Editorial | May 25,2019

Mar 13 , 2021

By Austine Sequeira

Following the adverse global economic recession induced by the COVID-19 pandemic last year, the world is eager to see an economic recovery. The much anticipated V-shaped recovery is highly sought after, but if reports by the World Bank are any suggestion, it will not probably happen this year.

In economic parlance, a V-shaped recovery is the economic growth statistics charted in a “V” shape - signifying the sharp decline of growth and subsequent sharp recovery. The world has witnessed such recoveries in the aftermath of the US economic depression of 1920-21 and 1953.

Is there hope for a V-shaped recovery now?

The world today is building up an arsenal of Covid-19 vaccines. Vaccine inoculation is happening in big economies. These developments, although muted, have brought a ray of hope for a better tomorrow. Three economies have been officially declared to approach the end of the recession by several economic publications: China, India and Bangladesh. It is too early to predict whether these economies are exhibiting V-shaped recoveries. Nevertheless, they have reversed the downturn of 2020 caused by Covid-19 and have started clocking in growth from the first quarter of 2021.

Interesting to note here is that enhanced spending on infrastructure building by the public sector at the cost of public debt and a greater role for the private sector-driven service sector through incentives has been key to revival in normal times. Surprisingly, negating this prophecy, the economies that are exhibiting sharp recoveries, such as China, India and Bangladesh, are currently being supported by the revival of the manufacturing sector.

Globally, Covid-19 restrictions on travel and transportation of goods and services are yet to be withdrawn. Therefore, international trade is taking some more time to resume at pre-Covid-19 levels. This has created great opportunities for local manufacturing sectors to ramp up production and replace imports with homegrown products and serve cross-border opportunities.

How can the most be extracted out of manufacturing?

Although the world is moving toward automation, the manufacturing sector will continue to generate jobs, consume resources and add value. Both the Indian and Chinese economies have shown resilience to downturns with support from the manufacturing sector. Their manufacturing sector has balanced their foreign trade, enabled lower supply-side inflation, and inflated their current account surplus.

