Advertorials | May 30,2025

Nov 13 , 2021

By Jim O’Neill

With all eyes on the United Nations Climate Change Conference (COP26) in Glasgow this month, there has been ample media coverage of youth protests, high-level diplomacy, and new agreements to reduce methane and protect the world’s forests. But no task is more important than making decarbonisation compatible with efforts to foster economic development in neglected parts of the world. If developing economies – and lower-income people in developed economies – are not brought along, global climate targets will remain out of reach.

Reading recent commentaries on this topic, I have found myself reminiscing about the oil crises of the 1970s, which I studied closely as part of my PhD. Among the most stimulating analyses is a policy brief for the Peterson Institute for International Economics by my good friend Jean Pisani-Ferry, who argues that “Climate policy is macroeconomic policy, and the implications will be significant.” He, too, sees many comparisons – as well as key contrasts – to the 1970s oil shock.

I have written before about my PhD experience when offering predictions of what might happen to crude-oil prices. I reflect often on those lonely, uncertain three years, because while I was fortunate to be able to undertake such a project, I sometimes suspect that mine was not as worthy as others. Not only did I have extremely poor data to work with, but it was also hard to prove anything. Still, in addition to testing my capacity for independent thought, I learned an invaluable lesson: Never trust anyone when it comes to forecasting oil prices.

Consider the research on the 1970s oil crises that was published at the time (most of which I surveyed as part of my studies, and have kept ever since). The consensus then was that the shocks had ushered in a new era of erratic but persistent increases in oil prices. In fact, the exact opposite happened throughout most of the 1980s and 1990s.

The reason for this trend is still not entirely clear. But among the likely explanations are that there was a strong supply response to higher prices in the form of increased investment in oil production and exploration, as well as in alternatives; and a strong demand response, reflected in improvements in energy efficiency. Japanese energy-consumption patterns since the 1970s provide significant evidence to support this hypothesis.

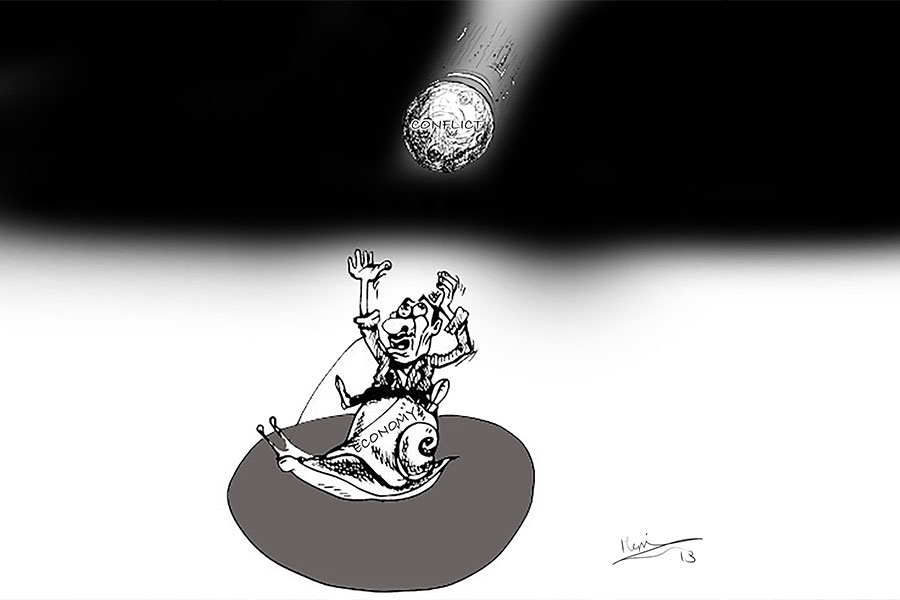

Many of the commentators and policy advisers who are now pushing for a higher carbon tax are hoping to recreate this demand-side scenario without the corresponding movements on the supply side. But as we have seen this year, there is a problem with this approach, because we cannot move from 80pc fossil fuels to 0 overnight. Stronger initiatives to discourage or even penalise fossil-fuel production and financing means that there will be less marginal supply of fossil fuels sloshing around. That is precisely the point of such policies. And yet, when there is a demand spike for energy – owing to a strong recovery from a recession, as is happening now – we will need all the energy we can get. Otherwise, there will be price mayhem, with all the social and political instability that entails.

The upshot is that policymakers who are already confronting the massive challenge of moving the world away from fossil fuels also must come up with ways to prevent severe oil, gas, and electricity price volatility.

One counterintuitive idea is for G20 policymakers – or perhaps all UN member states – to agree on a scheme of expanded oil, gas, and maybe even coal reserves, on the condition that these reserves would be tapped only in an emergency. For example, the agreed benchmark could be a movement of spot prices by more than two standard deviations away from the 200-day moving average.

To be sure, there would be serious challenges to such a scheme. If the reserves are not big enough, some bad actor could try to precipitate a supply crisis and then profit massively as a supplier of last resort. But that is all the more reason to agree to a framework that is solid enough – and reserves that are large enough – to forestall any such threat. Moreover, without a global strategic reserve initiative, the spikes in energy prices experienced this year could become a new normal, potentially derailing the other agreements that emerge from global climate conferences.

We have entered a new era in which the climate crisis, and what it will mean for future generations, is finally receiving the global attention it needs. But we have also entered a period in which policymakers will need to do more to ensure that the benefits of capitalism are more evenly shared. That means sparing developing economies – and lower-income people everywhere – from the turmoil fueled by shocks to global energy prices. Failing that, rich countries’ lofty net-zero commitments, made with the best of intentions, will have been for nought.

PUBLISHED ON

Nov 13,2021 [ VOL

22 , NO

1124]

Advertorials | May 30,2025

View From Arada | Jul 31,2021

Viewpoints | Dec 19,2020

Commentaries | Sep 21,2019

Editorial | Nov 21,2020

Viewpoints | Jul 27,2024

Advertorials | Feb 12,2024

Viewpoints | Jun 07,2025

Fortune News | Apr 19,2025

Sponsored Contents | Mar 28,2022

Photo Gallery | 177118 Views | May 06,2019

Photo Gallery | 167330 Views | Apr 26,2019

Photo Gallery | 157944 Views | Oct 06,2021

My Opinion | 136960 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 26 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...