Radar | Mar 26,2022

Jun 7 , 2020.

It is hard to tell just by looking at its website, but the Ministry of Innovation & Technology is a federal agency tasked with leading the country’s transition into the next frontier of technological advancement. Aside from what can be found on its homepage, the website contains little relevant information. And despite claims of giving services in four languages, it only works in the federal working language, Amharic; and English, passingly.

Some of the links are also dead ends. The display is an assault on the senses with its drab and disorganised design, mangled colour composition and inconsistent use of fonts. It is a far cry from the intractability, functionality and aesthetic that a small company would find indispensable to attract users, let alone a government agency meant to support and inspire innovation in the digital sphere.

The global digital ecosystem has developed an operative phrase: the Internet of Things (IoT). The discourse out there in the world is about the deployment of artificial intelligence (AI) in face and object recognition; behavioural and audio analytics; motion detection; sense-and-avoid system; and edge computing. These are all phrases behind concepts driving the functions of many things that facilitate or dictate everyday life, such as drones, unlike not living up to the most mundane tasks an innovation ministry could have accomplished.

Although the Ministry's pathetic digital presence stands in sharp contrast to the intractability and sharpness of display of the Prime Minister Office's website, which has much more appeal to visitors, its website makes no mention of one of its landmark achievements. The Ministry's high ranking officials and technocrats are behind the passing of a bill that provides the legal framework for transacting digitally.

In the making for the past year, and intended to work in tandem with a directive by the central bank that allows non-financial institutions to provide electronic money services, it was drafted by the Ministry and tabled to Parliament late last month. Unanimously voted to pass, it seemed to be a bill that was not just critical to realising a competitive edge in the economy in the brave new era of the digital revolution but well overdue.

The legislation is in line with the current administration’s emphasis on restructuring the economy, and the essential role the service sector has to play to realise the new paradigm.

It is comforting to see policy wonks in Prime Minister Abiy Ahmed`s (PhD) administration have a good grasp of this paradigm: inclusive development; effective service delivery; and, an innovative approach to laws and regulations. With the "Homegrown Economic Reform" programme in full gear, they are advocates of a contractionary fiscal policy and are on a controversial liberalising mission. The former, however, has been interrupted by the economic consequences of the Novel Coronavirus (COVID-19) pandemic.

COVID-19 will have a significant impact on countries with accelerated trends in digitisation, market consolidation and regional cooperation, the global consulting firm McKinsey projected in its recent report on the prospect for economies in Africa. In their response, McKinsey advises that countries need to focus on boosting local manufacturing, formalise small businesses and upgrade infrastructure. It urges policymakers to develop leadership and acquire foresight in promoting digitisation of the financial sector, retail, education and the bureaucracy. Representing one-third of the 12 sectors in an economy identified by McKinsey in terms of digital penetration, they are in sharp contrast to the agricultural sector, which is listed down at the bottom.

It is an insight which will compel policymakers to reemphasise priorities in the economy, thereby delivering a blow to the developmental state model of the previous decades. It is also a move away from the agro-industrial focus given to macroeconomic policy formulations up until recently.

Not surprisingly, Prime Minister Abiy's administration has tried to acknowledge information technology as a potential source of growth, although federal government expenditure in ICT and telecommunications stood at a mere three percent last year. More than that, the liberal voices in the economic policymaking camp hope - by revolutionising the service sector, which includes communications, transport and banking - they can help improve productivity across the economy.

It is quite a bet for a country where the labour force is moving en masse away from the agriculture sector and desperately needs a manufacturing base to cushion the impact. The service industry, requiring higher skills and a much different infrastructure than the country has been preparing for, requires a more considered approach in a world that is digitising rapidly if the country is to reap benefits from it. Latest macroeconomic reports corroborate this trend: the service sector has contributed 39.8pc of the GDP in 2018/19, surpassing that of agriculture by 6.5 percentage points.

Consolidating this change in the structure of the economy is wise, if not inevitable. The passing of the electronic transactions bill by parliament is one of the considered steps in the effort to modernise the economy. It stands at the heart of the reforms that needed to take place.

Central to any economy is the medium of exchange, which has been cash for decades after taking over from silver and gold for centuries before then. Since these commodities were not wealth in themselves, not in the strictest sense, their most important function has been in facilitating the exchange of goods and services between people. Naturally, the more convenient and flexible this medium of exchange, the more dynamic the trade can get.

