Oct 16 , 2021

By SAMUEL BOGALE ( FORTUNE STAFF WRITER

)

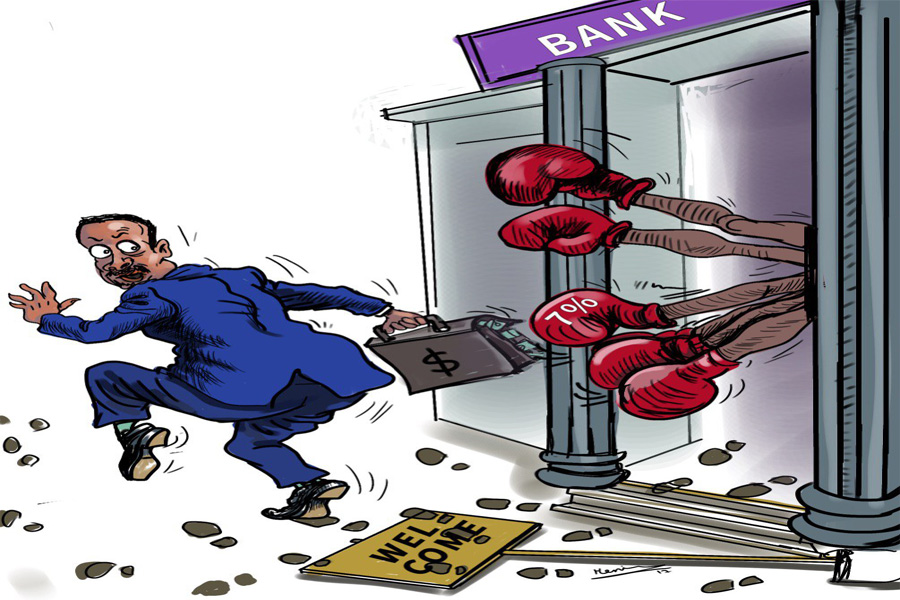

Employees of banks and borrowers who buy assets under foreclosure cannot process applications for mortgage loans, despite a notice issued by the central bank earlier this month relaxing the freeze on asset-based loans.

The central bank has exempted some from the freeze on collateral-based loans it imposed last August, including allowing employees of banks, international organisations and businesses with high forex income to take out mortgage loans.

The National Bank of Ethiopia (NBE) imposed a freeze on loans to control what government officials call "economic sabotage," hoping to halt capital flight. The central bank has amended its decision since, allowing asset-based loans to importers borrowing to settle letters of credit and edible oil producers.

Businesses in the coffee value chain were also exempted, while the restriction has been lifted for bank clients acquiring foreclosed properties. Employees have rushed to file mortgage loans ever since but were disappointed to learn that the exemption only applies to loan applications that had already been filed before the freeze.

The loans banks provide to their staff comprise three percent of the total loan they advance for mortgages.. The private banks advanced 271 billion Br loans last year.

A staff member at Nile Insurance, who requested anonymity, was among those who were let down last week. He made his way to Debub Global Bank to apply for a loan, hoping to buy a house but was promptly told he was ineligible.

"The restriction doesn't make sense," he said. "Housing loans like this only benefit employees."

A senior director at the central bank confirmed that his office has instructed the banks to turn down any new applications for housing loans. They are allowed to provide a full range of loan services to the exporters of sesame, buyers of foreclosed properties, and emergency loans to bank staff.

“It's only applications under review banks are told to process," the director told Fortune.

Dereje Zenebe, president of Zemen Bank, confirmed that his firm received the communication from the central bank on the loosening of the loan freeze. The emergency loans for bank staff are for salary advances than they are other loan categories. He did confirm that Zemen is processing housing loans.

“We're disbursing loans for those who applied before the freeze,” said Dereje.

Businesses in the coffee industry had also been complaining. They have been unable to process loans needed for working capital. However, exporters are taking loans, according to Asfaw Alemu, president of Dashen Bank.

“All sectors that have been exempted are using the window,” he said.

Dashen Bank is processing applications for mortgage loans submitted prior to the freeze.

For Dawit Tadesse, a managing partner of Lead Plus Consultancy, the freeze applying to new loan applications makes no sense in a country with a housing shortage and lack of access to mortgage financing.

“The value of properties is rising by the day, which will further increase the cost of borrowing when the central bank lifts the restriction,” Dawit remarked.

PUBLISHED ON

Oct 16,2021 [ VOL

22 , NO

1120]

Radar | Apr 17,2020

Fortune News | Feb 13,2021

News Analysis | Apr 19,2025

Radar | Dec 12,2023

Radar | Apr 27,2025

Radar | Oct 30,2021

Radar | Jun 25,2022

Agenda | Dec 04,2021

Editorial | Dec 14,2024

Commentaries | Jun 12,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...