Feb 24 , 2024

By Austine Sequeira , Andrea Sequeira

The shifting dynamics of the global economy show the critical importance of adaptability, strategic investment, and the pursuit of sustainable growth strategies. As countries emerge from the post-pandemic world, the lessons drawn from these economic developments will be instrumental in shaping the future of global economic stability and prosperity, argue Andrea Sequeira (andreasequeira031@gmail.com), an economist student at Warwick University, and Austine Sequeira (austinesequeira@gmail.com), an independent consultant.

In recent economic developments that have redrawn the global financial landscape, Germany has overtaken Japan to claim the position of the world's third-largest economy, while India has surged past the United Kingdom (UK) to secure the fifth spot. This reshuffling of ranks, however, is attributed not to a spurt in economic growth but rather to contractions faced by several leading economies.

Japan, previously the world’s third-largest economy, witnessed two successive quarters of GDP decline last year, with a sharp 3.3pc fall in the third quarter followed by a 0.4pc contraction in the following. The UK, too, is struggling with economic downturns, recording contractions of 1.4pc and 0.3pc in the final two quarters of the year, respectively.

The shifts in global economic standings come at a time when many analysts and conservative economists are projecting a continued period of economic headwinds for the UK and Japan this year. The International Monetary Fund (IMF) projected the economies of these two countries are poised to remain subdued, with anticipated growth rates of 0.9pc (UK) and 0.6pc (Japan).

Contrasting sharply with these figures are the economic performances of the United States (US) and India.

The U.S. economy, defying expectations, maintained a robust growth rate of 3.3pc in the fourth quarter of 2023, a full two percentage points above economists' forecasts. India, too, emerged as a beacon of growth, with its economy expanding by just over seven percent throughout last year. Germany averted the label of a recession-hit economy despite experiencing a 0.3pc decline in one quarter of 2023.

The backdrop to these developments is the widespread economic upheaval triggered by the COVID-19 pandemic, which saw countries across the globe adopting accommodative economic policies. These measures, while intended to cushion the economic blow, fueled inflation across many economies, particularly those with a heavy reliance on services, such as the UK and the US. However, a retrospective analysis of the economic data from the US and India for last year suggests that these countries not only managed inflation effectively but also leveraged domestic inflation and supply chain disruptions to boost manufacturing opportunities, thereby contributing to GDP growth.

The evolving dynamics of global economics show the crucial role of domestic consumption, capital expenditure, and government spending in shaping a nation's GDP. With nearly half of GDP contributions stemming from domestic consumption, the interplay between spending and manufacturing becomes a critical driver of demand, supply, job creation, and investment. This cycle, balanced by per capita income and the size of demand, underpins steady economic growth.

The economic models of the United States and India, while both showing signs of growth, illustrate contrasting approaches. The U.S. economy benefits from high-income levels, which translate into greater consumer spending, whereas India's growth is propelled by its vast population and significant public investment in infrastructure.

In contrast, the United Kingdom has faced economic setbacks following its exit from the European Union (EU), with Brexit leading to a loss of international markets and a dearth of new free trade agreements. Manufacturing and exports have suffered due to diminished demand and reliance on foreign labour, while high energy rates have exacerbated domestic inflation, leaving little room for monetary policy adjustments.

Japan's economic challenges stem from a different set of issues, including competitive manufacturing and an overreliance on exports, compounded by a declining domestic population and purchasing power. Despite these hurdles, government initiatives in Japan, such as fiscal packages aimed at offsetting inflationary pressures through temporary tax cuts and fuel subsidies, hint at potential paths to economic recovery.

Observers of global economic trends might argue that the contractions observed in developed economies are minor and that a rebound is inevitable. Nonetheless, the implications of these GDP contractions on the global economy, particularly for developing nations, are profound and warrant careful consideration. The experiences of Japan and the United Kingdom offer valuable lessons in economic resilience and adaptability.

For developing countries, particularly those in Africa, the global economic shifts emphasise the importance of embracing population growth as an asset rather than a liability, provided there are strategies in place to build capacities. Sustainable economic growth hinges on the quality and quantity of the population. This insight is exemplified by the relative prosperity of countries like Ethiopia, Nigeria, Senegal, and South Africa, which have leveraged their sizable populations to achieve growth, albeit to varying degrees.

The challenges faced by smaller African countries, often constrained by geographical and demographic factors, highlight the critical role of economic unions and trade agreements in promoting regional stability and growth.

The imperative for African governments to drive economic development through public spending on infrastructure and basic industries, alongside the strategic utilisation of natural resources, cannot be overstated. The constraints imposed by multilateral agencies on public debt and the need for more effective financial intermediation in Africa call for a concerted effort to bolster the continent's financial services sector and unlock its potential for investment, job creation, and technological advancement.

PUBLISHED ON

Feb 24,2024 [ VOL

24 , NO

1243]

Radar | Jul 30,2022

View From Arada | Jul 07,2024

Fortune News | Aug 12,2023

View From Arada | Sep 01,2024

Radar | Mar 18,2023

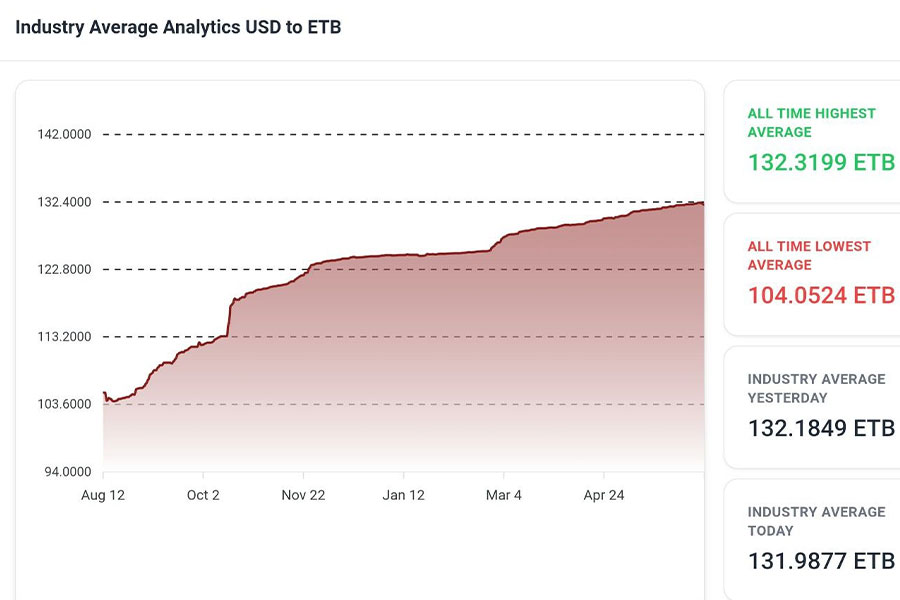

Money Market Watch | Jun 15,2025

Obituary | Jun 17,2023

Radar | Dec 08,2024

Radar | Jan 09,2024

Radar | Aug 18,2024

My Opinion | 131454 Views | Aug 14,2021

My Opinion | 127806 Views | Aug 21,2021

My Opinion | 125787 Views | Sep 10,2021

My Opinion | 123422 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...