Anybody who is familiar with Shola Market would know that the area is the scene of a constant flurry of activity any day of the week. As one of the prominent marketplaces in the capital, shoppers from every corner pour into Shola to buy both food items and non-food commodities. Last week, however, walking down the streets of Shola felt more like walking through a graveyard than it did a market.

Anguach Mekuanint was sitting idly inside the shop operated by herself and her spouse. The couple sells berbere [Ethiopian spice mix], garlic, shiro and the like in a small quarter on one of the footpaths in the market.

“What sales?” she exclaimed when commenting about how business has been lately. “People don’t have money; they’re not buying anything from us."

Not only is the shop troubled by a lack of customers, but the level of supply has dropped too, according to Anguach.

The market has been overwhelmed by a slew of challenges starting from the COVID-19 pandemic to political instability and armed conflict to the ever-present forex crunch. Some vendors in the market, especially those selling non-food items, claim that the market has been dead since March of last year, ever since the outbreak of the pandemic. The prices of goods have been steadily increasing as well, reaching a peak after the conflict broke out in Tigray Regional State, according to the vendors.

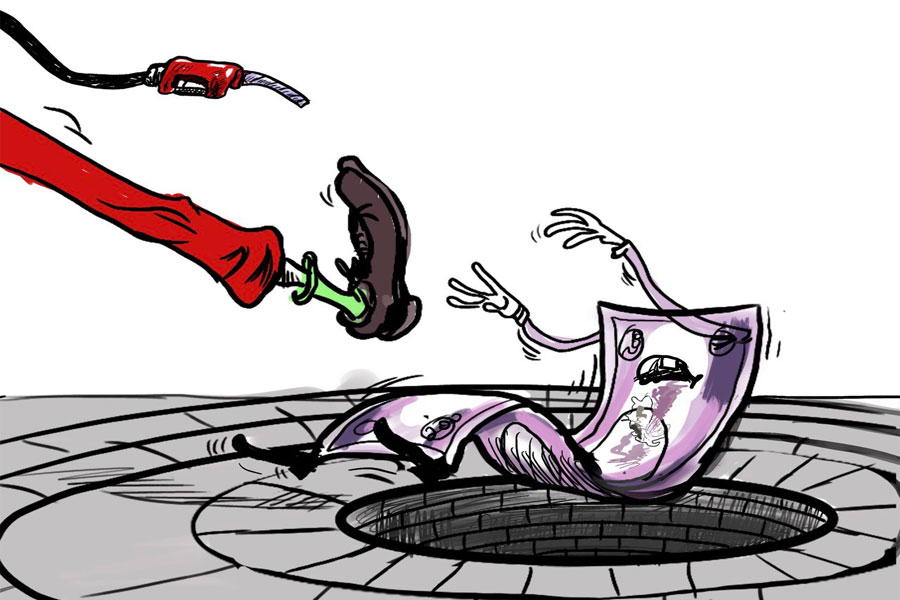

It seems that the recent climb in the price of fuel was the final straw; and the market, the metaphorical camel. Following the petrol price hike, the cost of everyday necessities like bread, milk, teff, onion, berbere, and flour, to name a few, has shown a marked increase. Cross-country and city transportation costs have also increased as well as prices for commodities like coffee and sanitary pads.

Experts explain that the disproportionate increase in the prices of commodities can be attributed to the excessively long value chains in the market structure and the expectation that a spike in certain commodities' prices will translate to the same in others.

However, some, like Andualem Tilaye (PhD), a senior researcher at the Ethiopian Development Research Institute, believe that the interconnectedness of the market is not as simple as is usually presented. Even though the price increase in fuel cannot directly affect certain businesses, it is logical for the cost of outputs to go up as the businesses account for their indirect costs.

"All outputs are related to one another directly or indirectly," Andualem remarked.

Although Ethiopia is touted as being one of the fastest growing economies in Africa, scoring 8.2pc GDP growth during the second five-year Growth & Transformation Plan, which ended in 2019, and experiencing 9.6pc growth over the last fiscal year, runaway inflation remains a headache. Over the past decade, the nation's headline inflation rate averaged 14.4pc, driven by 15.2pc food and 13.7pc non-food inflation.

Last month, headline inflation registered at 19.2pc, while food inflation stood at 23.1pc. The numbers are expected to grow even more in the coming months, and the rise in the cost of living is noticeable by anyone.

