Editorial | Mar 11,2023

Feb 9 , 2019

By MESFIN ZEGEYE ( FORTUNE STAFF WRITER )

By FORTUNE STAFF WRITER

Ethiopia reoriented its financing agreements from bilateral sources to multilateral institutions in the first half of this fiscal year, according to data released by the Ministry of Finance.

Disbursement from multilateral institutions stood at 40.6 billion Br, more than double the amount in the previous fiscal year, and 17 billion Br was disbursed by bilateral partners, which saw a 42pc drop from the same period a year ago.

From both sources, 57.6 billion Br of foreign currency was injected into the economy for projects and programmes, a figure that is higher than the previous fiscal year by 14pc.

Close to half of the disbursements were in the form of concessional loans that bear low interest rates and long repayment periods. The rest, 31.4 billion Br, came from multilateral institutions, which disbursed 61pc of the total.

“Concessional loans charge very low interest rates, typically 75 cents for every 100 Br, and are offered by many international lending financial institutions,” Haji Ibsa, public relations and information director at the Finance Ministry, said.

The period also saw Ethiopia signing 85.6 billion Br in financing agreements from external sources, almost two-thirds of which were from multilateral partners. A third of the funding, which will be disbursed in three to 10 years, was in the form of loans.

“It has more to do with politics than economics, because it shows how much the finances the country receives from multilateral institutions has increased, and the government is trying to show that they are getting international support,” said a macroeconomist who preferred to stay anonymous.

“The funding the World Bank provided is what raised the share of the financing portfolio from multilateral institutions.”

Just last October, the World Bank approved 1.35 billion dollars in development financing to Ethiopia, 89pc of which came in the form of loans. The Bank’s commitment to the country also tripled last year to 3.2 billion dollars compared to 2017.

“Receiving loans without building the capacity to pay it back is dangerous,” warned the macroeconomist, although he added that when adjusted for inflation, the increment this year cancels out. “The country's revenue from exports is decreasing, and we are still in the high-risk zone regarding our debt.”

Ethiopia’s external debt stood at almost a third of gross domestic product (GDP) in the past fiscal year, compared to 18pc six years before. With public debt, including domestic, standing at 61pc of GDP, the International Monetary Fund stresses that while liquidity risks are elevated, the public debt remains sustainable.

PUBLISHED ON

Feb 09,2019 [ VOL

19 , NO

980]

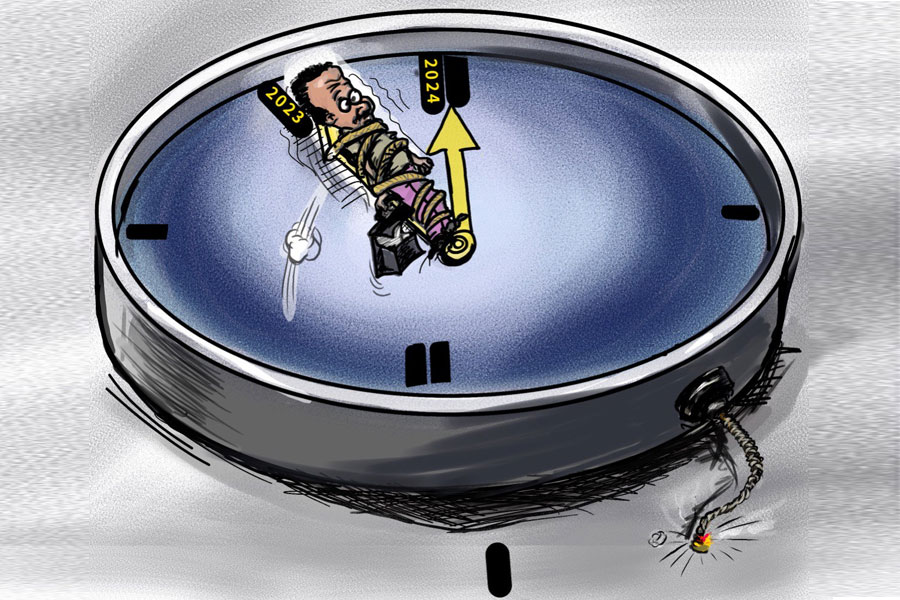

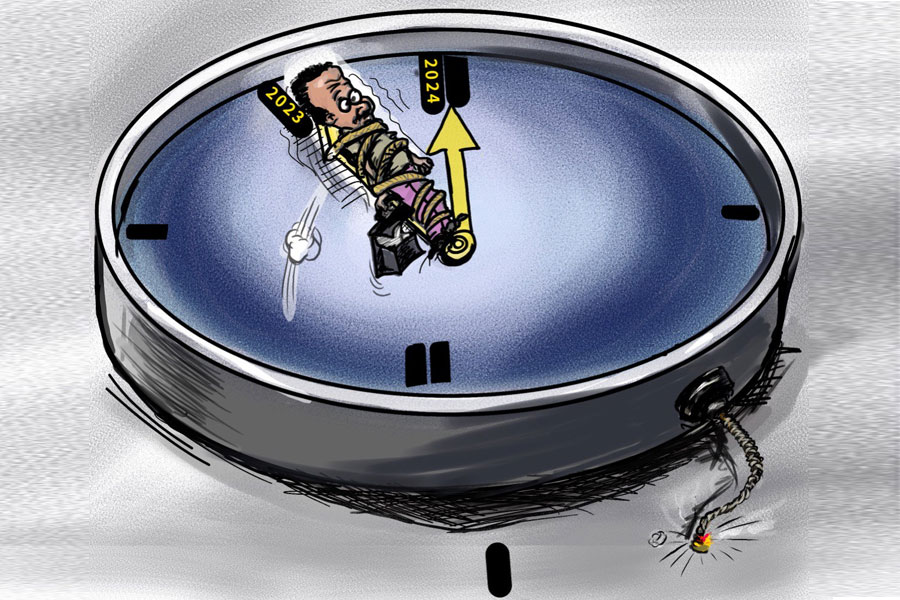

Editorial | Mar 11,2023

Commentaries | Oct 02,2021

Viewpoints | Apr 02,2022

Sponsored Contents | Oct 25,2021

Fortune News | Apr 04,2020

View From Arada | Dec 26,2020

Fortune News | May 11,2019

Fortune News | Mar 30,2024

Radar | Apr 30,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...