Radar | Sep 10,2022

Mar 20 , 2021

By Christian Tesfaye

It is no secret. Consumers are devastated. The rise in the cost of living has pushed the goalpost further; many have been pulled below the poverty line. The unabated rise in the price of goods and services has understandably frustrated people. The lucky ones worry about how long they would have to delay plans to build a family, move to a better location or start or expand a business. The less fortunate worry whether the next paycheck would be enough to put food on the table for the next month.

Policies that result in increasing the cost of living – such as depreciating the Birr or cutting subsidies from basic commodities such as fuel – can seem inhumane. In my conversations with people, few things make them as emotional as the suggestion that, indeed, the Birr is still overvalued and that electricity and fuel subsidies are too high to be sustainable in the long term. I do not blame them, especially if they have a fixed income.

The whole idea that the public should endure short-term pain for the promise of sustainable economic development in the long term is hard to swallow for many. It is an issue complicated further by mistrust between the public and the authorities. But with a government that has discipline in its spending and borrowing habits, liberalisation is indeed the appropriate and long overdue booster to what is an otherwise ailing economy.

Let us present a simple illustration with shoes. About a year ago, men’s leather shoes from a modest shop in downtown Bole would cost somewhere around 3,000 Br. Almost all of them carry shoes made in Italy, Pakistan or Turkey. Today, their prices hover around 4,000 Br as a result of the depreciation of the Birr. Dollars are exchanged for Birr somewhere along the supply chain, probably by someone who travels to Dubai or, increasingly, Turkey.

This is a waste of national resources in more ways than foreign currency being moved out of the country. It is not news that Ethiopia has the highest livestock population in all of Africa. This means that the raw material - animal hides - is already present in abundance for a thriving leather and garment industry. Some 20 million livestock are slaughtered annually in Ethiopia, although only a fraction of the hides meet quality requirements to add value to the industry. Nonetheless, the resource is there for the taking.

The other ingredient is the human capital with the desire, innovative spirit and know-how to tap into this resource. This is present as well, even if the incentives are few and far apart. Take the modest bazaars and fairs that pop up around town, such as a recent one at the Addis Abeba Golf Club in the Lideta District. Artisans showcase Ethiopian-made handcrafted leather products that are, on average, much cheaper. A pair of leather shoes, for instance, could be found for a price that is half of what an imported pair would cost.

No doubt, these are not Italian shoes. But neither are they cheap products that are offensive to the eye and get worn down weeks after being bought. Many of these leather products are well-designed, comfortable and produced with care. They are indeed a good bang for one’s buck.

But this thriving industry, more than tax cuts and a smooth value chain, requires demand to grow. It cannot as long as consumers spend money on products produced overseas by multi-million dollar companies that do not need our business. The local ones do. Much of their consumer base are the few expats eager to take something "exotic" back home, but the more demand they have from locals, the more they could grow their business.

It means more jobs and value addition, fewer imports and better profits for these businesses to attract a skilled workforce and innovate further. In time, Made in Ethiopia could sound as fashionable as Made in Italy when it comes to leather products. Adjusting the value of the Birr is an essential ingredient in this. It could translate into a rise in the cost of living. But if it is measured – without having to resort to instruments of shock therapy – and integrated with greater discipline in spending and borrowing by the government, it is the right instrument to shake the country out of its current economic lethargy.

PUBLISHED ON

Mar 20,2021 [ VOL

21 , NO

1090]

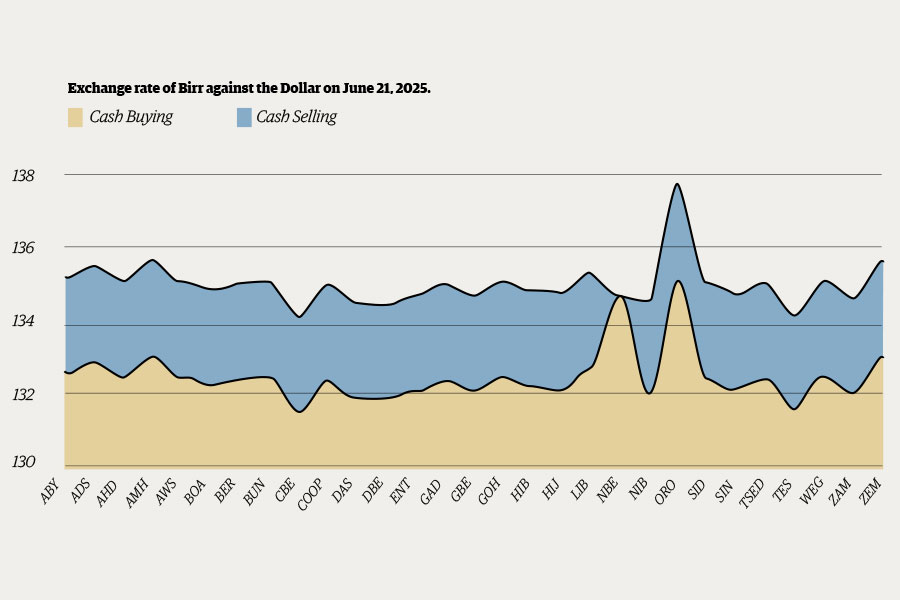

Money Market Watch | Jun 21,2025

Fortune News | Aug 08,2020

Agenda | Oct 12,2019

Radar | Apr 04,2020

Radar | May 28,2022

My Opinion | 131819 Views | Aug 14,2021

My Opinion | 128203 Views | Aug 21,2021

My Opinion | 126147 Views | Sep 10,2021

My Opinion | 123767 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...