Dec 16 , 2023

By Edris Hussien

The intertwining issues of foreign exchange dynamics, trade practices, and tax collection demonstrate the complexity of the current economic landscape. A comprehensive solution demands addressing both foreign exchange constraints and implementing measures to streamline and fortify the tax collection process. By doing so, Ethiopia can foster economic stability, encourage fair trade practices, and create an environment conducive to sustainable growth, argued Edris Hussien.

Ethiopia's economic landscape is navigating a turbulent period, characterised by a severe foreign exchange (forex) shortage that presents severe hardships to its stability and growth prospects.

At the core of this crisis lies a substantial gap between the official exchange rate and the parallel market rate for the Birr against major currencies like the US Dollar. The official rate exchanged last week was nearly 57 Br for a Dollar, while the parallel market rate hovers around 110 Br. The significant disparity signals the overvaluation of the Birr and poses a substantial 'implicit tax' on exporters, diminishing their competitiveness in the global market.

The consequences of this forex crisis are particularly evident in the coffee industry, a vital sector of the economy. Reports indicate that coffee exporters are defaulting on contracts due to the disparity between international prices for the beans and their corresponding domestic prices. The issue is further exacerbated by Birr's persistent overvaluation, which impacts exports' viability. It is also compounded by the mandatory requirement for exporters to surrender their foreign exchange earnings at the official rate, limiting their ability to leverage more favourable market rates and placing them at a competitive disadvantage in the global market.

The overvalued currency acts as an 'implicit subsidy' for imports. Businesses and importers accessing forex at the official exchange rates gain advantages, exacerbating trade imbalances and weakening the domestic market. This dynamic exposes the complexity of forex challenges and calls for a comprehensive strategy to address the economic implications.

In response to the forex crunch, the National Bank of Ethiopia (NBE) has implemented forex rationing, which presents significant challenges for local manufacturers and importers who rely heavily on imported inputs. The dilemma resonates across diverse industries, impacting tax collection and triggering a chain reaction in the economy. The problem is particularly acute for companies engaged in wholesale trade, which are unable to secure the required foreign exchange through official channels and are compelled to resort to the parallel market.

Importers declare the value of their imports before customs officers based on the amount of foreign currency obtained from the official market. This strategy has economy-wide repercussions, including complications in the tax collection process within the domestic market. Understating the value of imports makes it difficult for customs officers to maintain accurate tax records and monitor trade activities.

International financial institutions advocate for the devaluation of the Birr as a potential remedy to narrow the gap between the official and parallel market rates—however, global experiences, such as Nigeria's, caution that devaluation alone may not suffice. A comprehensive strategy that considers economic realities, external factors, and political stability is essential for success. The short-term result of currency devaluation on domestic prices warrants careful consideration.

The impact on domestic prices, spare crucial government imports like fuel and fertilisers, is likely to be marginal. This is perhaps because the pricing of these goods in the local market is determined by the parallel market exchange rate, rather than the official rates, even if importers source their foreign exchange from the official markets.

There might be a transient response in domestic prices following the enforcement of devaluation measures. The fluctuation could stem from the anticipation that accompanies the central bank's currency devaluation, leading to speculation over the increase in the parallel market rates. As the central bank initiates a devaluation, it sets in motion a ripple effect. The parallel market, operating more fluidly and responsively, tends to mirror these changes more promptly than the official rates. This prompts local businesses to recalibrate their pricing strategies in anticipation of potential shifts in the market dynamics. The short-term price reactions can be attributed to the psychology of market participants.

Currency devaluation creates an environment of uncertainty, prompting both consumers and businesses to adjust their behaviour in response to perceived changes in the economic landscape. Consumers may anticipate an increase in the cost of imported goods, leading to a temporary surge in demand as they seek to secure purchases at existing prices.

Simultaneously, businesses may adjust their pricing models to hedge against potential future increases in import costs, contributing to the observed fluctuations in domestic prices. While the overall impact on local prices may be subdued in the long run, these short-term reactions show the interconnectedness of currency dynamics, market psychology, and pricing strategies within the complex economic ecosystem.

The implication of currency devaluation on public debt, particularly external debt, requires careful review, considering the increased cost of servicing external debt. A pragmatic approach to devaluation is inevitable for economic trajectory. Success depends on addressing political instability, adopting a comprehensive strategy, and drawing valuable lessons from global experiences. Ethiopia stands at a crucial juncture where a well-timed and carefully executed strategy can harness the benefits of devaluation, ensuring sustainable economic growth.

