Agenda | Mar 20,2021

Dec 9 , 2023

By MUNIR SHEMSU ( FORTUNE STAFF WRITER )

Ethiopia's manufacturing sector remains in a tangled web of macroeconomic pressures, security challenges and exogenous shocks. The trifecta highlighted through the latest study by the United Nations Development Program (UNDP) reveals that 450 factories have ceased production in the last year. As a result, the share of the manufacturing sector in GDP saw a 1.5pc decline.

Poor policy frameworks, tedious bureaucracy, underfinancing, unskilled labour force and shaky macroeconomic grounds have plagued the nascent sector, largely limited to light industries which contribute 4.2pc of GDP.

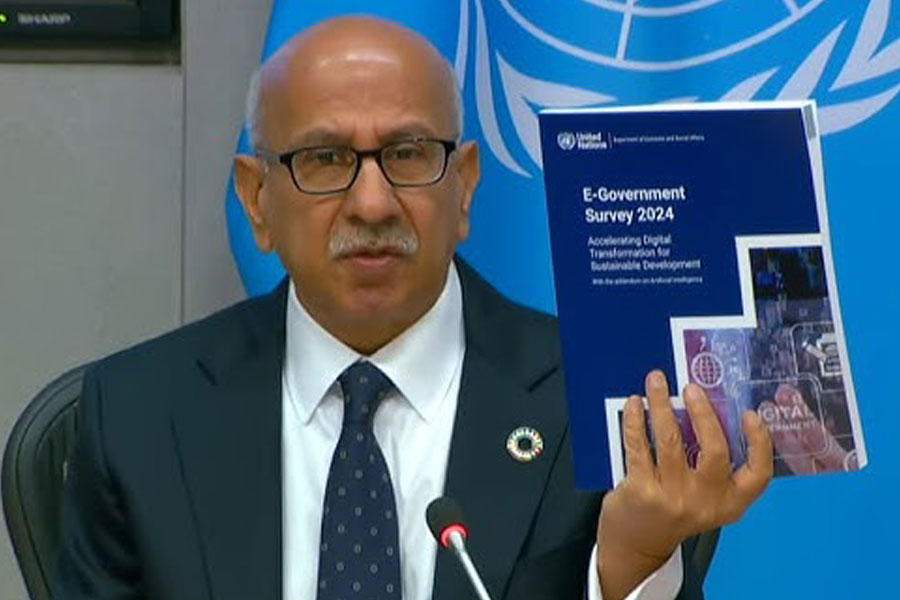

Aiming to jumpstart the sector’s capacity, a 70-page working paper was unveiled at the Hyatt Regency Hotel last week. With the moniker "Can Ethiopia Become a Manufacturing Powerhouse", it crosscuts through the dynamic interplay of challenges and opportunities the country is confronted with in the world economy, which is recovering from a series of shocks.

After outlining challenges plagued by the onslaught of war and pandemics, one of the primary contributors Ali Zaffar, an economist at the UNDP pointed to the absence of peace and stability as the biggest deterrent to manufacturing and development success in Ethiopia.

With decades of experience in advising emerging economies, Ali recognises vast potential in Ethiopia to the point of reaching 10 billion dollars worth of export volume by 2030.

But, only if the critical constraints are unwinded.

At the forefront was the logistics policy. Ethiopia spends around 1.5 billion dollars annually, nearly half of its earnings from export of goods on port fees. Despite the global significance of proximity to international maritime trade corridors, the conspicuous absence of diversification and monopolisation of multimodal operations by a single state-owned enterprise was puzzling to the economist.

To further strengthen his argument that Djibouti ports are very expensive, Ali recalled a comical anecdotal experience of Chinese manufacturers who claimed lesser costs in sending goods from Shanghai to California, than through the logistics channels of Ethiopia.

"It's costly, slow and dominated by a state monopoly," he told Fortune.

Drawing international experiences from Vietnam and Bangladesh on private investment and strategic partnerships of Switzerland and Cambodia, a variety of modalities were proposed.

Upscaling infrastructure of existing corridors beginning with Mojo Dry Port was deemed critical. Reflecting on the experiences of Vietnam and Bangladesh, the infusion of private investments into the logistics sector was suggested while a strategy that entails economic agreements with neighbouring countries for access to ports much like Switzerland and Cambodia was indicated as the top priority. Ethiopia has a long way to go before it becomes competitive like Bangladesh. The Asian Tiger exports above 40 billion dollars annually with 83pc textile products. Rival manufacturing behemoth like Vietnam with more than 220 billion dollars worth of annual exports bolstered by a vibrant electronic manufacturing industry.

Ali pointed to profit-sharing arrangements, concessions and special deals as a few of the possibilities Ethiopia can explore in developing a comprehensive port strategy which is economic at the core.

"You can benchmark the competitiveness of ports," he said, pointing to potentials in Kenya and Somalia.

The importance of serious studies to evaluate empirical data on port potential, which could ultimately be the basis for reducing the cost of exports and improving the price competitiveness of goods, was stressed. Cognizant of tight monetary policy to fight inflation and the necessary capital expenditure to augment the capacities of the logistics infrastructure, potentials in foreign direct investment through valuable propositions to investors and concessional loans after Ethiopia resolves its debt problem was suggested.