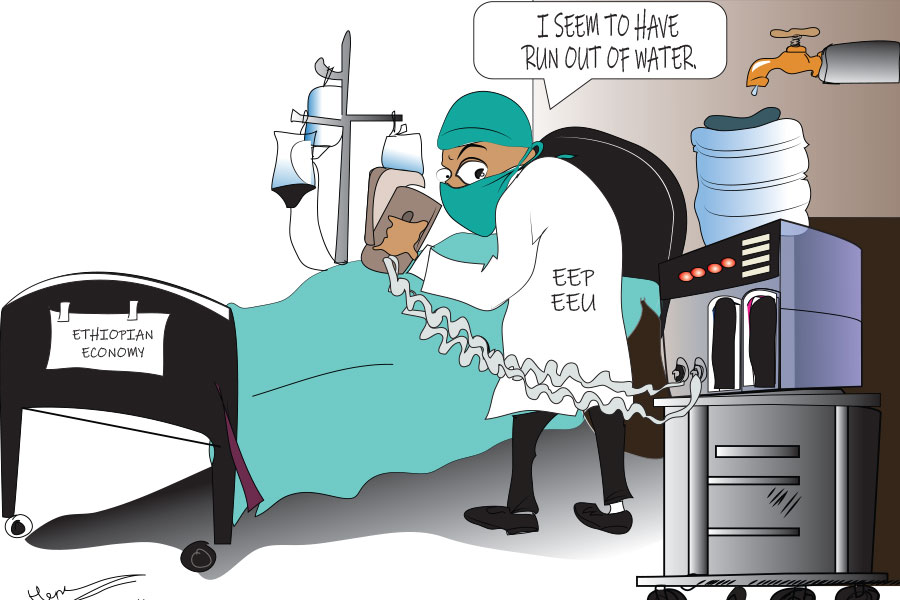

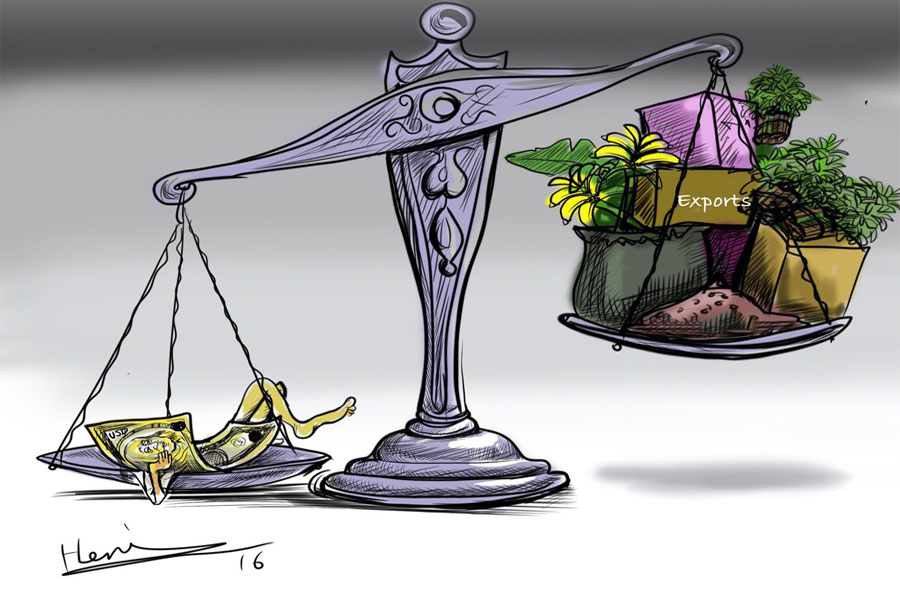

Unfortunately, large African economies, including Ethiopia, are yet to address the issue of supply-side inflation by promoting local manufacturing through incentives and tax breaks. Africa generally suffers from low income and saving rates, which adversely hits capital formation and investment. The solution is not higher taxes, export of natural resources and agro-products but production-linked incentives and value-added exports.

We have not seen a single, successful export-oriented unit or special economic zone in the African continent during the past five years. Unlike India, China and other ASEAN States, African leaders do not talk about “self-sufficiency”. This buzzword has the power to build a vibrant small and medium enterprise (SME) sector locally.

A key to the growth of a manufacturing sector, and particularly the SME sector, is a vibrant financial services sector. Large manufacturing projects need voluminous, continuous funding, while the SME sector needs low-cost working capital. The government of the day must play an important role of “an enabler” by controlling interest rates and formulating production-linked incentive schemes so that the banking sector extends soft credit to the industry. Free movement of non-monetary resources is another subject the administrators must tackle to unshackle the manufacturing sector.

There was a time when the SME sector grew on informal financial means and was prone to tax leakages. Financial intermediation, digitation and tax reforms can help reform SME compliance. This sector today can attract large credit inflows from banking sectors and start up investment from prestigious international funds in emerging economies such as China and India.

Let us hope the African economists and leaders alike note the global post-COVID-19 developments and initiate far-reaching changes for sustainable growth.

PUBLISHED ON

Mar 13,2021 [ VOL

21 , NO

1089]

