Radar | Aug 21,2021

African Reinsurance Corporation (Africa Re.), the premier continental reinsurance firm, has warned its client firms in Ethiopia to apply precautionary measures when selling a political violence and terrorism policy.

This comes as demand for the policy coverage exhibits tremendous growth, with businesses starting to avoid potential losses due to conflicts. Alarmed by the ongoing political instability and recurrent conflicts across Ethiopia, Chaucer Group, an international speciality insurance and reinsurance company, has increased the risk rating for civil unrest to 3.7, up from three.

The civil war in Tigray Regional State, which involves Eritrean troops and the plodding killings of civilians across the country from intercommunal conflicts and insurgencies, has contributed to the increase in the risk level.

Out of 11 billion premiums the 18 insurance firms had written by the third quarter of the current fiscal year, political violence and terrorism insurance policies, also known as PVT, account for below three percent of their portfolio. However, claims they pay on these policies are likely to be much higher than for other policies, considering the large volume of assets the products cover. The policies give coverage to clients against losses due to riots, strikes, protests, and unexpected outcomes driven by political volatilities.

"We've alerted them to make risk management practice more stringent and avoid the accumulation of risk," said Habtamu Debela, country director for Africa Re. "The combined risks that could be involved in a single loss event, due to an increase in exposure to political violence, can be higher. We haven't, however, adjusted premium as we have not seen an accumulation of risk thus far."

Political uncertainty is already high, and it is difficult to know when and where violence could happen, which make both insurers and reinsurers exposed to a large number of claims, risking their financial statements, according to Ebsa Mohammed, an insurance expert and manager of Alpha Consultancy.

Deadly and destructive protests in the Amhara and Oromia regional states led to the loss of more than five billion Birr worth of properties during the two years before the ascent of Prime Minister Abiy Ahmed (PhD) in 2018, according to an individual who has seen an assessment report. Many of these losses were not covered with PVT, imploring businesses to scramble in buying new policies to cover potential losses.

"Such amount of loss would have been catastrophic to insurance firms if they were covered," said Habtamu. "With an increase in political risks, it would be appropriate to avoid risky businesses."

Globally, political violence resulted in a significant increase in insurance claims last year. In the US alone, the protests after the death of George Floyd cost the insurance industry between one billion and two billion dollars in claims, according to Axios, an advisory firm involved in the insurance sector since 1974. Taking such global experiences into account, experts advise insurance companies in Ethiopia to act together.

"They have to do a risk mapping before it`s too late," said Ebsa.

Nyala and United insurance companies took the pioneering role in introducing political violence and terrorism insurance policies in 2017. Almost all insurance companies provide this policy, with a premium amount between 0.7 Br and four Birr for 1,000 Br in assets. But the final deal depends on the risk involves where the property covered is located.

African Re sets a premium rate for some properties, including houses and vehicles, while it does a case-by-case review if the insured assets involve higher risks, according to Habtamu.

Leaders and executives of the domestic insurance industry have little incertitude over what they face. They have already moved to soothe their risk factor, applying stringent measures in reviewing offerings of a product such as PVT. Awash Insurance, a market leader among private insurers, is among these firms.

"When there is an increase in risk, it means the chance of something unfortunate happening turns from probability to reality," said Gudissa Legesse, CEO of Awash. "With the recurring political violence in the country, it's obvious that the policy should be categorised as a real risk."

Meseret Bezabih, CEO of United Insurance, echoed the same caution over providing political risk and terrorism coverage.

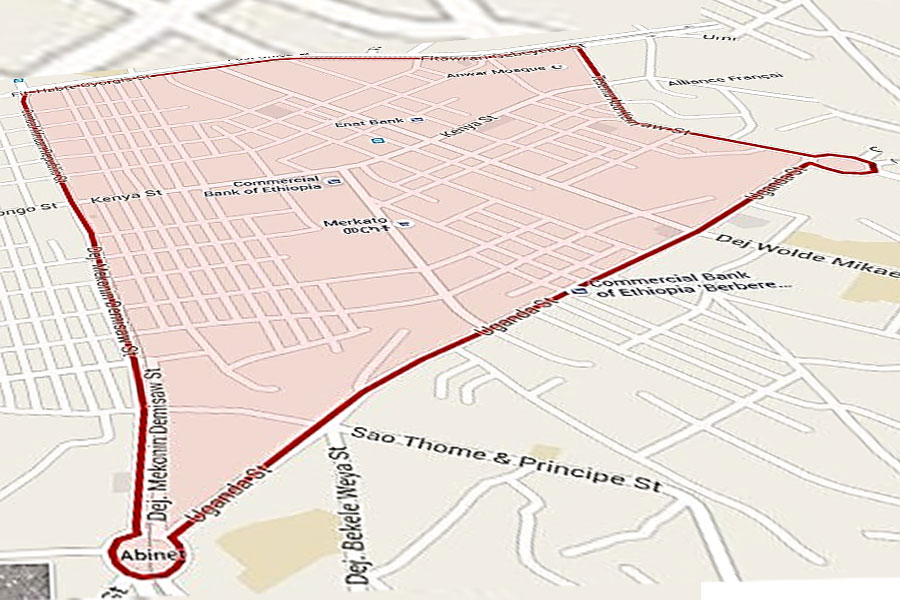

"We've already started turning back properties that involve higher risk," said Meseret. "This includes vehicles and assets located in areas where there has been higher exposure to violence."

PUBLISHED ON

May 29,2021 [ VOL

22 , NO

1100]

Radar | Aug 21,2021

Fortune News | Jan 25,2020

Agenda | Jul 03,2021

Radar | Jun 21,2021

Commentaries | Mar 07,2020

View From Arada | Mar 13,2021

Fortune News | Sep 18,2021

Commentaries | May 23,2021

Agenda | Jan 01,2022

Fortune News | Apr 13,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...