Oct 28 , 2023.

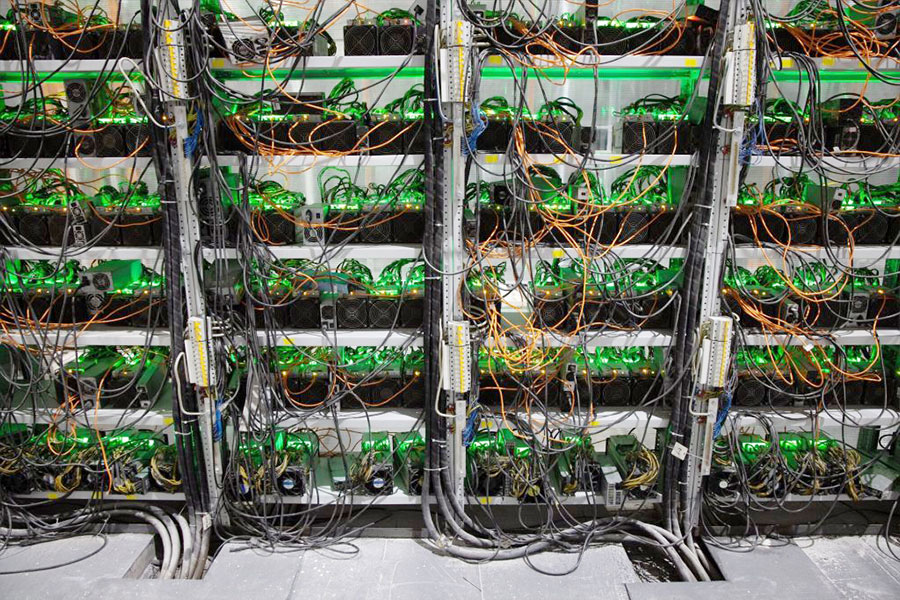

In the corridors of global geopolitics, where military and political turbulence often makes headlines, Ethiopia’s quieter march on the roads of digital finance appears to have gained momentum. Prime Minister Abiy Ahmed’s (PhD) Administration recently demonstrated its intent to modernise with the Council of Ministers, giving the nod to a pivotal personal data security bill. It signals that Ethiopia seeks a stake in the budding global digital economy.

Historically, policymakers’ attempts at constructing a data privacy framework have been more piecemeal than cohesive. A scattering of legislations sporadically advocated for personal data protection. But the most promising of them all – a draft crafted by the Ministry of Innovation & Technology experts – remains in the legislative purgatory, awaiting ratification. Notably, a directive mandating financial protection for consumers, issued four years ago, has been a sole sentinel, demanding financial institutions uphold data confidentiality.

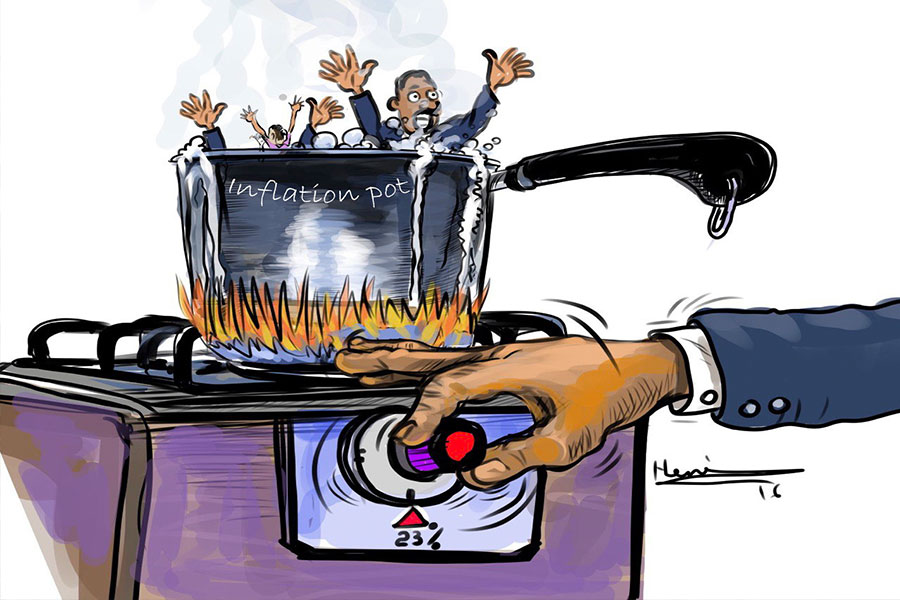

Against this backdrop, Ministry of Finance officials proposed revisions to the value-added tax (VAT) proclamation, foretelling a tax on digital transactions. Their goal appears to be enforcing an alignment, bringing digital business models into the fold of broader financial inclusion. However, such fiscal changes tread a thin line, potentially, if not arguably, disincentivising businesses from embracing digital platforms.

