Agenda | Jan 09,2021

In the late afternoon of Tuesday, February 25, 2020, Tewodros Kidane, 30, the owner of Adi Bar & Restaurant was sitting outside his business located in Gotera Condominiums. Accompanied by two regular customers, he was engaged in conversation with his little brother, who helps him by working as a waiter.

His bar is among the eight bars in the area that complain about business not being the same as it was a week ago.

Tewodros established his bar, which sells beer, wine, gin and vodka, seven years ago by renting the venue for 10,000 Br a month.

After the price of beer increased a week ago due to the new excise tax law, the number of customers who consume beer and alcohol at his bar has significantly decreased.

Tewodros, who supports his mother with the income he gets from the bar, previously sold two to three crates of beer a day, but now he is lucky if he sells one.

"Because of the new excise tax, my customers aren't consuming beer like they used to and even stopped visiting the bar," he said.

The average price of beer has jumped from 17 Br to 25 Br a bottle. A bottle of gin that used to cost 82 Br now costs 148 Br at his bar.

The price of one crate of beer from the distributor used to cost 290 Br but has now increased by 140 Br to 430 Br. The price of soft drinks has also risen from 10 Br to 15 Br a bottle.

"The increase in the price of beer damaged my business," he said. "Even though the price of beer increased, I sold it at the previous price for two consecutive days in order not to alarm my customers."

The proclamation that increases the income the country gets from excise tax has been in a drafting process for the past year. On February 13, 2020, the proclamation, which passed through 12 discussion meetings with different stakeholders, was approved by members of parliament with four opposing the motion and seven abstaining of the 320 MPs who attended the session.

After the enacted excise tax, beverages that have an alcohol content of less than seven percent must pay a 40pc excise tax or 11 Br per litre, depending on which is higher.

The excise tax applies to other goods beside beer. It also imposes a 25pc and 15pc tax rate on soft drinks and bottled waters, respectively. The government plans to collect close to 254 million Br in excise tax from water bottlers this year.

The production line at Heineken, the largest brewer in Ethiopia, has a production capacity of 5.6 million hectolitres a year.

Because of the excise tax, a bottle of beer directly from the manufacturer costs roughly six Birr more than the previous price. Soft drinks are being sold at a minimum of 13Br and a litre of bottled water is being sold at a minimum of 12 Br.

Since the new prices took effect, Tewodros has decreased the number of crates he buys from the factories.

"Because of the decline in the number of beer consumers," he said, "I have to reduce the amount taken from the distributor from 13 to four each week."

Bar owners like Tewodros are concerned by the decrease in beer consumption and so are the beer manufacturers.

"Even though we were involved in the discussions during the drafting of the excise tax law," said Gebreselassie Sifer, commercial PR manager of BGI, "we're not happy about the outcome."

BGI is one of the largest brewers in Ethiopia with a production capacity of 5.3 million hectolitres a year.

After the excise tax came into effect, the company noticed a fall in the consumption of its products.

"We haven't still identified if the drop in consumption is because of the fasting period or the price increase,” said Gebreselassie. There is usually a decline in the market during the fasting period, he said.

The company revised its wholesale price after the implementation of the tax. It has increased the price of a crate from 275 Br to 410 Br. Draft beer used to cost 770 Br a keg but now costs 1,110 Br.

The previous excise tax rate was calculated based on the production cost, according to Gebreselassie, but now it is imposed on the selling price, which is another factor pushing retail prices higher.

"We believe that we should've been given a grace period like other businesses. The decision was very sudden for us," said Gebreselassie.

The excise tax gives a grace period of six months to car importers, but it was applied to the beer manufacturers immediately.