Editorial | May 25,2019

Covid-19 | Mar 28,2020

Commentaries | Aug 29,2020

My Opinion | Apr 22,2022

Viewpoints | Mar 27,2021

Fortune News | Apr 03,2021

Fortune News | Jul 17,2022

Viewpoints | Sep 06,2020

Viewpoints | Apr 30,2021

Radar | Dec 16,2023

Photo Gallery | 96139 Views | May 06,2019

Photo Gallery | 88400 Views | Apr 26,2019

My Opinion | 66994 Views | Aug 14,2021

Commentaries | 65716 Views | Oct 02,2021

My Opinion | Apr 13,2024

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

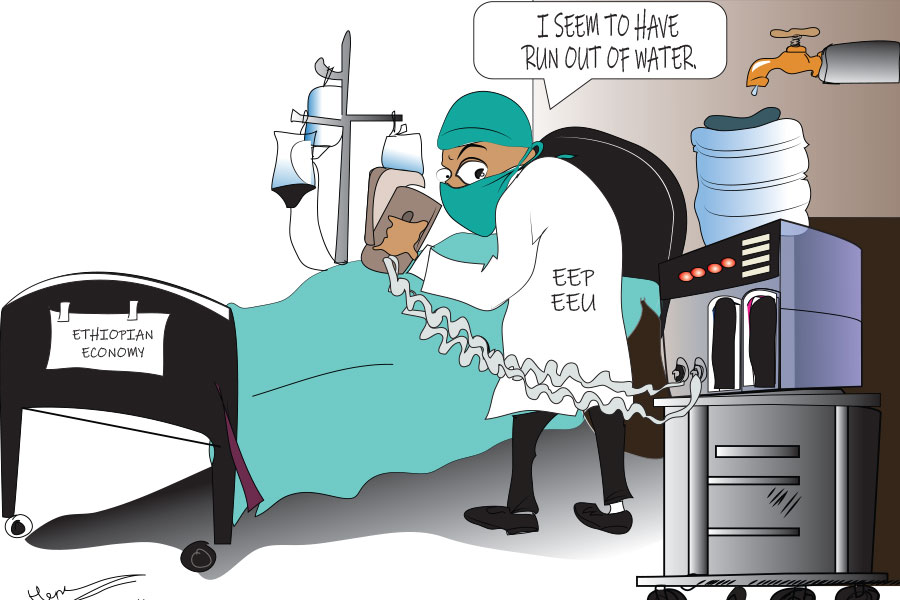

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

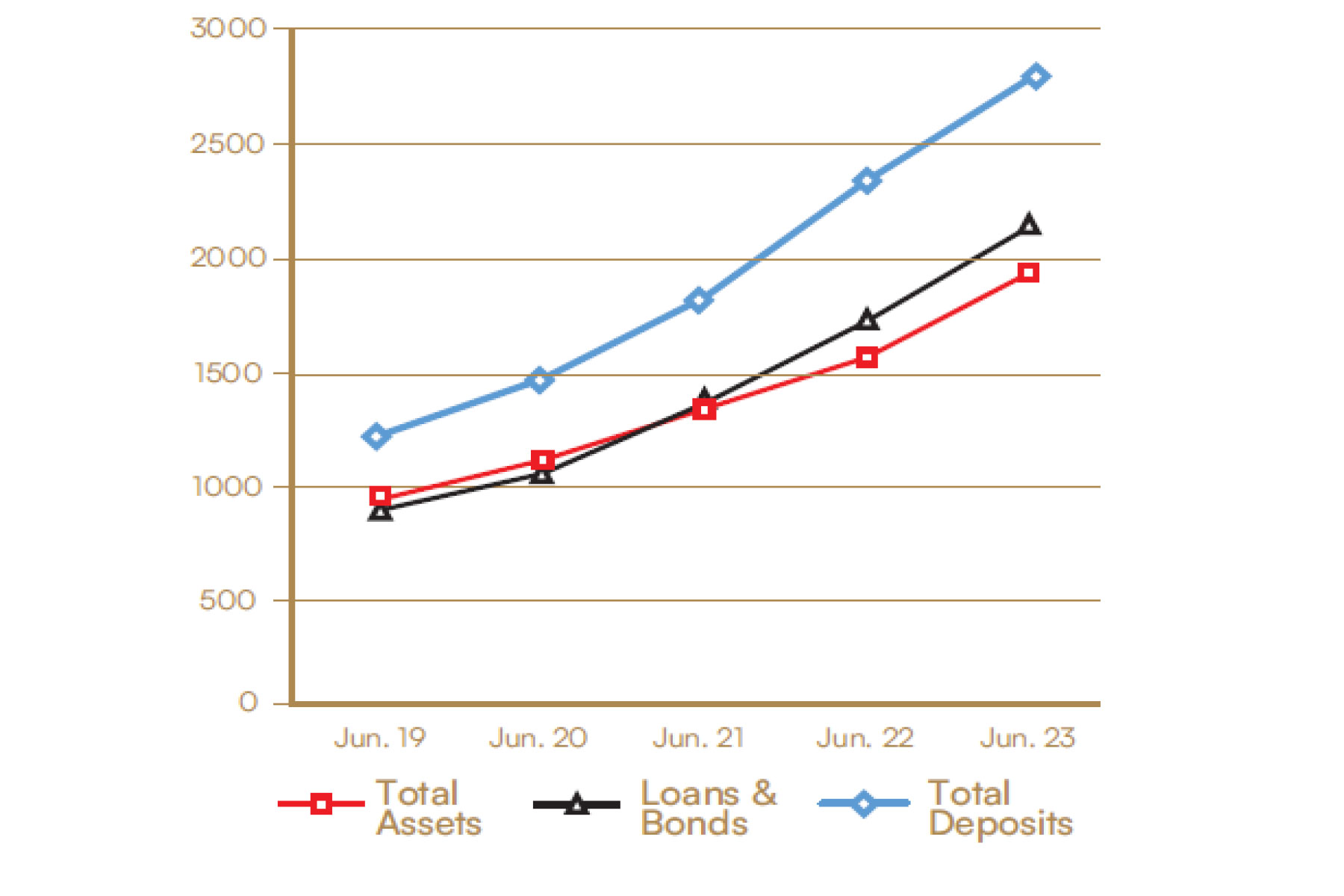

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...

Mar 23 , 2024

Addis Abeba has been experiencing rapid expansion over the past two decades. While se...

Apr 13 , 2024

A severe financial stranglehold has been imposed on the banking industry, underminin...

Apr 13 , 2024 . By MUNIR SHEMSU

In an unprecedented move, the central bank has published its inaugural stress test report, uncovering potential fault lines within the finan...

Apr 13 , 2024 . By MUNIR SHEMSU

In a bold departure from its historical position on foreign investment, the federal government has opened...

Apr 13 , 2024 . By AKSAH ITALO

A proposed excise tax stamp system draws controversy amongst industry leaders in the alcohol, tobacco, be...