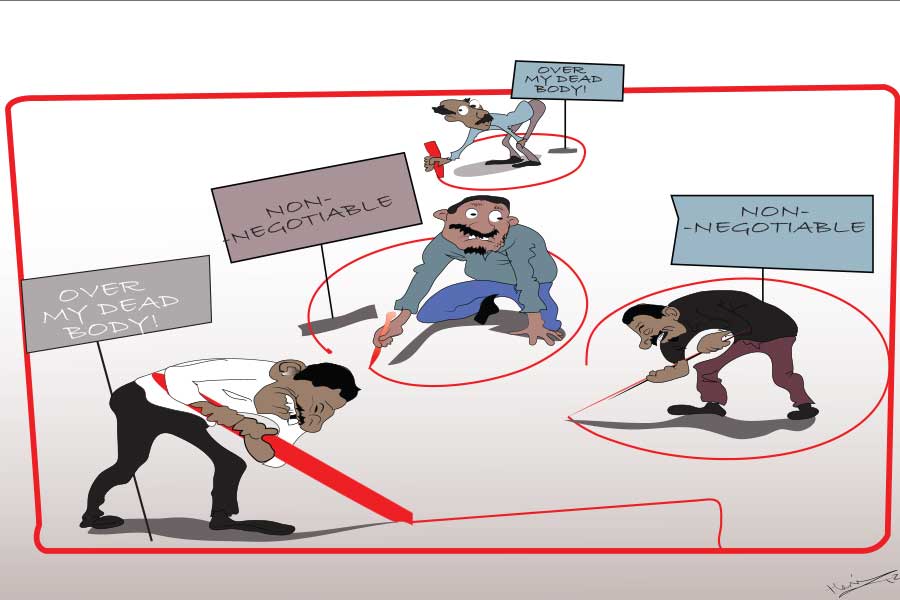

Editorial | Jan 04,2020

Radar | May 13,2023

Radar | Aug 16,2020

Fortune News | Jun 25,2022

Covid-19 | Apr 11,2020

Radar | Jul 11,2021

News Analysis | Oct 13,2024

Radar | Dec 16,2023

Radar | May 15,2021

Radar | Feb 27,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...