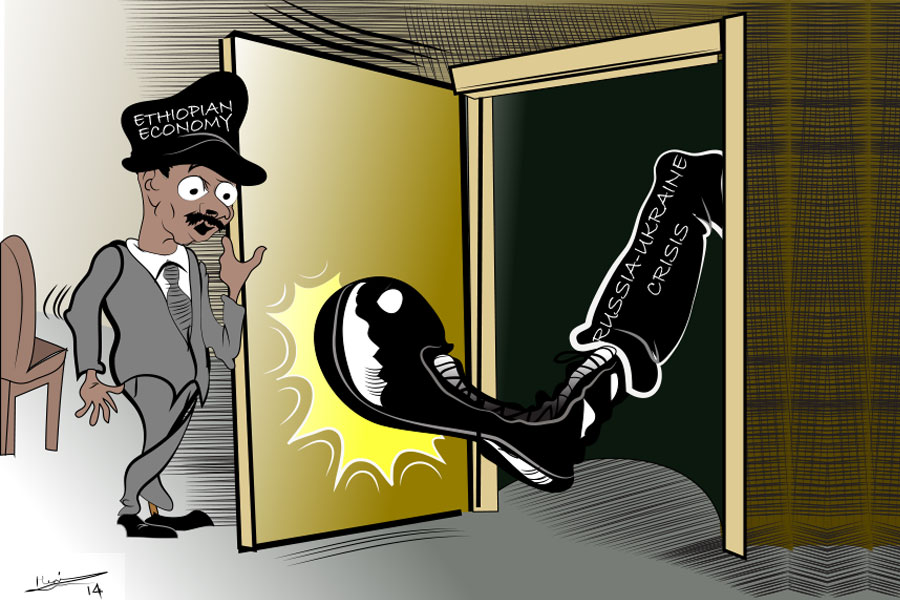

With a populace exceeding 100 million, Ethiopia’s economy had been a poster child for growth, during the decade and a half beginning in the mid-2010s. Yet, its headways have been punctuated with slowdown, affected by domestic and external headwinds from global pandemics and droughts to civil wars and volatile commodity markets.

Peeling back the layers of the financial fabric reveals a rather conventional story. Approximately 30pc of the adult population remains tethered to traditional banking systems, while a mere 32pc have the luxury of internet access. For Ethiopians’ digital finance dreams to thrive, creating a regulatory framework that marries protection with transparency should be central.

Recent data does suggest some optimism.

Financial inclusion has seen a modest jump from 22pc in 2014 to 46pc six years later. However, these figures pale in comparison to regional counterparts. The urban-rural divide is particularly pronounced, with city dwellers thrice as likely to own a bank account. Adding to this disparity is the gender divide, with men often leading the charge in account ownership. The federal government’s audacious financial inclusion strategy, which aspires for a 70pc inclusion rate, can be seen as a beacon of hope. A particular spotlight stands on bridging the gender disparity.

Community-centric initiatives, such as savings and credit cooperative organisations, are making valiant efforts. The entry of Safaricom, a telecom behemoth, post-liberalisation after over a century of monopoly by the state-owned Ethio telecom, has given the mobile banking sector a shot in the arm.

Mobile banking, long viewed as a panacea for the financial sector’s woes, remained an elusive dream, shackled by regulations that barred non-bank entities from offering such services until 2020. Even now, with the second permit granted to Safaricom going live and operational, the public is waiting with its boundless patience for optimal services.

With the promise of growing mobile phone usage and a subpar 46pc financial inclusion rate, the mobile banking realm stands on the cusp of a transformative era. But realising this potential demands a harmonious evolution of policy, digital literacy, and trust. Interestingly, the Administration’s blueprint reveals its commitment to this digital dream. The financial inclusion strategy projects a staggering 150pc surge in digital payments by 2025. Barely two years remaining, policymakers can ensure that the digital payments strategy offers specifics, emphasising infrastructural fortitude, innovation, and rigorous regulation.

However, foundational challenges persist as the Prime Minister and his ministers appear to be readying themselves to lead the digital charge. Tech affordability, for one, remains a hurdle. The Administration would do well to reexamine its position on mobile phone import taxation, push for low-cost localised smart feature phones, and negotiate with tech companies for device financing. They can push the industry for USSD service enhancements to lower data costs.

Another imperative is quality networks, especially for communities in far-flung regional states. While market assessments will undoubtedly influence investments, the onus is on mobile service providers to widen their reach.

A symbiotic effort from policymakers, development partners, and service providers can uplift digital literacy. The endgame should be services that are intuitive, convenient, and available in vernacular languages or with visual aids, making mobile money platforms widely accessible. Empowering agents to provide basic digital training can further boost this task.

While promising, Africa’s tryst with digital finance has been marred by hiccups. Redressal mechanisms, particularly in the event of network failures, have often been woefully inadequate. Ethiopia, for instance, wrestles with issues where a flawed ATM transaction can spiral into a week-long bureaucratic nonsense for trivial cash amounts. While the current Administration’s strides towards digitisation are commendable, a multi-pronged, inclusive, and customer-centric approach will determine Ethiopia’s place in the global digital ecosystem.

A dual focus is critical as the country embarks on its digital voyage. While bolstering its digital arsenal is vital, crafting a customer-centric legal framework to address the myriad challenges in the digital domain is equally crucial. Lessons from neighbours, like Tanzania’s sharp decline in person-to-person digital transfers post hefty VAT impositions, should serve as cautionary tales.

PUBLISHED ON

Oct 28,2023 [ VOL

24 , NO

1226]

Radar | May 04,2025

Fortune News | Sep 07,2025

Viewpoints | Apr 24,2021

View From Arada | Jul 17,2022

Fortune News | Apr 10,2023

Fortune News | Sep 28,2024

Editorial | Mar 05,2022

Fortune News | Sep 21,2025

Editorial | Jun 10,2023

Editorial | May 25,2024

Photo Gallery | 174530 Views | May 06,2019

Photo Gallery | 164757 Views | Apr 26,2019

Photo Gallery | 154939 Views | Oct 06,2021

My Opinion | 136687 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 12 , 2025

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...