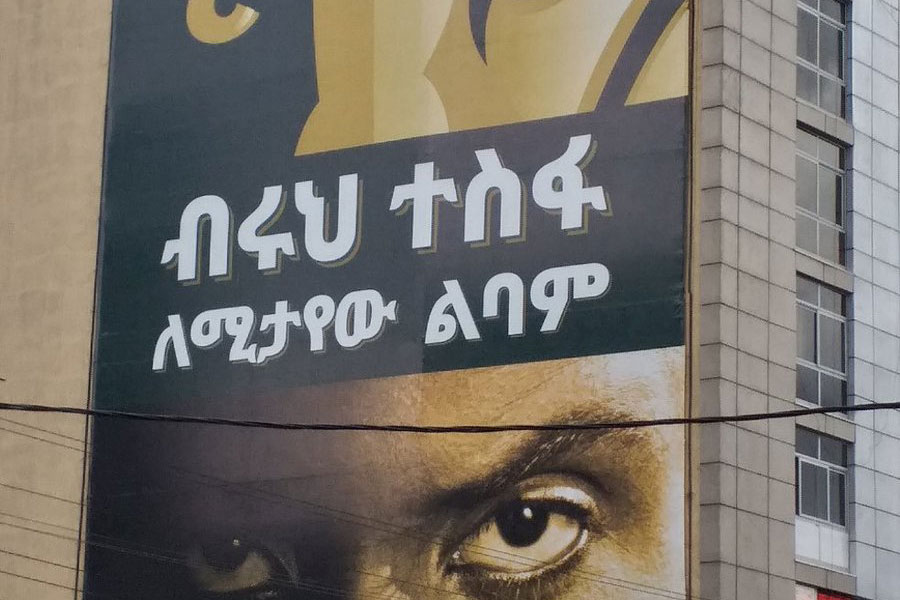

The owner of a bar in Gotera Condominiums that sells beer, wine and gin says the number of customers who consume beer and alcohol at the bar has significantly decreased since the imposition of the new excise tax.

The Ministry of Finance argues that there is no way a grace period would be given to beer companies, since they manufacture the product locally.

"Beer is a fast-selling product, but importing and selling cars takes months, and car importers ordered the vehicles before the excise tax was legislated and that is why we give them a grace period," said Mulay Weldu, tax policy director of the Finance Ministry.

Mulay argues that the excise tax that is imposed on the beer companies is appropriate, and modernising the tax collection system will attract foreign direct investment (FDI).

The FDI flow on the beer manufacturing sector was 1.5 billion dollars in the last six years. Beer companies paid 15.8 billion Br in taxes including excise tax, VAT, business tax and income tax over the past three years.

But the beer companies do not agree with Mulay, stating that they might be forced to lay off their employees or even withdraw from the business entirely.

A senior executive at Diageo Brewery, who wished to remain anonymous, complained about the sudden implementation of the excise tax.

"When there is a reduction in the consumption of our product, we are forced to produce below capacity, which leads us to shrink our workforce," he said.

"We're not thinking about any additional investment in the sector in the near future," he adds. Diageo Brewery currently employs 1,300 people.

But BGI, which pays close to 2.7 billion Br in taxes annually, is not considering reviewing its investment strategy so far.

"It's too early to restrain our investment plans," said Gebreselassie of BGI, which occupies a 38pc market share in the Ethiopian beer industry.

Heineken Brewery Ethiopia, a subsidiary of the Dutch brewing giant that operates in 85 countries, has already withdrawn its investment plans in Meshnti Wereda, close to Bahir Dar in Amhara Regional State.

The company has a production capacity of 5.6 million hectolitres a year but has changed its plans for a 250-million-dollar expansion that would have hired 3,000 workers. Currently, the company is restructuring its sales team by laying off 170 employees.

Fekadu Beshah, director of corporate communications at Heineken Ethiopia, declined to comment on the issue.

For this fiscal year, the government expects 58pc of the 387 billion Br federal budget will be covered by tax revenue. It plans to collect 6.8 billion Br from bottled water, soft drinks, beer, and alcoholic product manufacturers.

Out of total GDP, Ethiopia collects 0.7pc from excise taxes, half of what other Sub-Saharan African countries collect from excise taxes on average.

The average adult Ethiopian consumes 12.6lt of alcohol a year, of which beer comprises 55pc, according to the World Health Organization.

Ethiopia has five local and international beer companies that produce 14.5 million hectolitres a year. These companies have created over 5,000 direct and 21,000 indirect job opportunities. Close to 62,000 farmers provide 150,000tn of malt valued at 3.5 billion Br for the beer companies.

The beer industry has been profoundly affected by the quickly implemented policy, according to Hailemariam Kebede (PhD), a lecturer at Addis Abeba University's School of Commerce.

“The restriction on the advertisement of alcoholic products on the media is enough," said Hailemariam. "The government doesn’t have to increase the tax."

The beer manufacturing sector is one of the sectors that brings modern marketing strategies into the country, and the government didn't give the sector the weight that it deserves, according to the expert.

Since beer products can be substituted with traditional drinks, Hailemariam recommends that the beer companies should not increase their price at least for the coming three years.

"Even if the cost of raw materials increases, they have to minimise their profit margin," he said. "They should also focus on public relations activities and sponsorships to tackle decreasing demand."

Tewodros, whose business was affected by the increased prices, plans to change his business.

“Even though I don't know much about the boutique clothing business," he said, "I plan to give it a go, because I have a family to support."

PUBLISHED ON

Feb 29,2020 [ VOL

20 , NO

1035]

Agenda | Jan 09,2021

Fortune News | Sep 13,2025

Radar | Jul 06,2025

Fortune News | May 18,2019

In-Picture | Oct 12,2025

Radar | Sep 28,2019

Radar | Jun 25,2022

Fortune News | Sep 24,2018

Commentaries | Sep 20,2025

Radar | Aug 20,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...