PUBLISHED ON

Dec 16,2023 [ VOL

24 , NO

1233]

Fortune News | Nov 21,2020

Viewpoints | Dec 10,2018

My Opinion | Jun 26,2021

Featured | Jun 22,2019

Viewpoints | Jan 19,2024

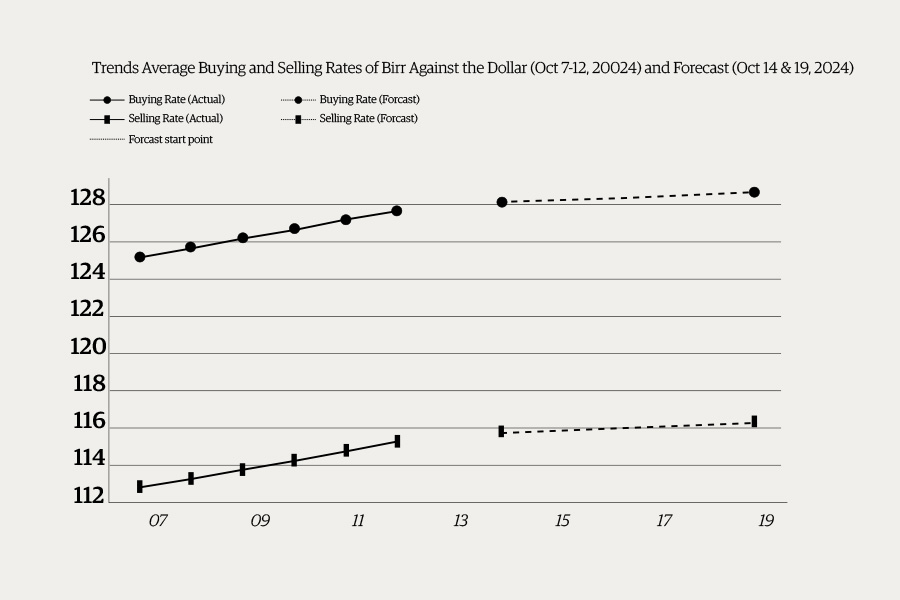

Money Market Watch | Oct 13,2024

Viewpoints | Jun 18,2022

Radar | Aug 06,2022

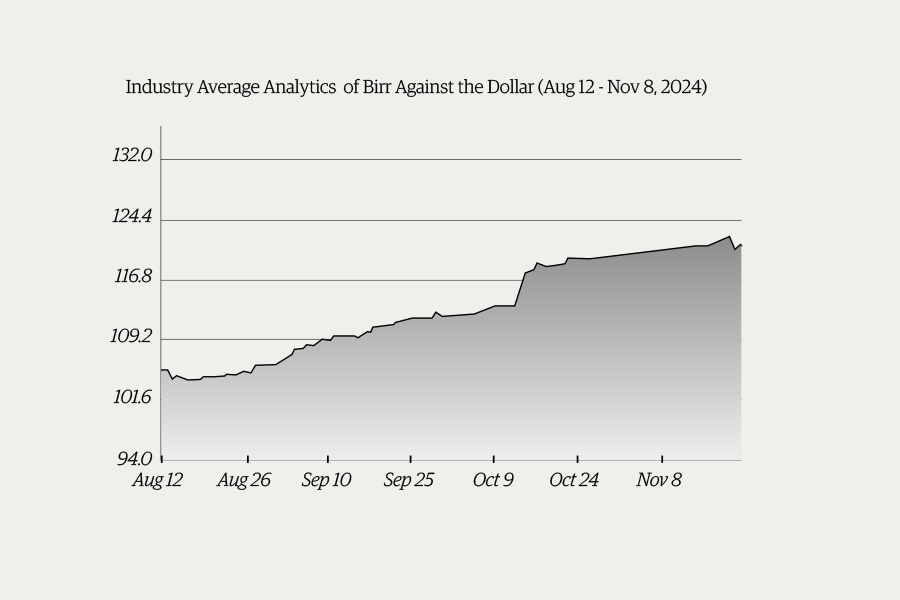

Money Market Watch | Nov 24,2024

Fortune News | Jan 18,2020

Photo Gallery | 174132 Views | May 06,2019

Photo Gallery | 164356 Views | Apr 26,2019

Photo Gallery | 154481 Views | Oct 06,2021

My Opinion | 136632 Views | Aug 14,2021

Editorial | Oct 11,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Oct 12 , 2025

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

Oct 12 , 2025 . By NAHOM AYELE

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...