Editorial | Mar 30,2024

Jun 14 , 2022

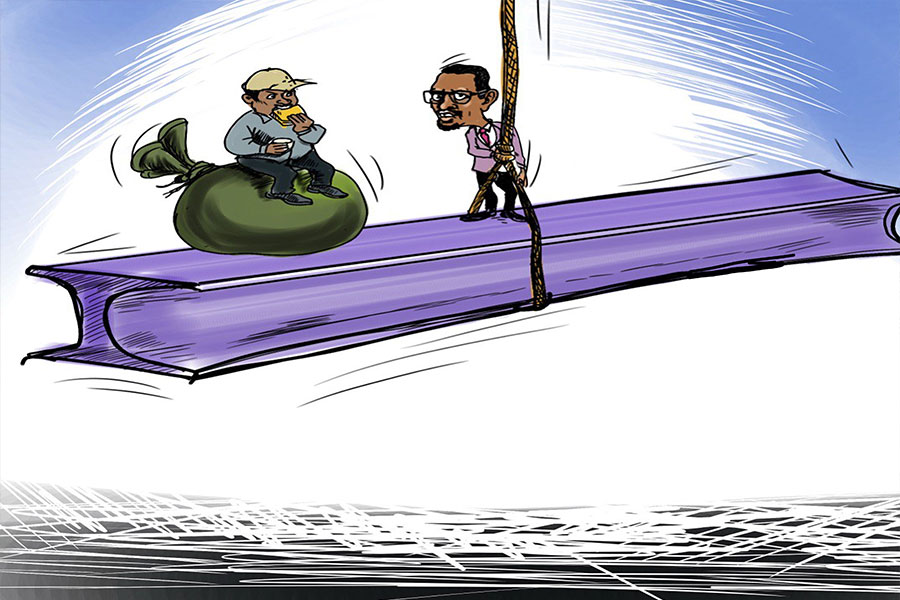

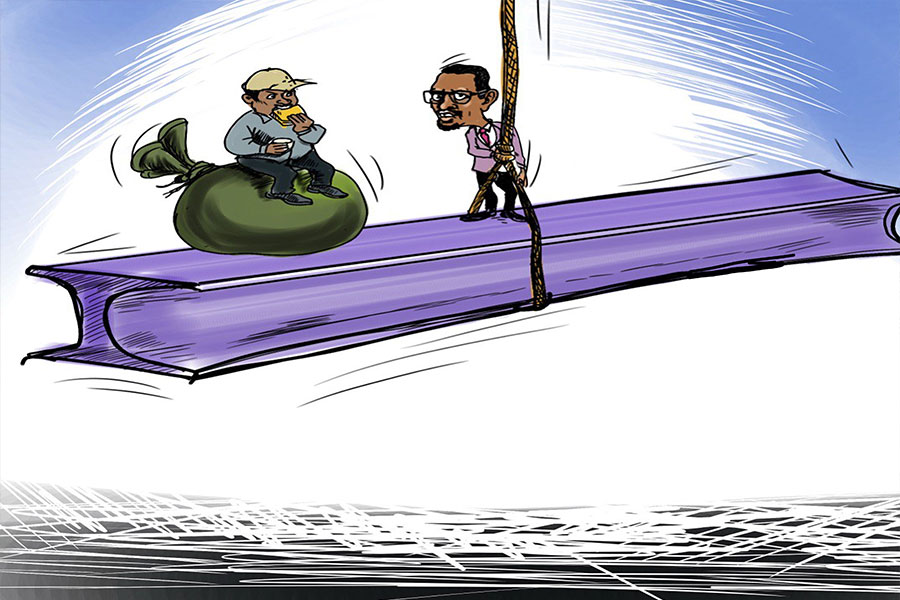

Regulators at the central bank have cut reserve requirements for commercial banks down by half to five percent.

It comes less than a year after the banking supervision directorate at the National Bank of Ethiopia (NBE) raised the requirement to 10pc of deposits. The reversal is hoped to ease the liquidity problem the industry faces. Finance Minister Ahmed Shide raised liquidity issues in the banking industry during question time in Parliament a couple of weeks ago.

Banks are compelled to keep their monthly average reserve-to-deposit ratio at no less than seven percent. The updated directive became effective last week.

Editorial | Mar 30,2024

Commentaries | Oct 30,2022

Fortune News | Jun 04,2022

Radar | Oct 03,2020

Radar | Jul 09,2022

Agenda | Aug 27,2022

Radar | May 09,2020

Radar | Jan 15,2022

Fortune News | Nov 26,2022

Fortune News | Feb 05,2022

My Opinion | 131590 Views | Aug 14,2021

My Opinion | 127946 Views | Aug 21,2021

My Opinion | 125921 Views | Sep 10,2021

My Opinion | 123545 Views | Aug 07,2021

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...