Enanye Yalew is a single mother of two. She makes her living through weaving carpets, and she is struggling to make ends meet month after month. Her earnings are barely sufficient to sustain a whole family. This is why she has sought support from Together Ethiopia, a non-governmental organisation that supports blind women like Enanye.

“The cost of everything has increased. I can’t pinpoint something in particular,” she said. “We’re surviving through God’s will.”

Shoppers arrive at the new vegetable market in Haile Garment.

The incessant surge in the cost of living has impacted her severely, leaving her practically incapacitated. Individuals like her are subject to even more misery as job opportunities or any means of extra income are slim. Much like many other economic and social affairs, it is the less privileged who are left to bear the burdens of poverty as well as growth.

Literature shows that Ethiopian economic growth was not accompanied by double-digit inflation rates before 2004. Experts explain that the exponential change in inflation can be attributed to post-2005 election economic policies when the government resorted to inflationary financing, simply explained as money creation.

The Homegrown Economic Reform Agenda adopted in September 2019 highlighted past challenges and set out ambitious plans in order to attain a stable macroeconomy. The pillars of the reform were to be the easing of structural bottlenecks and the creation of new opportunities and sources of growth, while its challenges were cited as the foreign exchange imbalances, a heavy external debt burden, limited access to finance and high inflation.

The Reform plan has been criticised for putting forth solutions without identifying the root causes of the country’s macroeconomic imbalances for which remedial actions should have been implemented. One of the critics in this regard is Alemayehu Geda (PhD), a macroeconomist with years of experience and several studies published on the topic.

Alemayehu argues that there is a sectoral imbalance in planning, where the planned growth does not result in the growth of food supply and foreign currency. The expert points out that food production growth does not match population growth and migration to urban cities.

Endalkachew Sime, the deputy commissioner at the National Planning & Development Commission, explains that inflation needs both structural and urgent interventions. The Homegrown Economic Reform Agenda is focused on addressing immediate needs, according to him.

Despite his argument, however, on-the-ground situations have not improved in the slightest. In relation to strategic interventions, the Commission has identified increasing production and productivity as one of the pillars of its 10-Year Perspective Plan. In addition, radical involvement from the private sector as a driver of productivity is another of the pillars.

Mamo Mihretu, a senior advisor for the Office of the Prime Minister, stated that basic supply intervention is being carried out through the import of wheat in addition to policy interventions.

"We recognise inflation is a serious macroeconomic challenge," he said. "It's not something that will vanish right away."

Mamo argues that economic growth, as set out in the Homegrown Economic Reform Agenda, has been hampered due to factors attributed to the COVID-19 pandemic and the "law enforcement operation" in Tigray Regional State.

The go-to remedy for hikes in the cost of living frequently carried out by the Ministry of Trade & Industry and the Addis Abeba City Administration is strict control of "illicit" market activities. Early last week, the City Administration Trade Bureau stated that it would be holding hoarders and price gougers accountable for the rising costs. Later the same week, the Administration announced that it was taking steps against 30,000 businesses whom it says are being held accountable for hoarding and hiding commodities and unreasonable pricing.

The State Minister for Trade & Industry, Eshete Asfaw, backs the government's belief that the current increase in the cost of living is caused by illegal hoarding and pricing. A taskforce headed by city mayors has been organised to regulate markets across Ethiopia. In addition, half a billion Birr has been dedicated to strengthening consumer cooperative unions, according to him.

However, some experts disagree, saying that the inflation this time around is not necessarily caused by growth in demand. Rather, built-in expectations, the depreciation of Birr, and rising fuel prices are the root causes, according to Andualem. The expert also raised his concerns about how the government defines illicit sales.

"What percent margin is defined as unreasonable?" he inquired.

Shuttering businesses, while these basics are not clearly defined, could backfire, according to him. By closing down shops, the market is made subject to a loss of supply, which could have short and long-term effects that cause rising prices.

Andualem also cites that high-profit margins are enjoyed by firms that have monopoly power over certain goods. A good example could be the few existing oil suppliers.

"I'm doubtful that monopoly power is characteristic of markets for most commodities in this country," he stated.

Matiwos Ensermu (PhD), an associate professor of logistics & supply chain management at Addis Abeba University School of Commerce, also agrees that regulatory interventions have proved they are improper solutions, time and time again. He stated his opinion that those doing regulatory work are unaware of the existing logistics problems.

