Fortune News | Jul 13,2024

Jun 12 , 2021

By Abdulmenan M. Hamza

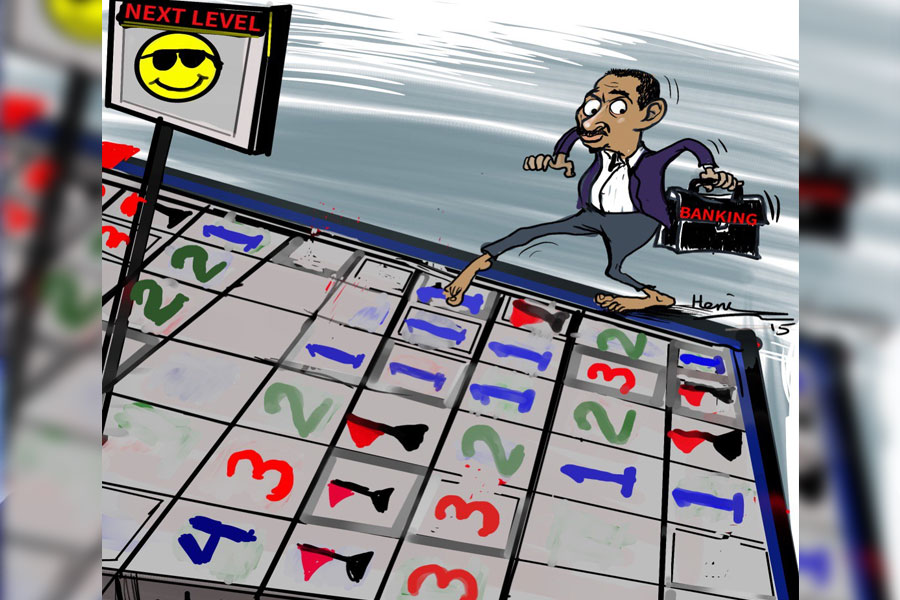

Spurred by the housing deficiency, specialised banks are popping up to offer mortgage deals. Unfortunately, they have rested their promises on unrealistic assumptions, writes, Abdulmenan Mohammed (abham2010@yahoo.co.uk), a financial statement analyst with two decades of experience.

In recent years, private mortgage banks are knocking on the doors of the Ethiopian banking industry, which has been known for commercial, industrial and agricultural lending for more than two decades. This has instilled hopes in helping address the housing problem, which has remained a serious concern. The availability of mortgage loans encourages investment in housing, which contributes to the national economy. Yet, caveats should be added to the hopes and enthusiasm of the promoters of the new banks.

Mortgage banking is not new to Ethiopia. During the socialist regime, the defunct Construction & Business Bank, reformed into a commercial bank in the 1990s, operated as a mortgage provider. In the past decade, many commercial banks, both the state and private, began providing housing loans, mainly targeting the diaspora, to increase their foreign currencies intakes.

What is different with the newcomers is that they are full-fledged mortgage banks.

Apart from this, they rested their promises on unrealistic assumptions like many of the initial public offerings in the past. The ideological assumptions of the mortgage banks include the planned amount of paid-up capital, the structure and source of funding, the size of the loans and the lending interest rates. For instance, Selam Bank, which is under formation, is based on a plan to raise a capital of two billion Birr, start operations in five months and lend up to 200 billion Br within five years. Borrowers must pay a deposit as low as 15pc of the house price over three decades, pay an interest rate a little over the inflation rate, and maybe even mobilise funds from NGOs and government bodies.

These projections are unrealistic. Over the past decade, newcomers to the banking industry have taken at least a decade to reach a loan portfolio of 10 billion Br. Over its quarter-century of existence, the outstanding credit and deposits of Awash Bank reached 56.3 billion Br and 70.6 billion Br as of June 30, 2020, respectively. Goh Bank, established by banking gurus, has taken two years to raise a capital of a little over half a billion Birr.

How on earth would a new mortgage bank lend up 200 billion Br within five years, raise capital of two billion Birr and start operations in five months?

Keeping aside the fanciful projections, several issues pertaining to mortgage banking should be dealt with in caution. Mortgage banking requires a functional housing market, for both residential and investment properties. Availability and affordability defines a thriving property market. The Ethiopian property market is dysfunctional. Severe housing deficits characterise the market, it is fraught with documentation problems, the houses are overpriced, and brokers highly influence deals. Such a situation has made housing transaction a cumbersome and lengthy process.

The housing deficit lies at the heart of the land policy. As land is publicly owned, the availability and affordability of houses are hugely determined by it. Unless the land policy is relaxed and private investment is encouraged, the housing deficits will undoubtedly persist, resulting in higher house prices. When this is combined with an inflationary environment, the interest for selling a property is very low and prices constantly change. This makes less property available for sale and sealing a deal difficult. The personal experiences of many people I know prove this fact.

Mortgage lending is specialised in nature in that long-term loans are given to the housing industry where risk is concentrated; apart from the security, it relies on the borrower's credit history where such records are not available in Ethiopia; and should be funded by long-term means. The new mortgage banks are planning to mobilise funding through deposit collection using a limited number of branches to finance their operation. This strategy has serious flaws. Primarily, deposits are not suitable for funding mortgages as they can be withdrawn at the customers’ whim. Secondly, it is tough to mobilise adequate funding using a limited number of branches. The main strategy of all commercial banks for mobilising deposits is the aggressive expansion of branches.

In an unstable macroeconomic environment, providing a mortgage loan, which lasts as long as 30 years at a fixed interest rate, entails significant risk. Once the lending rate is set, the bank is left at the mercy of the market for the interest rates it will pay to mobilise resources. And recent surges in the treasury bills interest rates indicate that saving rates will likely rise, increasing the risk of fixed interest rates for long-term lending.

In Ethiopia, most houses have been supplied by the government at a highly subsidised interest rate, less than half of the market, as part of a social policy. When it comes to mortgage borrowing, highly inflated house prices force borrowers to take out a massive loan at high mortgage interest rates, forcing borrowers to encumber a significant portion of their monthly income to pay the principal and interest. In a highly inflationary environment (mainly food price inflation) with stagnating wages, an increasing amount of the potential borrowers’ income will go to household expenses, squeezing the balance left for the mortgage payment, which will increase the risk of non-repayment. This may entail a bigger threat to the banking industry.

In several countries, mortgage lending was dominated by building societies until the financial sector deregulation of the 1980s, which ushered in a new era of universal banking. The Ethiopian banking industry has evolved mainly as a provider of commercial banking services, and the regulatory rules have been predominantly developed to suit these kinds of banking services. Full-fledged mortgage banking poses its own regulatory challenges regarding capital adequacy, provision for doubtful loans, financing structure and foreclosure. Therefore, the central bank needs to set out rules which are suitable for housing loans.

One main thing that induced the mortgage lenders is the huge housing deficit, mainly in the capital. This is not a sufficient condition to launch such banks by itself. The new mortgage banks should consider setting out commercial banking as their major operations and try sailing the uncharted waters of mortgage lending alongside, putting adequate risk management tools in place.

PUBLISHED ON

Jun 12,2021 [ VOL

22 , NO

1102]

Fortune News | Jul 13,2024

Radar | May 28,2022

Editorial | May 27,2023

Radar | Jun 12,2021

Obituary | Oct 20,2024

My Opinion | 131974 Views | Aug 14,2021

My Opinion | 128363 Views | Aug 21,2021

My Opinion | 126301 Views | Sep 10,2021

My Opinion | 123917 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...