Radar | Aug 16,2020

Mar 7 , 2020

By GELILA SAMUEL ( FORTUNE STAFF WRITER

)

The directive follows a proclamation that was legislated a few months ago, enabling banks to take movable assets as collateral for loans and advances. It allows low-income borrowers such as smallholder farmers and lower-scale entrepreneurs to secure loans for investment and job creation purposes.

The directive follows a proclamation that was legislated a few months ago, enabling banks to take movable assets as collateral for loans and advances. It allows low-income borrowers such as smallholder farmers and lower-scale entrepreneurs to secure loans for investment and job creation purposes. Banks must now allocate five percent of their annual loans to individuals in the agricultural sector and take movable property as a guarantee, according to a new directive that was issued last week.

Issued on February 26, 2020, by the National Bank of Ethiopia (NBE), the directive compels financial institutions to direct the loans to cooperatives, unions and small and micro enterprises in the agricultural sector beginning July 1, 2020. The directive also operationalises a law that allows movable assets to be taken as collateral to access loans.

The directive follows a proclamation that was legislated a few months ago, enabling banks to take movable assets as collateral for loans and advances. It allows low-income borrowers such as smallholder farmers and lower-scale entrepreneurs to secure loans for investment and job creation purposes.

If banks cannot disburse the loans directly, they can allocate a budget and partner with microfinance institutions to provide the credit.

The agreement may include motor vehicles; trailers; agricultural, construction or industrial machinery; and serial-numbered collateral held for business use. The collateral agreement will include the type of collateral, quantity or specific listing.

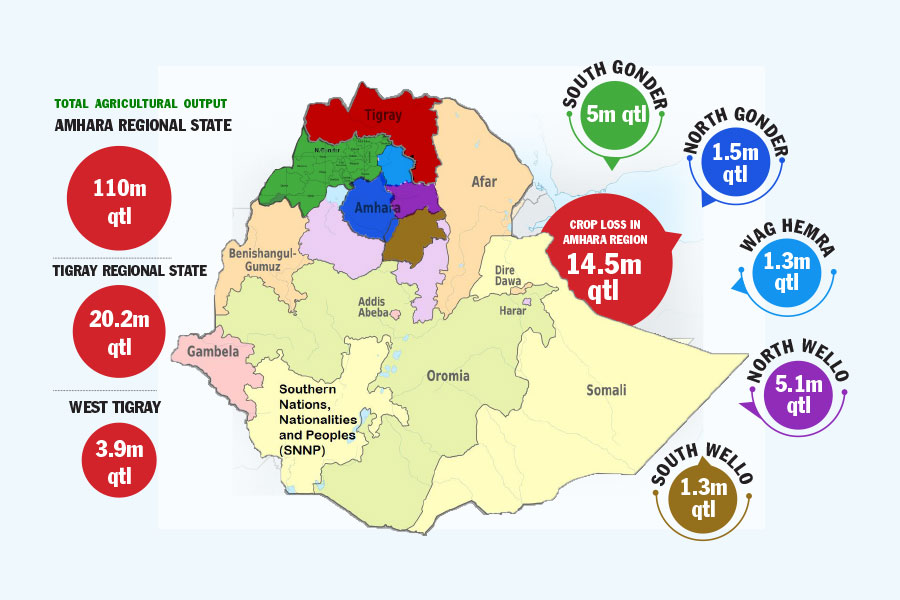

The scheme is part of the government's attempt to increase loans to the agricultural sector. In the last five years, less than 10pc of total loans were directed to agriculture.

"We targeted to increase this value between 30pc and 40pc," Anteneh Girma (PhD), a senior advisor at the Ministry of Agriculture (MoA), said during a meeting held a month ago at the Office of the Prime Minister on agricultural reform.

To move forward with the service, the central bank has established a Movable Collateral Registry Office, headed by a director, and the Electronic Collateral Registry System. The Office will approve and provide user accounts for creditors to access the collateral registry upon fulfilling the proper requirements.

"Establishing a single comprehensive electronic registration regime for secure transaction in movable property to determine priority rights among competing claimants is necessary," reads the directive.

Financial institutions with a user account at the registry will collect fees on behalf of the registry office of the National Bank of Ethiopia and credit the collected fees to the account of the Movable Collateral Registry Office.

It is going to be a hiccup for the banks as they do not have much experience with SMEs, according to Abdulemenan Mohammed, a financial expert with 15 years of experience in the United Kingdom and Ethiopia.

"Handling the risk management of the SMEs for the banks isn’t something they can adjust to easily," said Abdulemenan.

Wondwossen Teshome, president of Enat Bank, one of the youngest banks, agrees with Abdulmenan, saying it is going to be hard to implement the scheme right away and see the fruits of success.

"Despite the experience in the international field," said Wondwossen, "the risk management is debatable."

Banks that fail to comply with the new requirement will be subjected to a 10,000 Br fine. If any bank fails to achieve the target in the preceding budget year, it is required to double the allocation in the subsequent budget year.

“This can give a leg up to the banks by partnering with microfinance institutions, since the institutions have better experience with SMEs,” said Abdulmenan.