He urges that a value chain analysis be done for every commodity. "Those [stakeholders] who don't add value should be removed from the value chain," he said.

Eshete stated that a task force had been put together to look into the logistics structure though no action has been taken so far.

Matiwos also suggests that strengthening the Ministry of Transport's project to digitise logistics mechanisms should be encouraged.

Some also cite high tax rates as a root cause behind the galloping market prices.

The taxation of certain food items was lifted in September 2020, in light of the pandemic, only to be reinstated shortly thereafter. The tax relief was applied to edible oil, sugar, bread and baby food. The act managed to stabilise the market for a short while. Edible oil, which was sold for around 480 Br, dropped as low as 280 Br. Currently, edible oil is being sold for as high as 450 Br in the capital. Attempts to elicit a response on the matter from the Ethiopian Customs Commission were unsuccessful.

Eshete explains that the taxation currently imposed on the import of wheat, rice, sugar and edible oil is only five percent. The State Minister does not believe the amount of taxation is a contributor to the price increase the country is witnessing now. He further stated that wheat and rice are currently being imported tax-free.

Another of the macroeconomic imbalances described as a contributor to inflation is the devaluation of money.

In October 2017, a 15pc devaluation of money was enacted, aiming to encourage exports so as to relieve forex exchange shortages. The first of its magnitude since 2010, the nominal exchange of dollars increased from 23.4 Br to 26.91 Br. Following that, the Birr has gone through a series of devaluations and currently stands at 40.7709 to the dollar, a 48pc decrease in three years.

The decision to frequently devalue Birr has received wide criticism. Although the export volume has increased by 12 percent since the 2018/19 fiscal year from 2.7 billion Br to just over three billion Br in the last fiscal year, the inflation rate caused by the devaluation surpassed export growth. The past fiscal year's average headline inflation increased by 36.3pc from the previous fiscal year, whose average rate of inflation was 12.6pc.

The claim that devaluation is done for export growth is unacceptable, according to Alemayew.

"It's only resulting in inflation in our context," he said.

Another contributor to inflation recently is the government's attempt to cut subsidies. The subsidy on electric power has been lifted for usage of more than 50kW a month. Following that, the price of electricity has surged dramatically, with users now paying between 115pc to 300pc of the previous prices. The final push in subsidy cuts was implemented this quarter.

The government has also increased the price of fuel by almost 20pc over the last two months following global price increases. The government decided to cover 75pc of the increased costs while the public is left to cover the rest. The rationale behind these subsidy cuts is narrowing the ever-increasing budget deficit.

A budget deficit occurs as the expenditure of the central government is not matched by the country's gross domestic product. From 2003-2010, the budget registered a surplus; however, the government then started incurring a deficit, which increased severely year after year thereafter. In the 2018/19 fiscal year, the deficit amounted to 85 billion Br.

Mamo explains that the government plans to cease using money printing for deficit financing. In the last fiscal year, interventions were done to raise money through treasury bills which underwent a policy reform by which the constant return on T-bills was adjusted to be determined through competitive bidding. This was so that more institutions would take part, which has yielded positive outcomes. The outstanding treasury bills collapsed to 23.7 billion Br from 138 billion Br.

However, the timing when these decisions are taking hold is scrutinised as the country is rattled by a global pandemic and a regional conflict that has been ongoing for five months. Alemayehu, quite contrary to policymakers, adamantly says that cutting down on subsidies is the wrong move.

"It is obvious that subsidies are costly, but they are in place for a greater social cause," he said.

Alemayehu points out that immediate remedies can be applied along with long-term policy restructuring. Strengthening projects operating in cultivating superior food supply should be given the utmost attention, according to the expert.

When it comes to artificial price increases due to unfair margins on goods, setting up a strict monitoring method could be challenging, but the government should set up professional and incorrupt public shops in every kebeleso that the competitively low price caps would force disproportionate margins lower.

Frequent attempts to gain insight from the Ministry of Finance for this article were unfruitful.

PUBLISHED ON

Feb 27,2021 [ VOL

21 , NO

1087]

Fortune News | Jun 04,2022

Fortune News | Aug 11,2024

Fortune News | May 29,2021

Viewpoints | May 25,2024

Agenda | Apr 16,2022

Fortune News | Feb 09,2019

Editorial | Apr 29,2023

My Opinion | Jan 21,2023

Viewpoints | Apr 28,2024

Agenda | Oct 09,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...