Feb 22 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

Yet earnings per share (EPS) nosed down slightly.

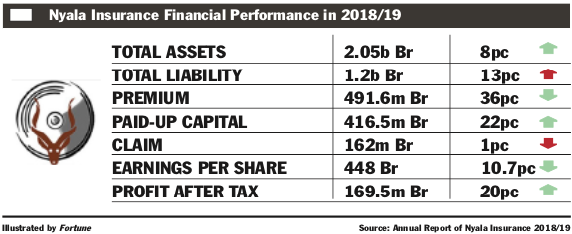

Nyala Insurance Financial Performance 2018/19

Nyala Insurance Financial Performance 2018/19 Nyala Insurance's profit grew by 20pc last fiscal year, maintaining its leading position in the industry though its earnings per share (EPS) slipped slightly.

In the last fiscal year, Nyala's net profit reached 169.5 million Br, while the company's EPS fell by 48 Br to 448 Br.

The EPS decline is attributed to a large increase in paid-up capital. Nyala's paid-up capital surged by 22pc to 416.5 million Br.

Yared Molla, CEO of Nyala, argues that EPS alone cannot be a measurement for the performance of a company.

"A company with a short-term success intention can easily increase its EPS," said Yared, "but it's also important to look at the healthiness of its balance sheet, particularly its liability."

Working on technical underwriting that led to the decline of net claims and proceeds from last year's mega risk underwriting helped the company to achieve positive performance, according to Yared.

The substantial contributors to its underwriting surplus were motor, marine, engineering and bond classes of business.

The increase in profit after tax was achieved due to a mixture of several factors including stagnant claims, a decline of the premium ceded and a surge in interest and dividend income.

During the reporting period, the company's gross written premium declined by 36pc to 491.6 million Br.

The reduction of the gross written premium is a terrible fall that requires the attention of the management, according to Abdulmenan Mohammed, a financial analyst with close to two decades of experience.

Yared says that the gross written premium plummeted due to well-intended pursuits.

"Gross written premium is simply public money temporarily kept under custody until a claim is paid," says Yared.

When the premium an insurer charges is not commensurate with the risk it undertakes, the claim ratio becomes too high, according to him.

"Thus, it’s not advisable to increase a gross written premium," Yared said, who decided not to pass a gross premium limit of half a billion Birr.

Yared explained that in the current market the industry is characterised by price undercutting, and therefore writing more premium means bleeding more.

To increase its net written premium, the firm should increase its retention rate, according to the expert.

Nyala's premium retention rate increased by 14 percentage points to 65pc. However, the retention rate of the firm is still lower than that of many other insurance companies, which average about 77pc.

Out of the total gross written premium, 173.1 million Br was ceded to reinsurers. In response to the reduction of the gross written premium, Nyala reduced premium ceded by 62pc.

"It's the right action to compensate for the decrease in gross written premium," said Abdulmenan.

In spite of the reduced retention rate, the claims of Nyala remained essentially the same. Claims paid and provided for went down by one percent to 162 million Br.

In the past year, Nyala earned a commission of 52.8 million Br, a decrease of 14pc and paid commissions of 16.8 million Br to agents, an increase of one percent.

This illustrates that Nyala succeeded in bringing in more income from investment activities, mainly from shares and property rental.

Nyala managed to write several mega risk policies directly without incurring intermediary commissions, according to Yared.

Interest earned on savings and other securities slightly dropped by one percent to 82.6 million Br, and dividends earned on investments in shares soared by 149pc to 65.2 million Br. Nyala’s income from rental fees increased by 15pc to more than 11 million Br.

In the past year, Nyala transferred a net 45.8 million Br from its profit and loss account to its life fund.

Nyala’s total expenses increased by a reasonable rate, according to the expert. Salaries and benefits increased by 15pc to 87.4 million Br, and general administration expenses went up by one percent only to 50.1 million Br.

Abdulmenan appreciated that Nyala controlled expenses well, calling it a positive performance.

Yared says that the cost controlling initiatives have been effectively utilised in the two pillars of their strategy - building the business and reforming internal processes.

The total assets held by Nyala increased by eight percent to nearly 2.1 billion Br. Investments in shares, government bonds, time deposits and rental properties slightly decreased by one percent to 878.5 million Br. These investments represent 42.8pc of total assets.

This proportion is lower than the preceding year’s rate of 46.3pc.

Nyala held a huge amount of cash and cash equivalents despite the reduction in value terms. Its cash and bank balances decreased by 22pc to 259.3 million Br.

Liquidity analysis reveals that Nyala's cash and bank balances accounted for 13pc of total assets. This level of liquidity is higher than what was held by other insurance companies.

The management of Nyala should channel the excess liquid resources into income-generating activities, according to Abdulmenan.

Nyala’s current liquidity level was kept on purpose, according to Yared, who adds that the firm has two mega projects that can consume much of its liquid resources. "We're also waiting on the [central bank] to deregulate the extremely tight investment programme."

Nyala’s capital and non-distributable reserves represent 32pc of its total assets.

This indicates that Nyala is a well-capitalised company, according to Abdulmenan, who recommends the management use its resources efficiently by expanding the business.

PUBLISHED ON

Feb 22,2020 [ VOL

20 , NO

1034]

Fortune News | Jun 08,2019

Viewpoints | Apr 03,2021

Fortune News | Aug 12,2023

Radar | Aug 13,2022

Fortune News | Dec 11,2021

Fortune News | Aug 28,2021

Radar | Jul 28,2025

Fortune News | Feb 20,2021

Radar | Aug 18,2024

Radar | Dec 26,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...