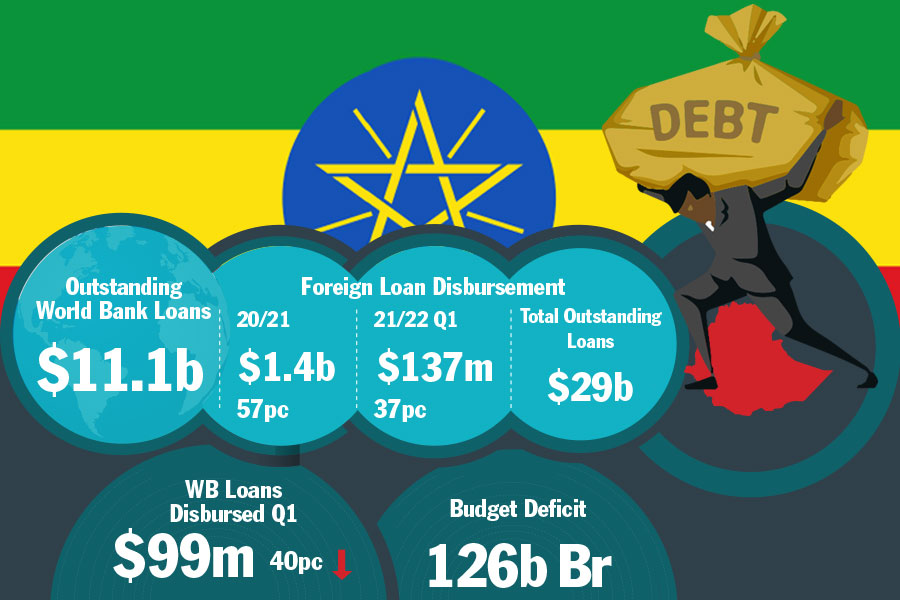

The 38 operational microfinance institutions have mobilised 41.2 billion Br in the last fiscal year. Their total outstanding credit has reached to 61.6 billion Br with total assets of 83 billion Br. In the same quarter, the banks have disbursed 39.6 billion Br in new loans from that.

"With the current liquidity issue, this is a nightmare for the financial institutions; however, the scheme is going to help a lot of SMEs," added Abudlmenan.

PUBLISHED ON

Mar 07,2020 [ VOL

20 , NO

1036]

Radar | Aug 16,2020

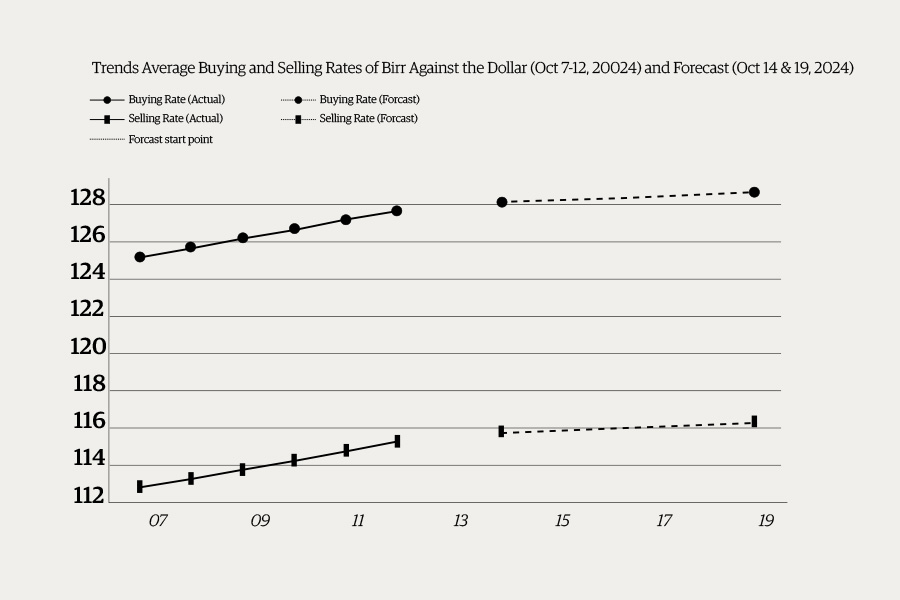

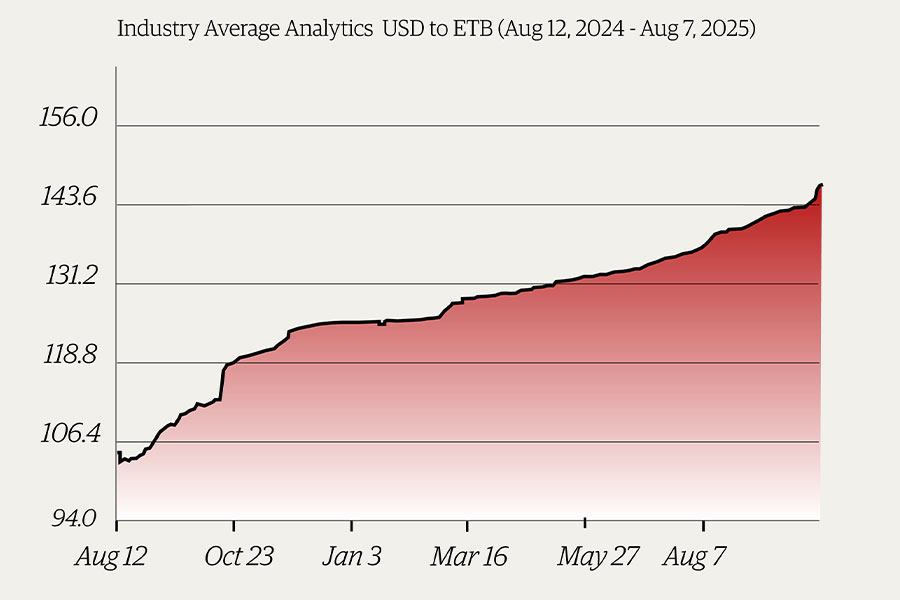

Money Market Watch | Oct 13,2024

Money Market Watch | Oct 18,2025

My Opinion | Nov 04,2023

Commentaries | Dec 10,2018

Fortune News | Nov 06,2021

Radar | Jul 18,2021

Fortune News | Dec 25,2021

Radar | Apr 09,2022

Radar |

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...