Commentaries | Sep 17,2022

May 3 , 2023

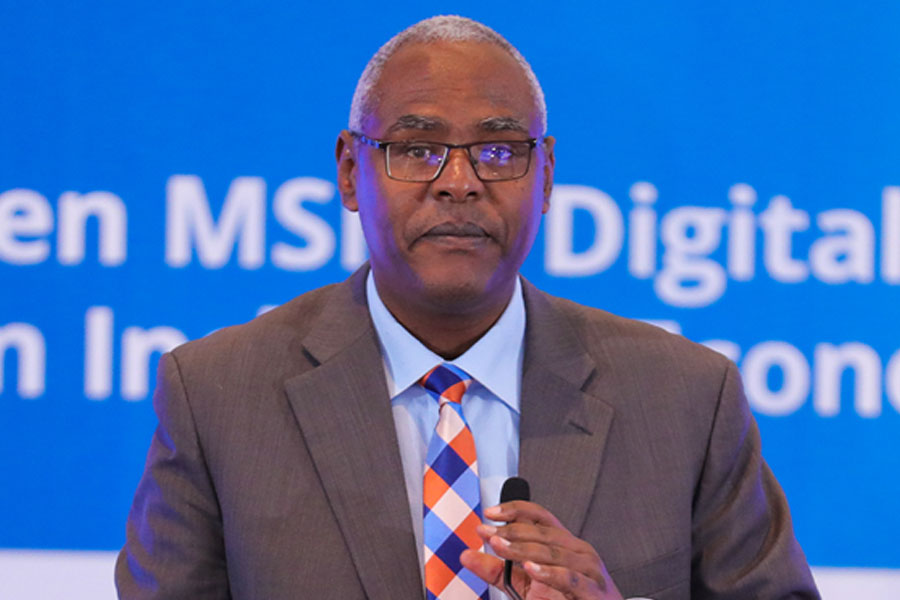

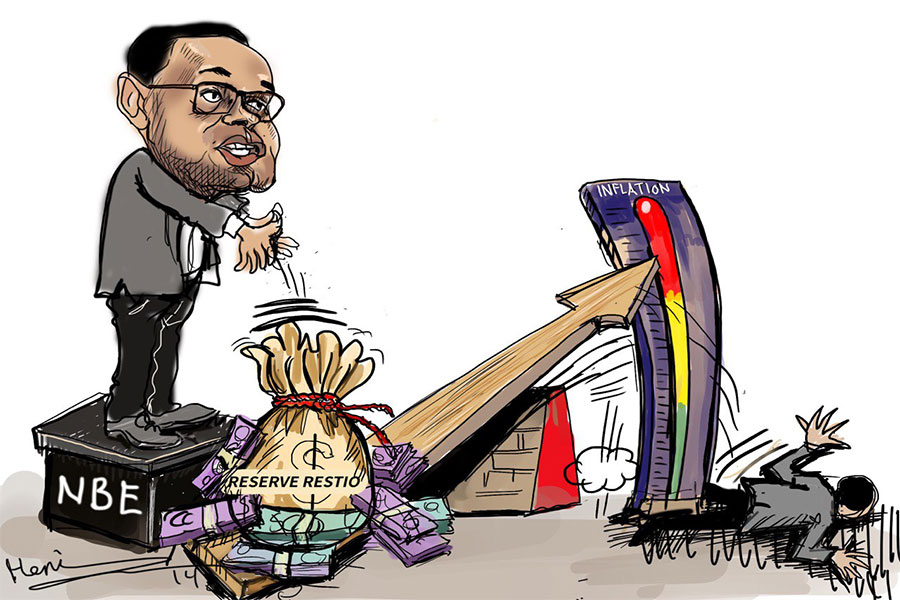

Ethiopia's central bank has announced a partnership with financial technology firms to develop and implement a regulatory framework for movable collateral and non-collateral loans to support micro, small, and medium enterprises (MSMEs). According to Vice Governor of the National Bank of Ethiopia (NBE), Solomon Desta, the Bank is actively working on the infrastructure to facilitate this initiative.

A panel discussion focused on digital lending was held at the Hyatt Regency Hotel on Africa Avenue (Bole Road). The event is expected to address strategies for overcoming barriers to financial inclusion in Ethiopia and beyond.

Last year, the central bank facilitated 3.6 billion Br in non-collateral loans to MSMEs, which marked a fourfold increase from the previous year. The authorities aim to extend financial access to 70pc of the population by 2025, said Solomon.

Experts are urging banks to broaden their financial services to traditionally underserved sectors, such as farmers. The primary reasons for banks' reluctance to support these groups include the lack of digital infrastructure, limited data, and an imbalance of risks and costs.

Commentaries | Sep 17,2022

Radar | Feb 24,2024

Viewpoints | Jun 05,2021

Viewpoints | Jun 26,2021

Fortune News | Jan 30,2021

Fortune News | Mar 04,2023

Radar | Oct 03,2020

News Analysis | Nov 16,2024

Fortune News | Aug 07,2021

Editorial | Jun 18,2022

My Opinion | 131974 Views | Aug 14,2021

My Opinion | 128363 Views | Aug 21,2021

My Opinion | 126301 Views | Sep 10,2021

My Opinion | 123917 Views | Aug 07,2021

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...