Mar 28 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

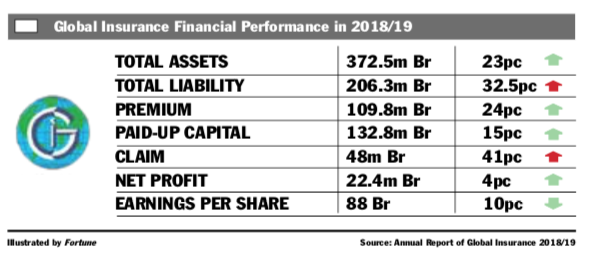

The company netted 22.1 million Br in profit, achieving four percent growth. However, its EPS fell by 10 Br to 88 Br as a result of an increase in paid-up capital, which increased by 15pc to 132.8 million Br.

The company netted 22.1 million Br in profit, achieving four percent growth. However, its EPS fell by 10 Br to 88 Br as a result of an increase in paid-up capital, which increased by 15pc to 132.8 million Br. Despite moderate growth in profit, Global Insurance’s earnings per share (EPS) fell slightly by 10pc in the past fiscal year.

The company netted 22.1 million Br in profit, achieving four percent growth. However, its EPS fell by 10 Br to 88 Br as a result of an increase in paid-up capital, which increased by 15pc to 132.8 million Br.

Considerable growth in interest and rental income has helped the company maintain profitability.

Ahmed A. Sherif, chairperson of the board of directors, noted in his message to shareholders that the past fiscal year had brought a mix of challenges and opportunities.

"The increase in gross written premium, profit margins, assets and capital bases of the company should be considered a positive achievement," he said. "Claims paid and total administrative expenses are adversely noted."

Efforts that have been made on underwriting and investments improved the firm's performance this year ahead of the preceding year, according to Tibebe Tesfaye, the company’s chief executive officer.

Last year the gross written premium of Global increased by 24pc to 109.8 million Br. Out of this, 26 million Br was ceded to reinsurers. The retention rate of Global has moved up by four percentage points to 76pc. The retention rate at Global is slightly lower than the industry average of 78pc.

The increase in retention rate was accompanied by disproportionate growth in claims paid to policyholders. Claims paid and provided for soared by 41pc to 48.1 million Br, hugely undermining the additional gross written premium collected throughout the year.

The management of Global should look into its customer screening and pricing policies, according to Abdulmenan Mohammed, a financial analyst with close to two decades of experience.

Spare parts and garage service costs along with other payments are the leading causes of the increase in claims. However, the management is establishing a claims leakage management strategy to control such gaps, according to the CEO.

In the reporting period, the company earned 8.2 million Br in commissions, an increase of three percent, and paid nearly 4.1 million Br in commissions, an increase of 17pc.

Global's direct operating expenses increased by 28pc to 13.8 million Br.

The expansion of direct operating expenses should concern the management of Global, according to Abdulmenan.

"Global should put a strong cost control mechanism in place to make sure expenses are not out of control," he said.

Expenses relating to branch expansion and more underwriting expenses have contributed to the increase of the firm's costs, believes the CEO.

"Even if the expenses of the firm have increased," said Tibebu, "we believe that we are at the tolerable margin."

In the fiscal year, the insurance company has spent 24.4 million Br on staff and administration expenses, an increase of 16pc.

Last year, Global's investments performed well. Interest income increased by 25pc to 15 million Br and rental income also went up by 25pc to 12.6 million Br.

The investment Global made in Ethio-Reinsurance and the time deposits it has at banks helped the firm to increase its income and profits.

Global's total assets increased considerably by 23pc, reaching 372.5 million Br. Out of this, 111.9 million Br was held in interest-earning fixed deposits, 22.7 million Br was invested in shares and savings bonds, and 11.9 million Br was invested in property.

The proportion of savings and investments to total assets decreased by three percentage points to 39.3pc.

This must have been due to Global's increased liquidity, according to the expert.

"This reveals that Global was maintaining excess liquid cash that could have been invested in income-generating activities," Abdulmenan said.

Global's increasing assets are similar to those of its peer firm, Nile, which increased its assets by 24pc to 1.4 billion Br last year.

Liquidity analysis indicates that Global's liquidity level increased enormously. Cash and bank balances increased by 42pc to 59.6 million Br. The ratio of cash and bank balances to total assets increased to 16pc from 13.9pc.

Global maintained liquid resources way above its operational needs, according to the expert.

"The management should reduce its liquid resources by investing in income-generating activities," recommended the expert.

Global's capital and non-distributable reserves represent 39.7pc of its total assets. The ratio is far higher than the private insurer average of 31.1pc.

"Global should use its strong capital more efficiently," remarked Abdulmenan.

The company is planning to build mixed-use buildings in the Bole and Kality districts, digitise its operations and launch an Islamic insurance policy, Takaful.

"Considering this, shareholders agreed to inject new capital of 250 million Br at the end of this fiscal year," said the CEO.

PUBLISHED ON

Mar 28,2020 [ VOL

20 , NO

1039]

News Analysis | May 11,2025

Fortune News | Aug 16,2020

Viewpoints | Sep 28,2019

News Analysis | Apr 20,2024

Fortune News | Nov 29,2020

Commentaries | May 06,2023

Radar | Feb 01,2020

Radar | Nov 16,2024

Fortune News | Jan 11,2020

Viewpoints | Jun 04,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...