Loose monetary policy, supply chain bottlenecks and elevated international prices in fertiliser and fuel are painted as the three forces behind galloping inflation rates. Meanwhile, overvaluation of currency subsidises importers who pass on the costs to consumers in the market.

"Overvalued Birr has an inflationary impact," Ali told Fortune.

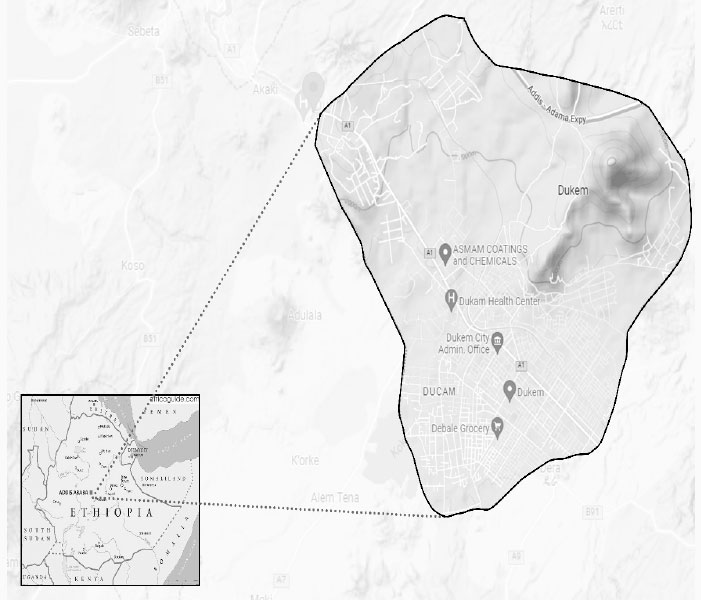

Ethiopia's industrial parks, a machination imported from Asia by the late Prime Minister Meles Zenawi, have managed to attract 740 million dollars in FDI over their 13-year. However, the recent struggle to adjust to the country’s suspension from the African Growth Opportunity Act (AGOA) has painted a grim picture on their fate. Close to 10 of the 5,000 manufacturing companies ceased production while the rest function at a third of their capacity.

Access to finance and forex remained at the forefront of manufacturers’ woes.

One of the selected panelists at the event was the major shareholder of Anegaen Manufacturing Plc, Tsegaye Habte, a returnee after three decades abroad. The Company was born out of his shock at learning of indoor pollution levels in the country upon a visit in 2011.

"This is money," he said, pointing to waste from an espresso machine.

After taking out a loan on his home of 600,000 dollars, he established clean stoves that rely on biomass gasification, in Bole Lemi Industrial Park four years ago. Sitting on 800sqm and an installed capacity to produce 200 pellet stoves daily, the company functions at nearly a quarter of its full production capacity.

"We still haven’t hit break even," he told Fortune.

Tsegaye bemoans a nexus of issues that assail the manufacturing sector. Challenges of access to finance, dearth of microcredit to consumers for healthier cooking options and breadth of bureaucratic challenges that hamper the growth of Ethiopia's manufacturing sector were central to his presentation.

He pleaded with international donors who try to address national problems at once with contingencies of gender and climate when funding to begin small and realise butterfly effects.

Amongst eight other constraints, the study reflected an unstable policy environment and a rather peculiar presence of domestic fragmented markets. Discrimination of investors and internal barriers to the movement of both capital and labour with “the rise of ethnic-branded banking,” were presented as testaments.

One of the contributors to the study, Haile Kibret, a senior economist at the UNDP, stresses the need to galvanise manufacturing industries to diversify the export sector of Ethiopia that relies heavily on agriculture and increase the limited forex earnings of the country.

"Ethiopia's demand for foreign currency vastly overshadows its earnings," he told Fortune.

Haile points out that the unproductivity of the manufacturing sector partly fuels the high demand for imports facilitated through a parallel exchange rate mechanism with significant variation to official rates. He explained that the underperformance of the industry parks in recent years is partly due to the high sensitivity of foreign capital to political shocks, which local producers could potentially manage.

"Enhancing local firms in manufacturing is critical," he noted

The economist points to the centrality of follow-up to realise the successful implementation of policy amidst a battle to tackle inflation. While Haile recognises the panoply of issues that add fuel to the fire, he also points to the role played by a strange market system.

"It's not a political statement to say intermediaries cause inflation in the country," he told Fortune.

Although import substitution and Ethiopia Tamrit type of initiatives are lauded as promising by officials such as State Minister for Industry Tarekegn Bululta, who spoke during the session, limited product diversification, lack of export complexity and a policy framework that favours import will remain challenges waiting to be addressed.

PUBLISHED ON

Dec 09,2023 [ VOL

24 , NO

1232]

Agenda | Mar 20,2021

Commentaries | Aug 03,2024

Fortune News | Jun 14,2020

Radar | Jun 11,2022

Fortune News | Oct 30,2022

Viewpoints | Mar 13,2021

Fortune News | Sep 28,2024

Radar | Mar 25,2023

Commentaries | Sep 10,2021

Radar | Oct 20,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...