Viewpoints | Feb 23,2019

Aug 8 , 2020

By Atsebaha Abay

The government should not leave it to banks to stimulate the economy by merely injecting them with cash. It should consider the losses that they incur and the role they can play in creating jobs, writes Atsebaha Abay (atsebahaabay@gmail.com), a banking and financial services expert currently serving as director at the Development Bank of Ethiopia (DBE).

There are currently a number of initiatives that are mobilising large sums of money to address different socioeconomic challenges. Some of these focus on private sector development and competitiveness, COVID-19 mitigation and green energy and have funds dedicated to them that are managed by different organisations, mainly banks. Other types of funds to stimulate the economy are also poured out by governments into banks in the name of saving jobs and improving the income of households.

It is assumed that banks are the lifelines of modern economies. But it is more complicated than that. Based on their ownership structures, banks pursue different goals. Everywhere in the world, private banks are established primarily to mobilise savings from the public and channel it to the rich for investment, thereby bringing profit to the owners.

Many of these banks tend to focus on risk-free, short-term financing such as for working capital. That is why banks and other financial institutions are blamed by many for being instrumental in making the rich richer and widening wealth and income inequality. It also shows that all banks are not equal in their contribution to development.

To close this gap, governments are tasked with creating a stable and well-functioning macroeconomic environment. Governments develop and implement various monetary and fiscal policy instruments to achieve a stable inflation and interest rate, boost long-term investments to attain full employment and redistribute wealth to create inclusive growth.

That is why governments establish policy banking - the Development Bank of Ethiopia (DBE) in Ethiopia’s case - to furnish fresh and low-cost loans to key economic sectors to bring faster and sustainable growth. They are established with the goal of creating new jobs, boosting foreign currency earnings and financing SMEs to flourish and serve as a base for the industrial development of the country.

It is in times such as these that they are most crucial; they can fill gaps where commercial banks do not believe there are profitable ventures. COVID-19 has provoked a challenge that has rarely been seen before, endangering livelihoods and the nation’s development trajectory.

COVID-19 has destroyed 330,000 jobs in just two months - last March and April - and this number will increase to 1.5 million in the medium scenario in six months, according to a study by the Ethiopian Job Creation Commission. Close to a third of those who lost their jobs have reported no other source of income.

The same study indicates that if COVID-19 endures in towns and cities for half a year, 1.9 million micro-enterprises would see their incomes halved. A further 1.4 million out of the seven million employees working in the manufacturing and construction sectors would lose their jobs in just six months.

We have also other quite worrisome internal problems that must be dealt with immediately: public unrest, political instability, huge national debt and poor tax collection. This is not to mention the millions of youth that will face extended periods of unemployment and possibly around 20 million people that might become food insecure as a result of the combination of natural and human-made disasters.

These problems will surely leave long-lasting scars with huge macroeconomic repercussions. The poor will get the short end of the stick as they lose their jobs and are unable to cover their daily expenses due to the soaring cost of living.

Fortunately, the government and international development partners are implementing various interventions, including capital (liquidity) injections to commercial banks. Recently, as part of the fight against COVID-19, development partners provided over 28.6 billion Br, and 20 billion Br came from domestic sources. Using this local and international funding, the government is implementing several interventions, including the availing of 15 billion Br for the bonds they had purchased from the central bank.

This is all well and good, but pouring money into the banks is only part of the solution. Thus, the government needs to put an appropriate regulating mechanism in place and plan how it should lend its money and to which banks.

During crises, it is common to see governments providing billions and trillions of long-term loans to banks in the name of stimulus funds at zero or nearly zero interest rates. Yet banks do not provide their plan of interest rate discounts, reduced service fees and bad debt write-off plans to the government. On the contrary, banks will make sure that, even under these circumstances, they will line the pockets of shareholders and the management with dividends and bonuses, respectively.

The resources that have been diverted to commercial banks are funds that will not likely be used to construct clinics, hospitals, roads, implement safety net programmes or support small-scale businesses.

For this reason, when the government provides such money to the banks, it should think of the socioeconomic costs forgone for every loan that is provided. Other socioeconomic criteria, such as the type of loan (short or long-term) and their operational scale in providing loans to SMEs and rural finance to help the rural poor, including women and youth, should be taken into account.

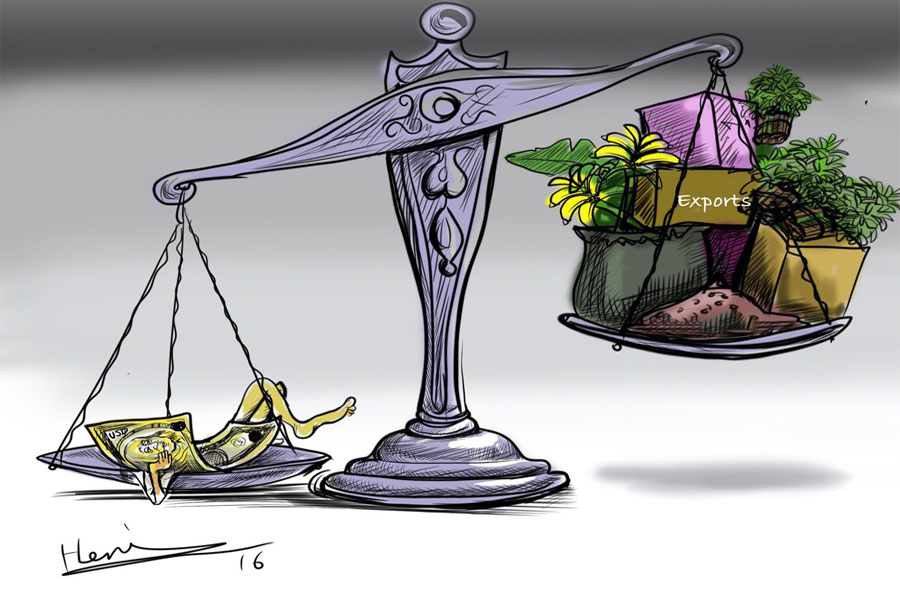

There is no justifiable reason for the government to follow a blanket rule for all banks in applying its liquidity interventions. Stimulus funds extended to banks should equate with the loss that banks incur, for instance, in the fight against COVID-19, and to the number of jobs they create and the foreign currency they generate.

The government’s support for the economy should be geared toward priority sectors where loans can be provided to new projects at low-interest rates. The only policy bank in the country, DBE [for which the author of this article works], may offer a good example of this. It has been extending credit between 7.5pc and 11.5pc for SMEs and rural savings and credit cooperatives and prioritising sectors that are rich in creating new jobs. It is these neglected sections of the population that need to be supported in lease and project financing.

DBE's experience in fund management should also be taken as a lesson. It has managed funds in market development for renewable energy and energy-efficient products, rural electrification, women entrepreneurs’ development, small and medium enterprise financing, rural financial intermediation, livestock development and carbon initiatives. These are experiences that can be built on and broadened as the government attempts to revamp the economy.

PUBLISHED ON

Aug 08,2020 [ VOL

21 , NO

1058]

Viewpoints | Feb 23,2019

Fortune News | Jul 28,2024

Commentaries | Aug 06,2022

Fortune News | Mar 16,2024

Radar | Oct 11,2020

Radar | Jun 11,2022

News Analysis | Mar 16,2024

Editorial | Nov 27,2021

Editorial | Nov 09,2024

Editorial | Apr 13,2024

My Opinion | 131770 Views | Aug 14,2021

My Opinion | 128153 Views | Aug 21,2021

My Opinion | 126099 Views | Sep 10,2021

My Opinion | 123721 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...