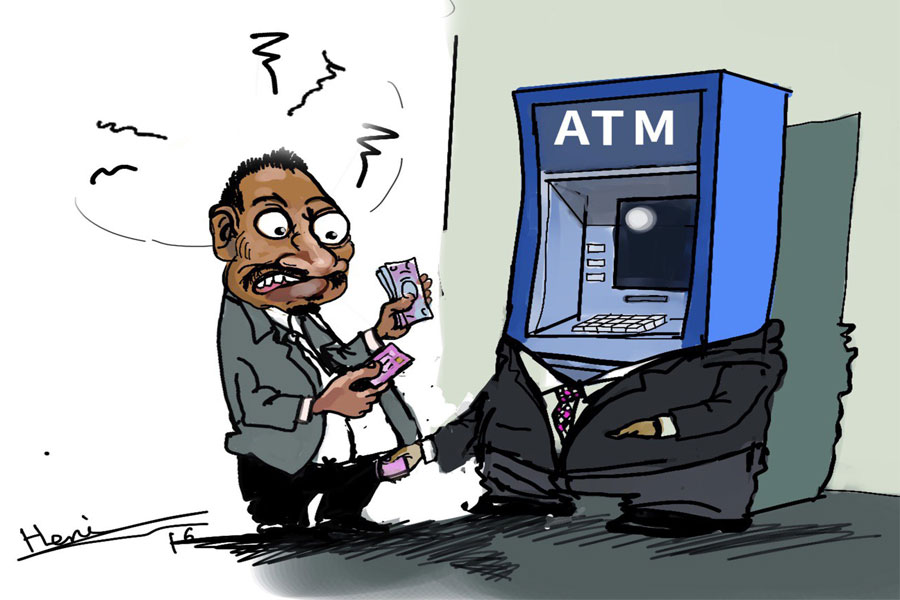

Electronic transactions offer this opportunity. Their primary good is in increasing operational efficiency along supply chains. On customers' end, this means greater flexibility in the ways they can buy products, which improves demand and stimulates supply. It is also a traceable system, thus lessening unreported transactions, which enhances the effectiveness of domestic revenues mobilisation. It is here the state needs to come into the digital age, to expand its online presence in the economy and broaden digital offerings.

With increasing accessibility of electronic transactions will also come a reduction in the number of money vendors and the cash consumers have to carry around. Going cashless would add about one and three percentage points to the annual gross domestic products (GDPs) of developed and developing economies, respectively, according to BCG, a consulting firm. Higher usage of electronic payment systems was also estimated to have added 983 billion dollars to the economies of 56 countries that were identified by Moody’s Analytics, a financial services company, in the four years beginning with 2008. Consumption grew by an average of 0.7pc across the board.

Perhaps the most crucial role electronic payment systems play is in facilitating the increasing commoditisation of data. Whatever its implications, the generation of large amounts of data sets - which can be analysed using sophisticated algorithms to generate information about patterns and human behaviours - is what determines the future of the global economy.

If under-developed economies such as Ethiopia's are ever to catch up, giving cyberspace a legal foundation and regulatory framework to tender digital products will be the first giant step forward. Abiy's administration has taken this step in fostering an enabling environment for the digitisation of the economy. It deserves an accolade and needs to be appreciated.

There is a caveat though. Electronic transaction systems are more complicated than cash. It had not been easy to convince people to exchange their assets or labour for a piece of paper guaranteed as legal tender in and prior to the 19th century. It will be harder now to persuade them that bits of zeros and ones on a screen are legal and acceptable either. It also does not help that there will be a necessity for third party intermediation, which will not always be a financial institution, or that electronic devices, from phones to point-of-sale (PoS) machines, can be hacked.

The administration needs to move fast in complementing the remarkable job it did last week in legalising e-signatures by pushing for the implementation of digital IDs and promoting online registries.

All will be in vain, however, without a behavioural change, which is tied in with the strength of the legal system, and scaling up of digital skill in the market and society. The financial literacy campaigns are all and well, but what will give electronic transactions legitimacy would be the assurance that there is the legal system in place that underwrites their status as facilitators of legal tender.

PUBLISHED ON

Jun 07,2020 [ VOL

21 , NO

1050]

Radar | Mar 26,2022

Fortune News | May 31,2020

Fortune News | Jun 10,2020

Radar | Jun 24,2023

Viewpoints | Sep 04,2021

Radar | Dec 24,2022

Fortune News | Sep 19,2020

Fortune News | Apr 24,2021

Radar | Aug 18,2024

Editorial | Oct 28,2023

Photo Gallery | 180559 Views | May 06,2019

Photo Gallery | 170753 Views | Apr 26,2019

Photo Gallery | 161829 Views | Oct 06,2021

My Opinion | 137293 Views | Aug 14,2021